The Canadian Grain Commission has reported large weekly shipments of wheat from licensed facilities in two of the past three weeks. Cumulative shipments are higher than average, while ahead of the pace needed to reach the current AAFC forecast.

The Canadian Grain Commission has reported large weekly shipments of wheat from licensed facilities in two of the past three weeks. Cumulative shipments are higher than average, while ahead of the pace needed to reach the current AAFC forecast.

The USDA made few significant changes to their estimates for global canola/rapeseed in October, while their ending stocks estimate remains well above the current International Grains Council estimate and bears watching.

December oat futures closed under pressure for a fourth session, ahead of an expected bearish USDA data release.

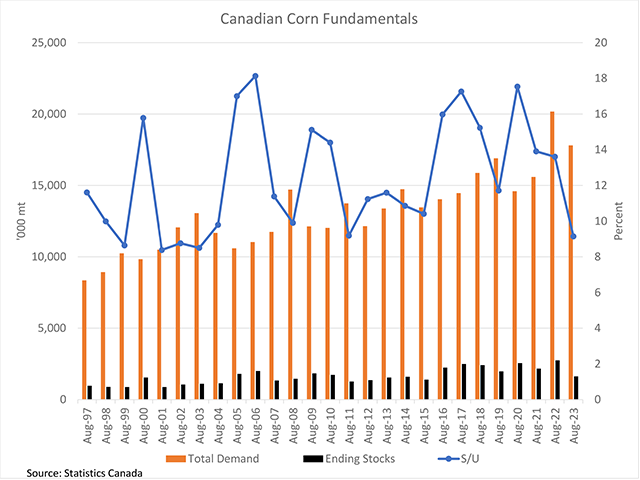

Statistics Canada released its ending stocks estimates for both corn and soybeans as of Aug. 31, while updating data in the supply and disposition tables.

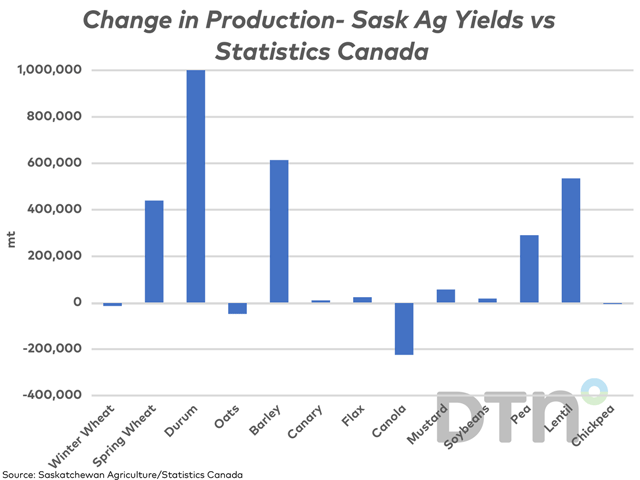

Saskatchewan Agriculture updated its provincial yield estimates for select crops this week, which may signal a larger crop than seen in official estimates.

This study looks at select crop and crop product trade data for August, 2023, the first month of the 2023-24 crop year for most crops.

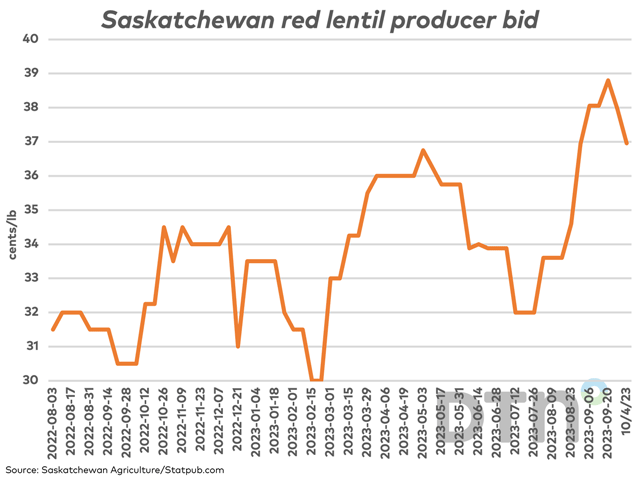

India has continued to escalate its actions against Canada, while the red lentil bid shows signs of weakness.

The Canadian dollar has faced heavy pressure in recent trade, while poised to test a long-term trendline.

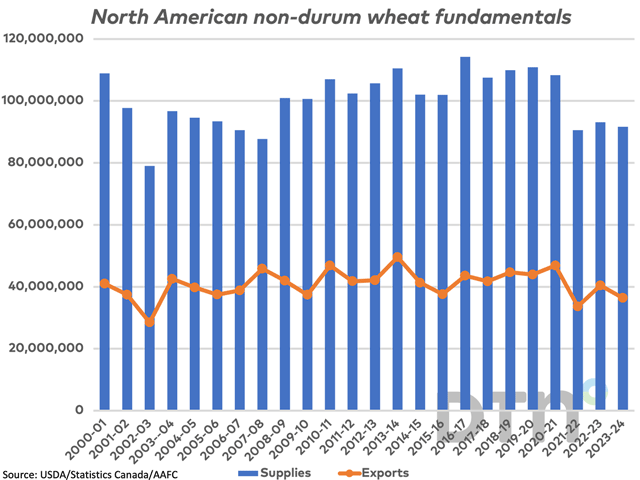

Following the release of the USDA's Small Grains Annual Summary on Sept. 29, we look at estimated non-durum wheat supplies for North America and the resulting export potential.

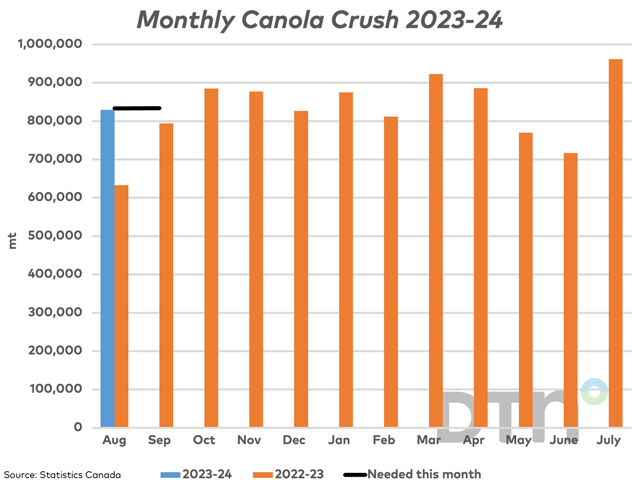

The August canola crush was the third largest August crush on record, only 845 mt lower than the August record set in 2020-21.

Hard wheat futures broke to new lows today, while Egypt shows patience in their quest to secure wheat imports.

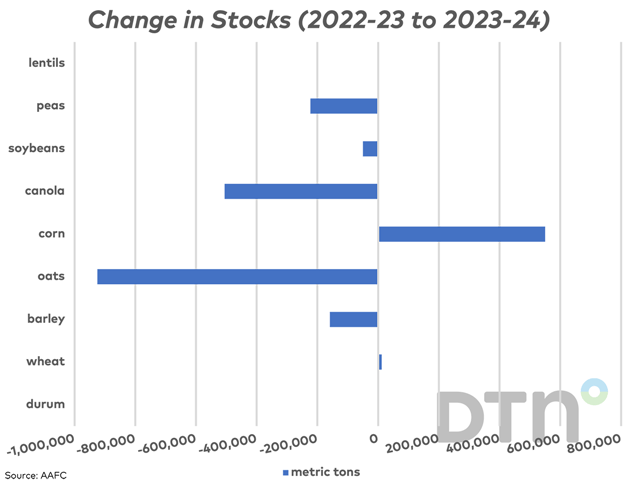

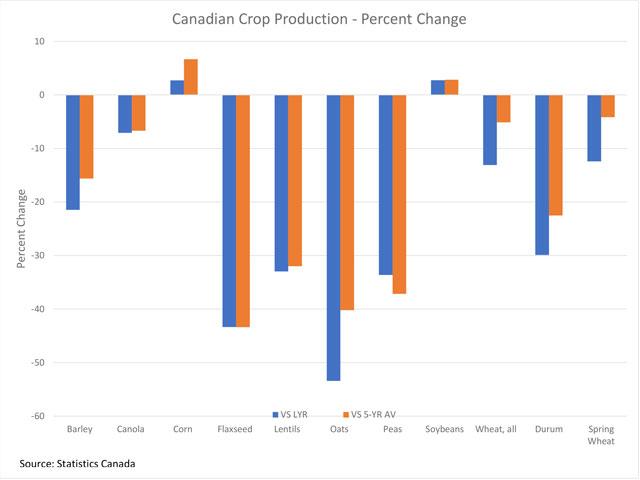

AAFC's 2023-24 supply and demand tables were revised this month to include the final official stocks estimates for 2022-23 along with Statistics Canada's model-based production estimates.

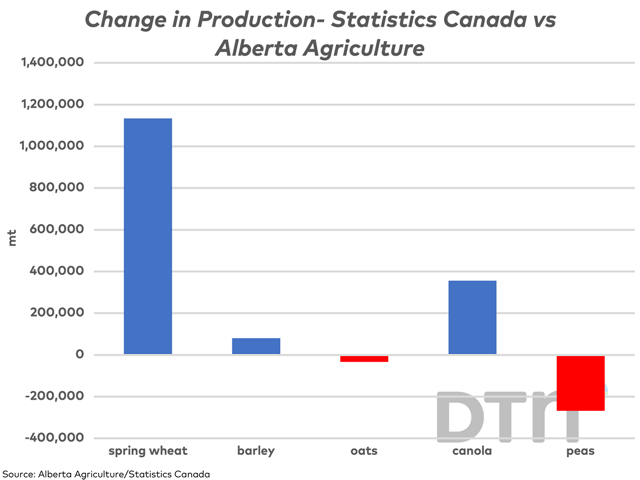

Alberta's latest crop shows an upward revision in yields, although official estimates show even greater potential and have tended to do so during the past three years.

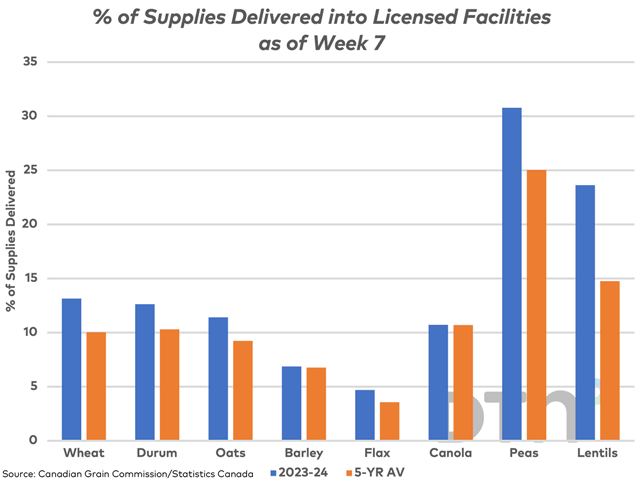

As of week 7, cumulative producer deliveries as a percent of available supplies (estimated July 31 farm stocks added to Statistics Canada's production estimate) is equal to or greater than average for the largest principal field crops.

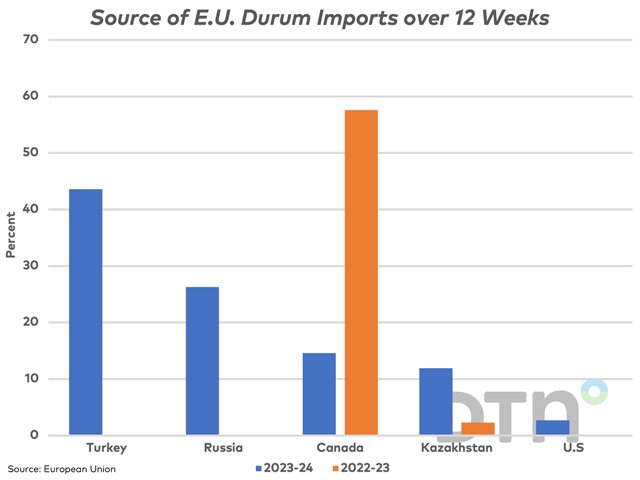

Canada's share of European Union durum imports has fallen sharply due to competitive pressures. The International Grains Council has forecast 2023-24 global ending stocks at the lowest in over 30 years.

The Canadian dollar has rallied against the U.S. dollar this month, although there are technical signals that suggest the move is reaching an end.

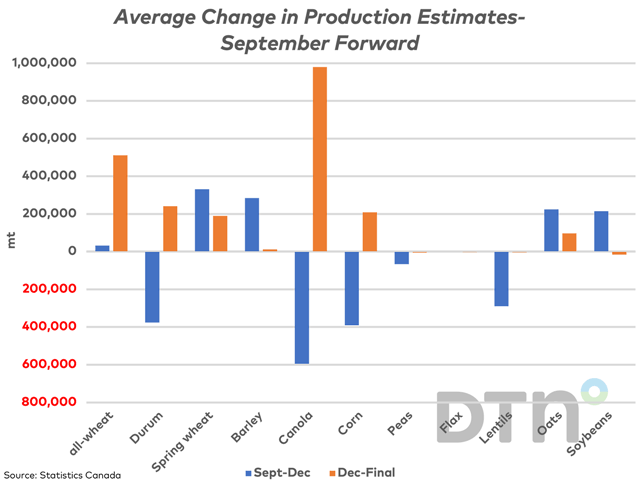

This study looks at the historical change in estimated production for select Canadian crops following the release of the August model-based estimates released in September.

November canola has slumped to potential support at the contract's 100-day moving average in Sept. 18 trade.

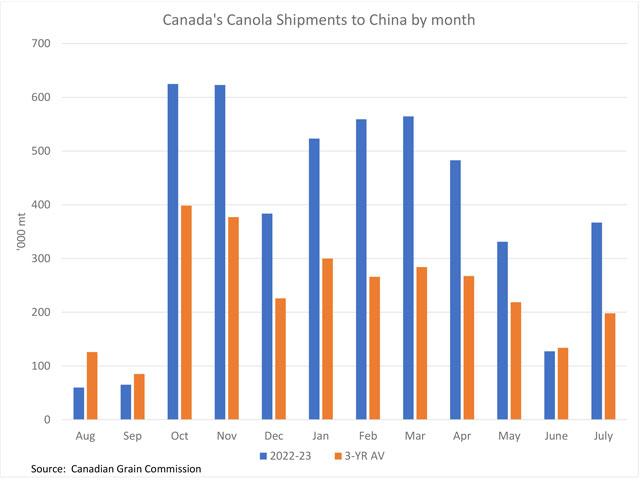

The USDA recently revised higher their estimate for China's 2022-23 canola/rapeseed imports, while over the past three years, the months of October and November have been the months where the largest volumes were shipped.

The largest changes in Statistics Canada's September production estimates, based on August model data, consist of an upward revision for spring wheat production, a lower revision for durum production, a lower revision for canola and a higher revision for corn.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]