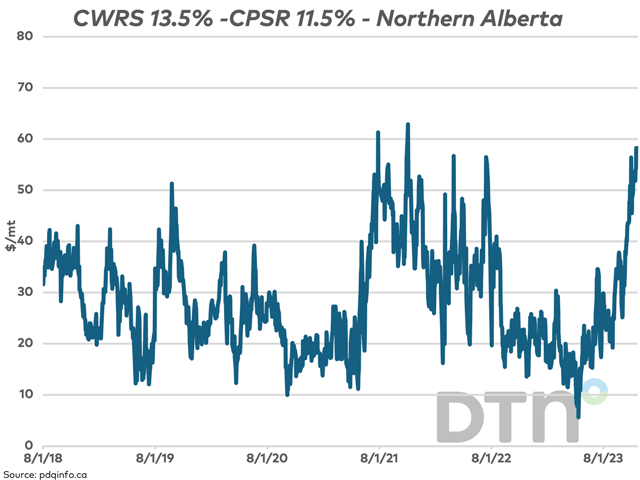

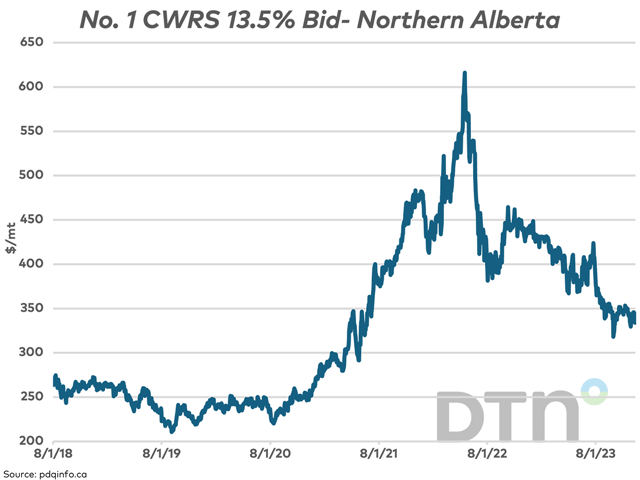

As of this week, the U.S. spring wheat basis is weaker than the five-year average. Depending on how it is calculated, the No. 1 CWRS 13.5% basis for the Northern Alberta region, one of nine regions monitored by pdqinfo.ca, is slightly stronger or slightly weaker than average.