Canada Markets

Canada's Estimated Durum Supplies Signal Trouble Ahead

There was perhaps no surprise in Statistics Canada's durum production estimate released on Aug. 29 of 4.259 million metric tons (mmt), which was close to the average of Reuter's pre-report estimates. Some estimates released in recent weeks pointed to production falling below 4 mmt.

It is important to note that this report is based on Statistics Canada's July model data, which will be followed by its estimates based on August model data on Sept. 14. During the past three years, since the model-based approach was used exclusively for both reports, the September report led to a lower estimate in each of the three years. In 2020, the September durum production estimate was 11.4% lower, in 2021 it was 11.3% lower and in 2022 was 5.5% lower, while averaging 9.4% lower during the three-year period.

It was no surprise that this week's Statistics Canada report included a prior-year adjustment, in this case a 347,000-mt upward adjustment to 2022 production. AAFC's August supply and demand commentary stated "there is speculation that the 2022 harvest was underestimated." Exports through the final weeks of 2022-23 forced AAFC to revise higher its export forecast for 2022-23; it was clear that there was more grain available than appeared in government estimates.

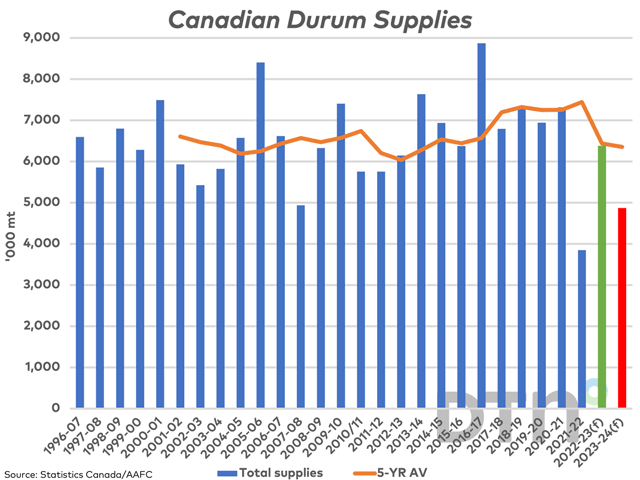

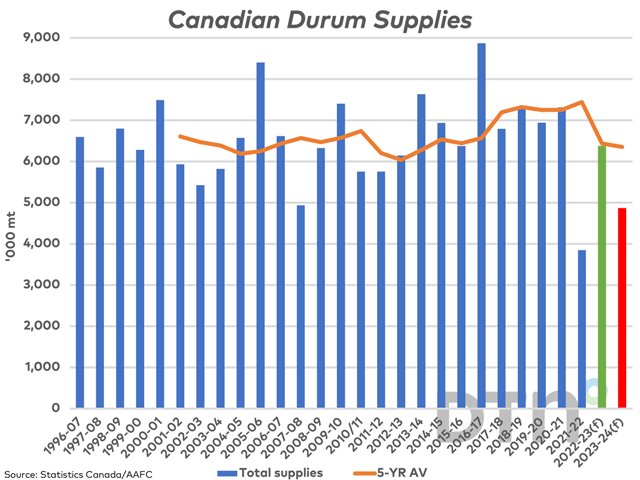

The green and red bars on the attached chart estimates crop year supplies for 2022-23 and 2023-24 by revising AAFC's estimates by the new production estimate for 2022-23 and this week's estimate for 2023-24. The red bar shows 2023-24 crop year supplies of 4.871 mmt. Two upcoming estimates will lead to potential revisions to this data, with Statistics Canada to report official estimates for 2022-23 ending stocks on Sept. 8, followed by an updated production estimate on Sept. 14.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

When compared to the five-year average supplies, indicated by the brown line, we see a significant reduction in supplies for the second time in three years in 2022-24. Supplies in 2021-22 of 3.853 mmt are 3.591 mmt below the five-year average, while projected supplies for 2023-24 of 4.871 mmt are 1.487 mmt below average. The five-year average volume exported is roughly 4.7 mmt, while AAFC is also forecasting food and industrial use at 200,000 mt for 2023-24 and total domestic disappearance of 770,000 mt.

Prairie producers are not at all opposed to storing durum and it remains to be seen just how quickly the new crop will be on wheels and delivered into elevators. This will tighten supplies even further.

Global News reports that Turkey has moved from an importer to an exporter, having shipped 300,000 mt and expected to ship 500,000 or even 1 mmt. At the same time, the country will run out of supplies in coming months and Canada's supply will be in focus.

Atalayar.com released a piece today focusing on the Canadian crop from the perspective of Morocco. "The problem is that it is not possible to replace imports of Canadian durum wheat with other suppliers, due to the high dependance of Moroccan consumers on this product," said Abdul Qadir Al-Alawi, president of the National Federation of Moroccan Mills. It is interesting to note that the online source used bold lettering for most of this sentence, indicating the significant nature of this trade relationship between Canada and Morocco. As of June, or the first 11 months of 2022-23, the Canadian Grain Commisssion reports exports to Morrocco at 785,200 mt, or the third-largest customer next to Italy and Algeria, which have been shipped similar volumes, both close to 1.2 mmt.

While not confirmed, a social media post from a commercial player has indicated that Algeria tendered for durum on Aug. 29, followed by Tunisia on Aug. 30.

Cash bids for southwest Saskatchewan reported by pdqinfo.ca have moved rapidly from a low $390/mt CAD level in July to a high of $530.96/mt as of Aug. 17, while have fallen in eight of the past nine sessions, reported at $523.96/mt on Aug. 30.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .