Canada Markets

Spring Wheat Searching for a Bottom

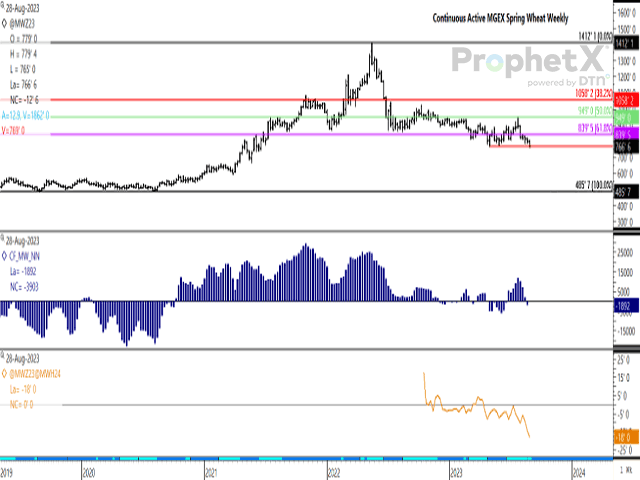

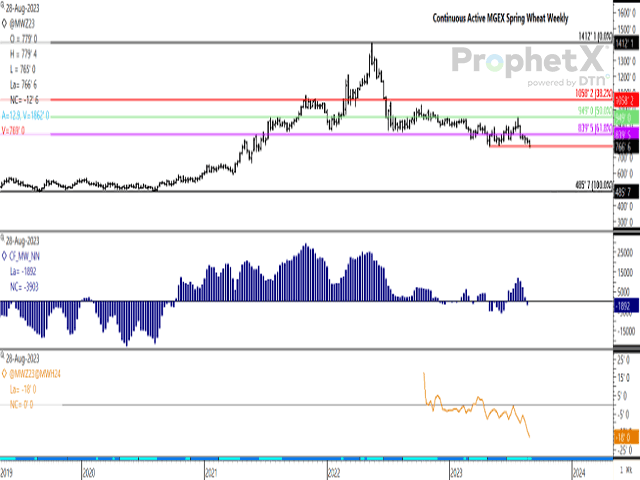

December MGEX hard red spring contract closed 12 3/4 cents lower on Aug. 31 to close at $7.66 3/4/bushel (bu), reaching a fresh contract low of $7.65/bu. This marks a fourth consecutive daily loss, totaling 35 1/4 cents in total. During August, the December monthly chart shows a loss of $1.02 3/4/bu, the first monthly loss in three months.

The continuous active weekly chart attached shows today's low taking out the recent May low of $7.69/bu, while reaching the lowest trade seen since the week of June 21, 2021, or more than two years. The weekly chart shows potential support from weekly lows from a four-week period in June 2021, ranging from $7.37/bu to $7.48 1/2/bu, which includes a double bottom at $7.37/bu. The next level of potential chart support is seen at psychological support at $7/bu.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The first study shows the noncommercial net position, which shows this group of traders moving to a bearish net-short position of 1,892 contracts during the week ending Aug. 22, the first net-short seen in nine weeks. This position will be updated for the most recent week on Sept. 1.

The lower study shows the Dec 23/March 24 futures spread, which weakened to minus 17 3/4 cents this session. This is a new low for this spread and compares to the five-year average for the Dec/March spread on this date of minus 8 1/4 cents. It is interesting to note that this is the weakest close for this spread on this date since the 2009-10 crop year.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .