Canada Markets

Global Wheat Stocks to Tighten

One of the surprises seen in the September WASDE report is a lower revision in the global production estimate for wheat and the estimate for 2023-24 ending stocks. The average of Dow Jones pre-report estimates pointed to an expected 600,000-metric-ton (mt) lower revision in stocks, while this month's report included a 7 million metric ton (mmt) drop to 258.6 mmt.

Production estimates for Argentina and the European Union were reduced by 1 mmt, while the estimate for Canada was reduced from 33 mmt to 31 mmt, or 2 mmt, and the estimate for Australia was reduced from 29 mmt to 26 mmt, or 3 mmt. Two of these estimates in particular bear watching. Statistics Canada's first production estimates of the season pegged production at 29.5 mmt (all-wheat), an estimate that will be updated on Sept. 14. Australia's ABARES September Crop Report pegged production at 25.4 mmt, with the current El Nino pattern an ongoing threat to the crop with Tuesday's forecast pointing to dry conditions affecting Eastern Australia.

Partially offsetting these lower revisions was a 1.5-mmt increase in the forecast production for Ukraine to 22.5 mmt, and USDA revised the export forecast higher by 500,000 mt to 11 mmt, as the country faces ongoing challenges in reaching export markets.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Another factor that bears watching is Russia's ability to dominate the market. This month's USDA estimates included a 1-mmt increase in the forecast for Russian wheat exports to 49 mmt, up from the 46 mmt estimate for 2022-23. Meanwhile, on Tuesday, private analyst SovEcon indicated on social media that they were scaling back on their forecast for Russia's exports in September, as they were reaching close to 100% of port capacity.

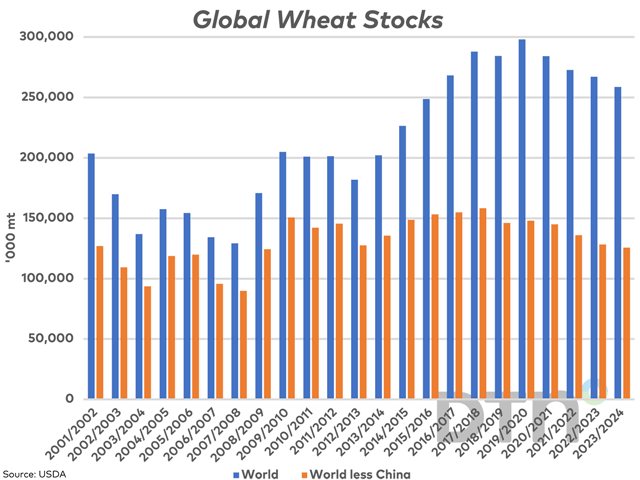

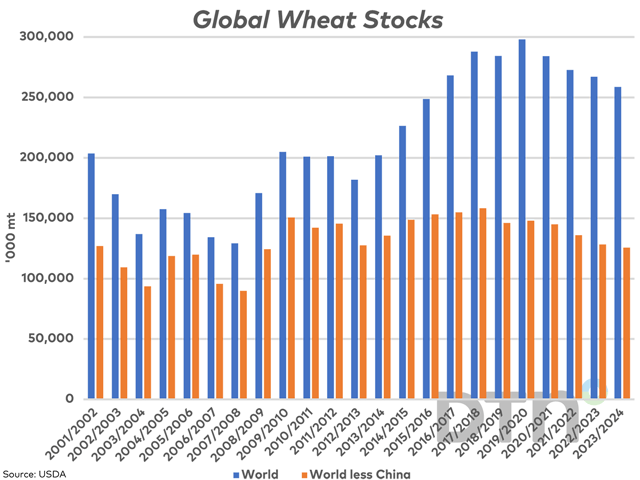

As seen on the accompanying chart (blue bars), global ending stocks of wheat for 2023-24, estimated at 258.6 mmt, would be the lowest in eight years or since 2015-16.

The brown bars represent global stocks, excluding China's stocks, which, at 125.7 mmt, would be the lowest seen since 2008-09, or 15 years.

When this calculation is made for the top eight exporting nations, USDA's estimated stocks total 54 mmt, or the lowest in 11 years. These stocks account for 20.9% of total global stocks estimated, close to the lowest percentage seen in at least the past 25 years.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .