The new-crop August rapeseed future traded above its 200-day moving average today, while closing just below it.

The new-crop August rapeseed future traded above its 200-day moving average today, while closing just below it.

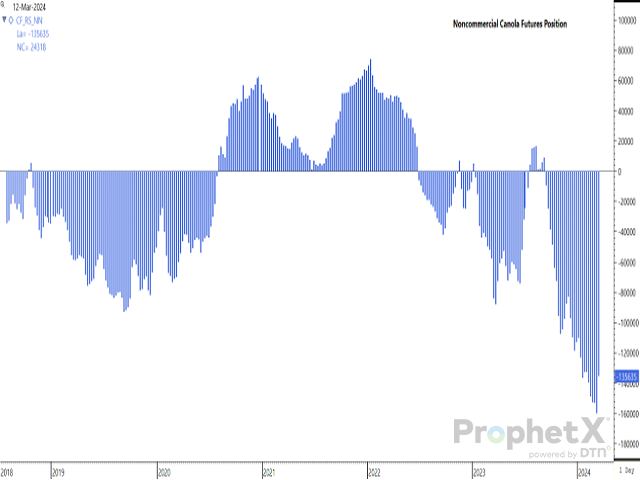

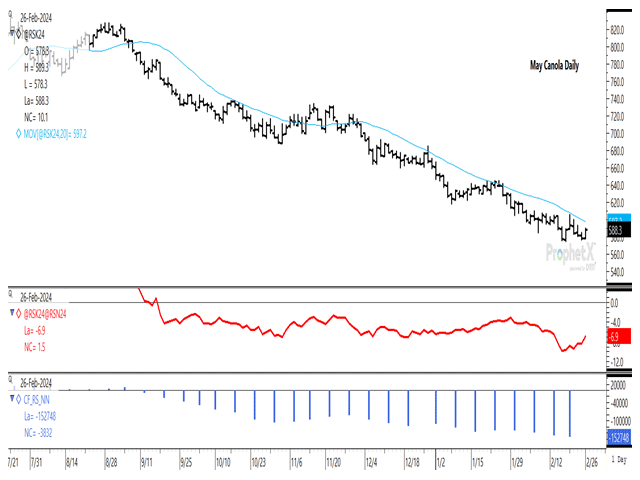

Recent CFTC data shows noncommercial traders paring their bearish net-short futures position for the first time in six weeks, while the net-short position realized its largest weekly drop on record.

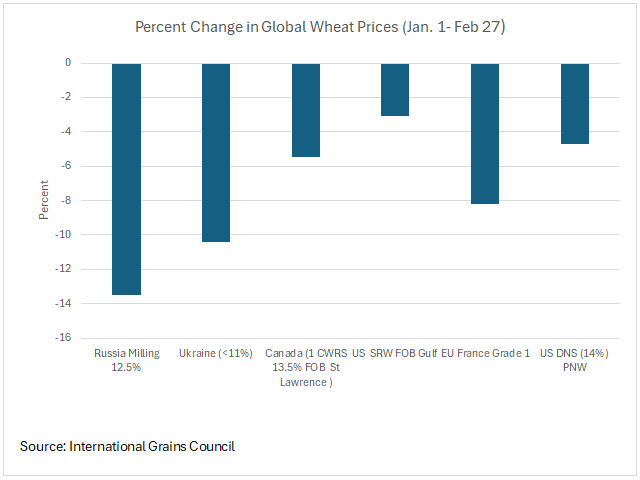

There was ample bearish news released for global wheat markets this week in the way of contract cancellations, although U.S. May wheat futures remain above contract lows and European milling wheat has ended with two consecutive higher weekly closes.

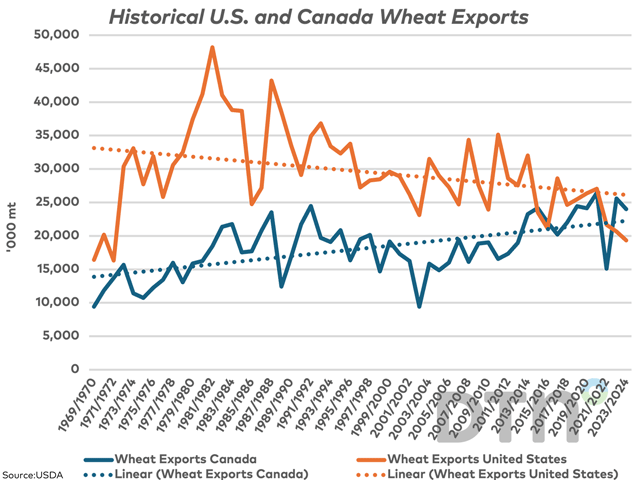

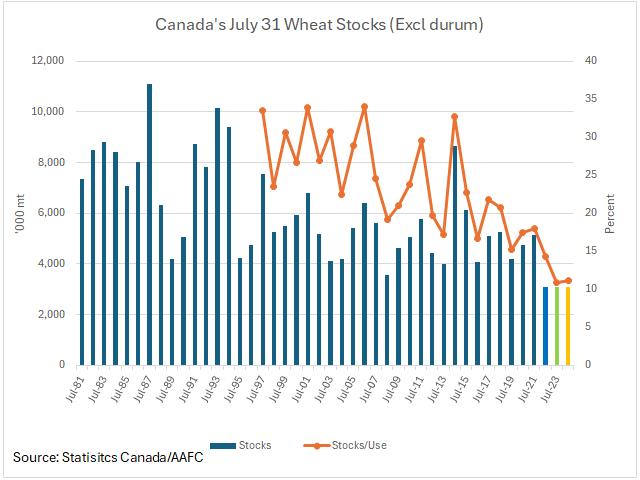

The most recent USDA estimates included a lower revision for U.S. wheat exports, with recent sales cancellations indicating there may be more cuts to come. The long-term trend for U.S. wheat exports is lower, while the trend for Canada is higher.

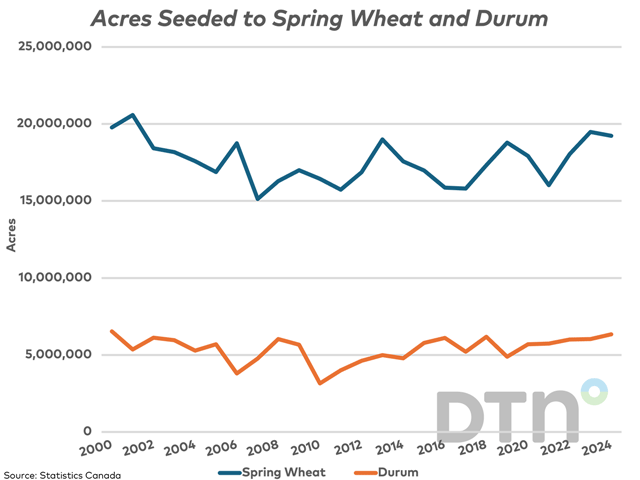

The first official estimates for 2024 planting of principal field crops was released Monday morning. Statistics Canada's estimate for total area seeded to field crops is seen at 78.2 million acres, down from the record 78.4 million calculated for 2023.

The new-crop canola future is showing a slow but steady move higher, which may prove to be a rounded bottom reversal pattern that bears watching over time.

Today's move in the Canadian dollar against the United States dollar was the largest one-day move higher since mid-December, while the spot loonie has traded within a 100-basis point range over the past four weeks.

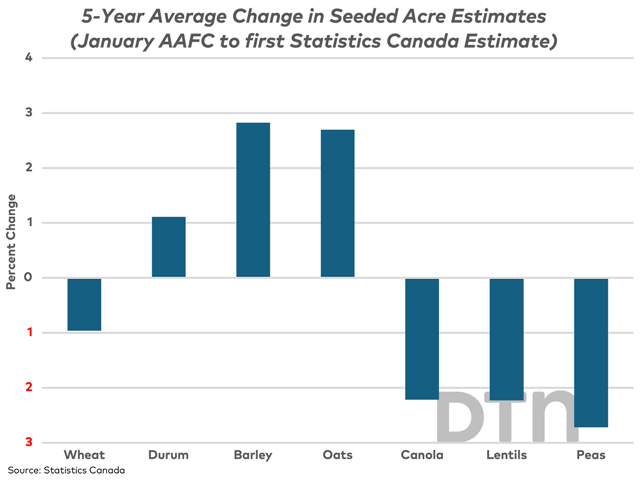

During the past five years, Statistics Canada's initial seeded acre estimates show a lower estimate on average for wheat (excluding durum), canola, lentils and dry peas. The 2024 report release will come earlier than ever, based on Dec/Jan surveys.

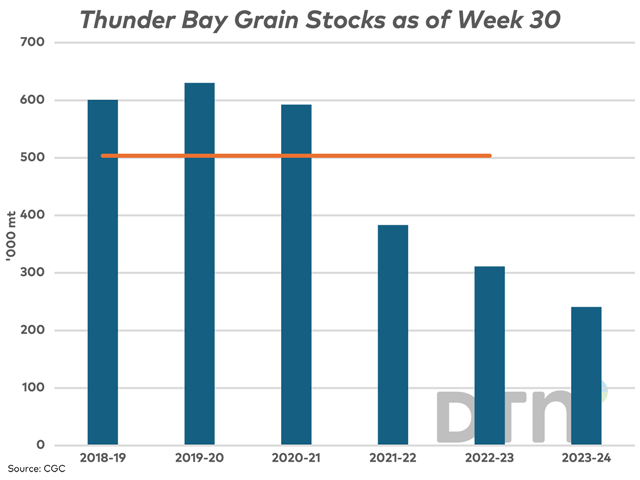

Rail activity is seen picking up at Thunder Bay while grain stocks are well-below average as of week 30.

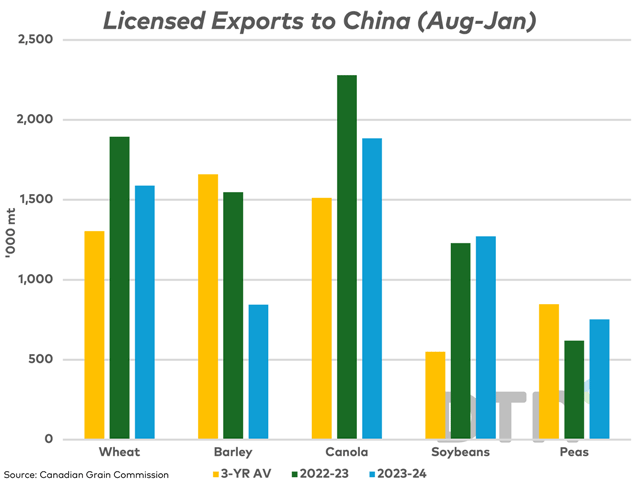

According to CGC data, overall crop exports are trailing the year-ago pace, while a large share of the drop is linked to movement to China.

ProphetX data shows that recent gains in palm oil cash prices have pulled the prices of competing vegetable oils higher in the Rotterdam cash market although rapeseed hasn't responded. The palm oil-soybean oil spread is historically weak.

Russia's wheat remains under pressure, setting the tone for global markets, while the IGC is reporting that Russia's prices continue to be lowered to attract export business.

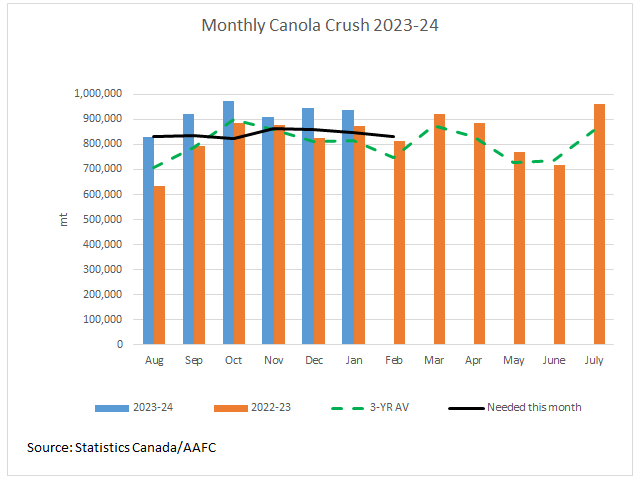

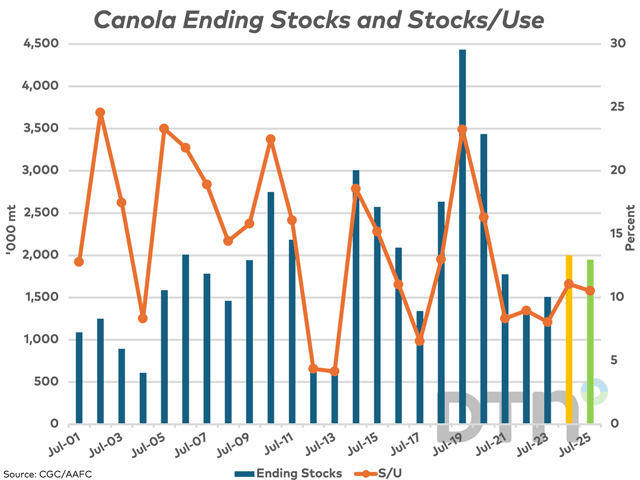

Statistics Canada reported January crush data today, with the pace of canola crush still at a favourable level.

Old-crop canola held above the previous week's contract low last week despite contract lows reached across the soy complex, while the Feb. 26 session saw the May contract hold in positive territory, ignoring early losses faced by soybeans and soybean oil.

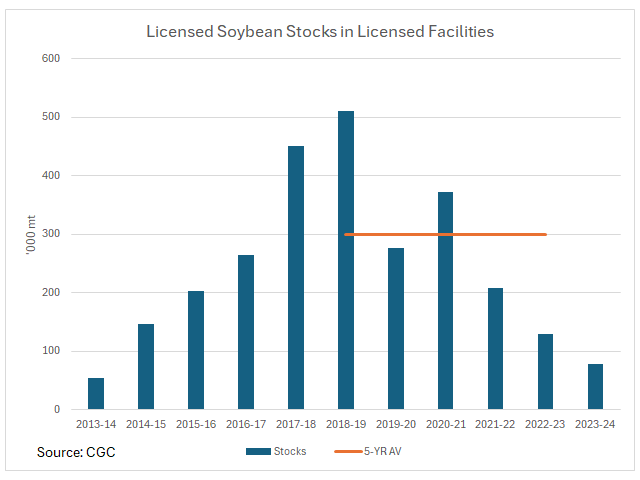

Soybean inventories in Canada's licensed facilities have dipped to 78,200 metric tons in week 29 of the 2023-24 crop year, the lowest in 10 years.

According to the government's recent estimates, ending stocks of Canadian wheat (excluding durum) in 2023-24 will be close to 3 mmt for a third year, while the current pace of exports is well ahead of the forecast pace.

AAFC revised its forecast for 2023-24 canola exports lower for the first time in six months, while the slow pace of movement may require more downward revisions.

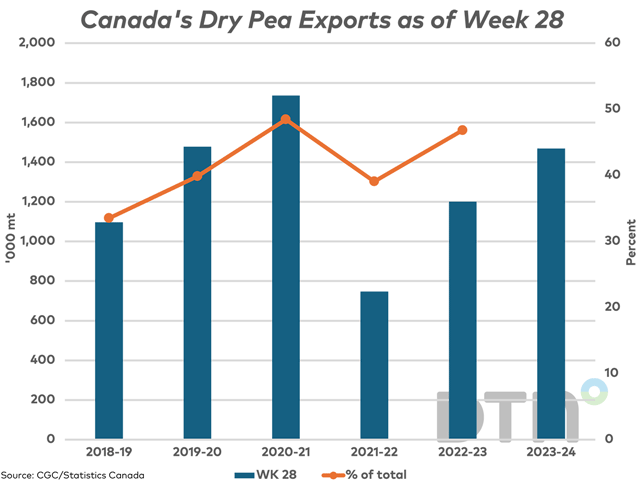

Dry pea exports through licensed facilities are seen as the highest in three years as of week 28. Cumulative exports as a percentage of the forecast exports for 2023-24 is also exceptionally high for this week.

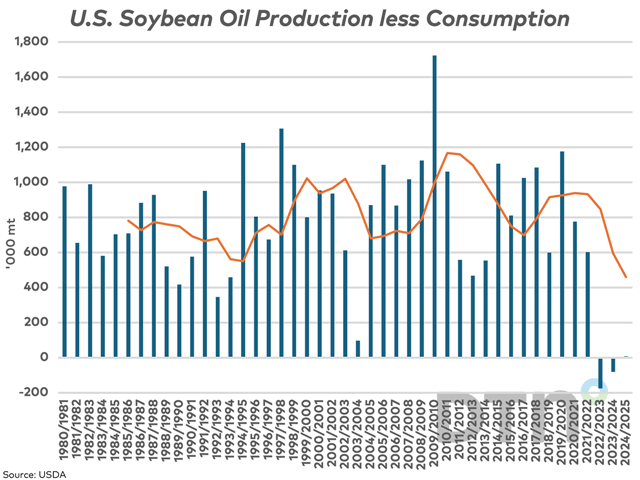

The USDA's first look at the 2024-25 crop year shows soybean oil production slightly exceeding consumption, leading to a year-over-year increase in stocks and continued pressure on prices.

A sharp drop in the Canadian dollar against its U.S. counterpart saw Canada's currency reach a 2024 low against the USD, while breaching chart support.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]