Canada Markets

Canada's First Government Crop Estimates for 2024-25

Agriculture and Agri-Food Canada (AAFC) released its first principal field crop estimates for the upcoming 2024-25 crop year, which provides a starting point for the next crop year but will face many revisions ahead as we move closer to and through the next crop year.

As of Dec. 31, the Canadian Drought Monitor has estimated that 81% of the country's agricultural land is facing some degree of drought. This analysis can be further broken down to show 100% of the prairie agricultural land facing some level of drought, including 74% of the Prairies facing from Moderate to Exceptional Drought conditions.

AAFC curiously stated, "Based on current market conditions and historical trends, the area seeded to field crops in Canada is forecast to increase marginally in 2024-25." At the same time, table data shows the area seeded to grains and oilseeds to fall by 1% and the area for pulse and special crops to increase by 5.3%. The area for all principal field crops is forecast to fall by 0.4% or 302,125 acres, which contradicts the previous statement.

Looking at the largest crops, Canada's all-wheat acres are forecast of fall by 1.9% or 526,323 acres. Acres seeded to wheat (excluding durum) are forecast to fall by 612,800 acres, after seeding the largest area in 10 years in 2023. This drop is forecast to offset a modest 86,485 acre increase in durum acres to 6.121 million acres, which would be the fifth highest area seeded on record.

Canola acres are also forecast to fall modestly, down 336,056 acres or 1.5% to 21.7 million acres, just slightly higher than the five-year average.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The area seeded to peas, lentils and oats are also forecast to rise. The largest year-over-year increase for all crops is seen for oats, with seeded area to rise by close to 685,000 acres, to 3.2 million acres, still well-below the five-year average of 3.5 million acres. On a percentage basis, the largest swings are seen with a 19% drop expected for flax acres, along with a 17% increase in chickpea acres.

This month's forecasts were made based on higher prairie yield potential, with AAFC forecasts using language such as a return to normal or trend yield potential. At the same time, yield potential for both corn and soybeans were revised lower from yields achieved in 2023 to reflect five-year-average yields.

Total supplies of the principal field crops is forecast to rise by 2.143 million metric tons (mmt) to 105.998 mmt, with an increase in 2024 production forecast to offset a drop in ending stocks in 2023-24.

Exports of Canadian grain in 2024-25 are estimated at 49.3 mmt, up only 1.3 mmt from the current year. The largest change seen is for durum due to a sharp rise in forecast supplies, with exports to rise 1.150 mmt year-over-year, while wheat exports are left unchanged at 20 mmt. Canola exports are also left steady at 7.7 mmt, despite the slow pace seen during the first 24 weeks of 2023-24.

Domestic use for all principal field crops is forecast only 0.3% higher than the current year. The canola crush estimate is left unchanged from the 2023-24 forecast of 10.5 mmt, while noting this is a conservative estimate and will depend on the timeline for new plants and current plant expansions. At the same time, the current 2023-24 pace is well-ahead of the pace needed to reach the government's forecast, with one industry indication that we could see new capacity come online as early as March.

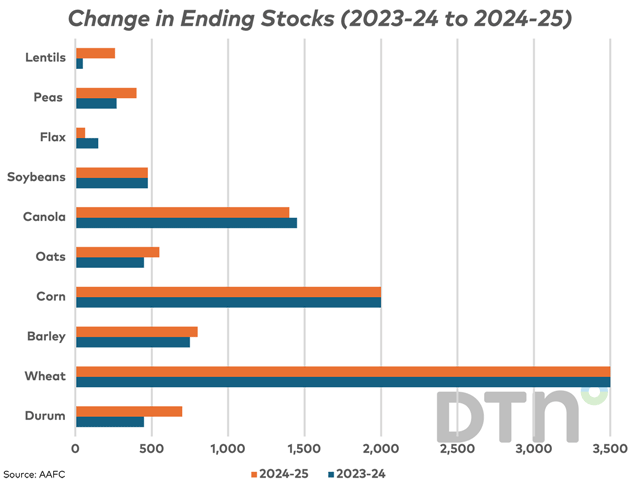

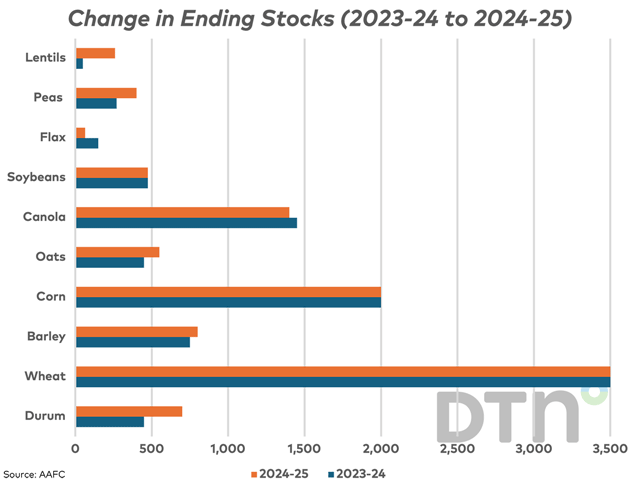

Carryout stocks for all grain are forecast to rise by 6.7% or 670,000 mt. As seen on the attached chart, stocks of peas, lentils, oats, barley and durum are forecast to rise year-over-year. The largest increase is seen for durum, with stocks forecast to rise 250,000 mt year over year. Wheat stocks (excluding durum) are forecast to remain steady at 3.5 mmt and canola stocks are forecast to fall by a modest 50,000 mt to 1.4 mmt.

AAFC's snapshot in time has led to price forecasts for the upcoming crop year that are steady to higher for row crops while generally lower for prairie crops. The average soybean price is estimated to remain unchanged from the current estimate for 2023-24, while the estimate for corn is $5/mt higher. The estimate for wheat shows a $5/mt drop from 2023-24 to 2024-25, with durum to fall by $75/mt, canola by $40/mt, barley by $25/mt, oats by $40/mt, peas by $90/mt and lentils by $240/mt.

Greek philosopher Heraclitus is noted for having said the only constant in life is change. These are early days and the only guarantee is that there are a lot of moving parts and changes can be expected.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .