Canada Markets

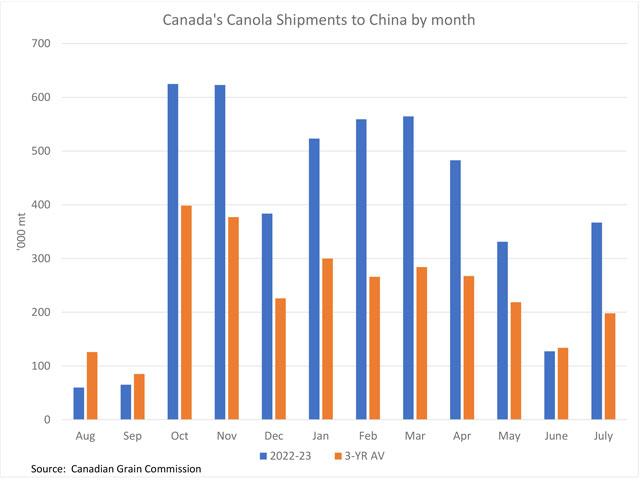

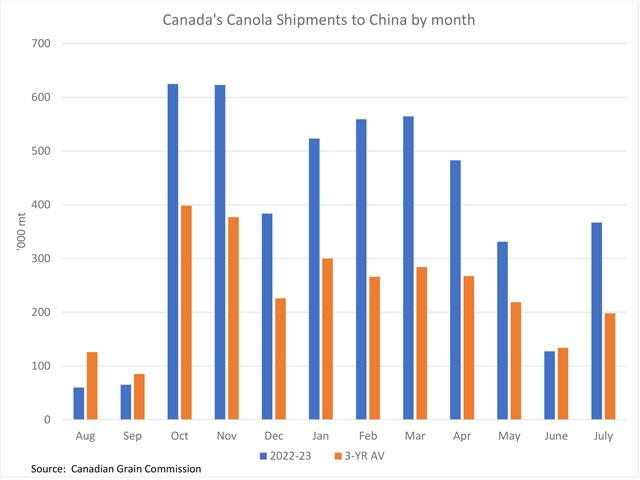

Canada's Historical Shipments of Canola to China

This week, the USDA's Oilseeds: World Markets and Trade report included an upward revision to the forecast for China's 2022-23 rapeseed/canola imports of 400,000 metric tons to a record 5.1 million metric tons (Oct-Sept crop year). One year ago, the same report was forecasting China's 2022-23 imports at 2.8 mmt, while as recent as January of this year, imports were forecast at 2.5 mmt for China's crop year which ends this month.

This forecast has been questioned over 2023, with Canada's shipments over the first four months of China's crop year (Oct 2022-Jan 2023) totaling 2.1 mmt, close to the USDA's forecast volume for the entire year from all sources.

China's imports of rapeseed/canola surprised to the upside over the past crop year and here's hoping that this will be the situation in 2023-24. This week's report has estimated China's 2023-24 imports at a reduced 3.4 mmt, while the USDA revised higher their forecast for soybean imports by 1 mmt to 100 mmt, citing stronger demand and improving crush margins, with imports forecast at a volume close to the 102 mmt record imports seen for the 2022-23 crop year. Headlines pointing to weak economic data from China have had very limited effects on this activity.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Weekly shipments of canola to all destinations have been lackluster. Over the first six weeks of 2023-24 (August-July), licensed exports have averaged 97,268 mt/week. Over the past 14 weeks, only five weeks have seen exports exceed 100,000 mt, while ranging as low as 22,700 mt, which was reported for the most recent week 6, or the week ending September 10.

Licensed canola exports over six weeks or the week ending Sept. 10 to all destinations total 465,000 mt, the highest volume shipped for this period in three years and just below the three-year average of 558,700 mt.

When it comes to movement to China, as seen on the attached graphic, little should be expected in August and September while signals in the following two months may be key.

As seen in weekly CFTC data, speculative traders have moved to a bearish net-short position over the week ending Sept. 12 and for the first time in nine weeks. Positive export signals would be welcome soon.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .