Canada Markets

Traders Signal Uncertainty in Canola Market

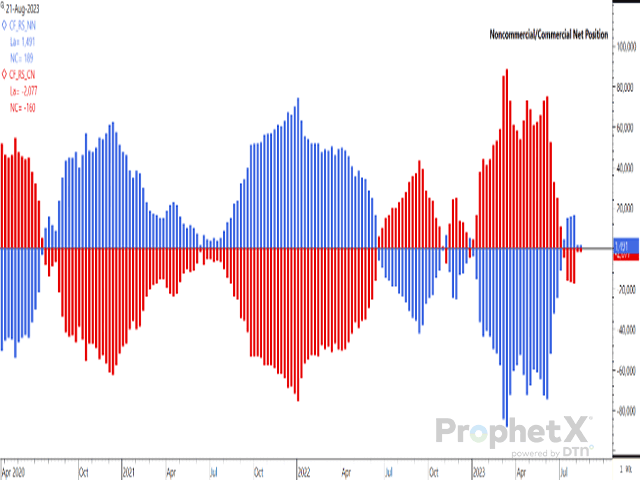

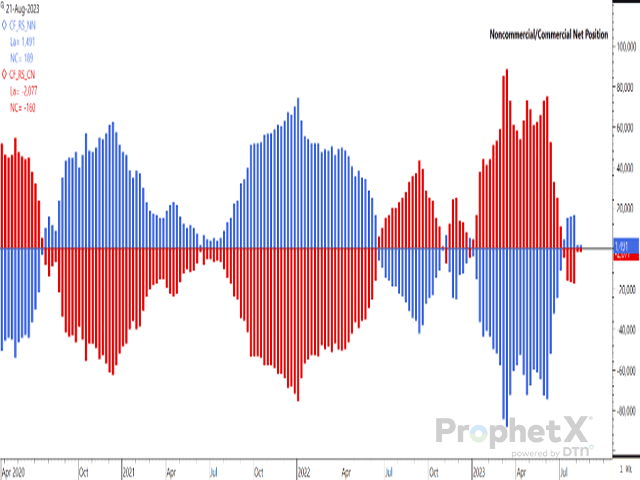

Ahead of the Aug. 29 Statistics Canada production estimates, CFTC data is showing both commercial and noncommercial traders noncommittal in their approach to trade, holding a neutral position as of Aug. 22. Perhaps it is viewed as a "nobody moves/nobody gets hurt" scenario.

Over the week ended Aug. 22, noncommercial traders (blue bars) increased their bullish net-long position for a fourth time in five weeks, although just by a modest 189 contracts to a net long of 1,491 contracts. This followed a very sharp plunge of 15,048 contracts in the reported net long in the previous week due to a sudden change in sentiment. Note that pre-report estimates have pegged Canada's canola crop from as low as 16 million metric tons (mmt) to as high as 19.2 mmt, a wide spread that leads to risks for the speculative trade and does little to encourage selling by producers.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Over the same week, commercial traders increased their net-short position by 160 contracts to 2,077 contracts net short (red bars).

Ahead of Statistics Canada's crop production estimates to be released on Aug. 29, traders are showing extreme caution, with the noncommercial position the smallest net position seen for this week since the CFTC began reporting canola data at the beginning of 2018-19.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .