Canada Markets

Canola Crush Backs Off but Remains Strong

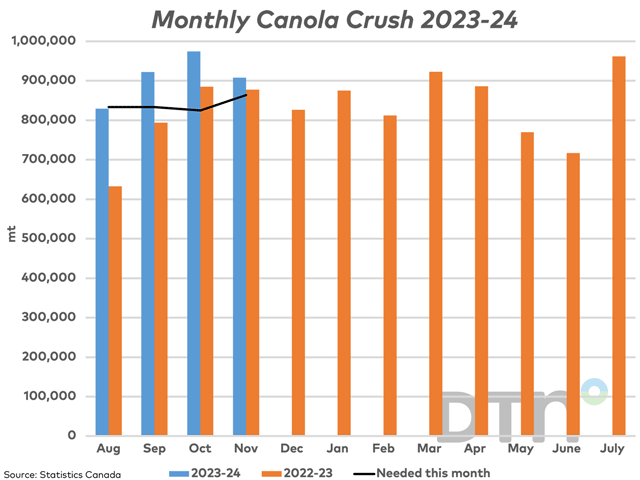

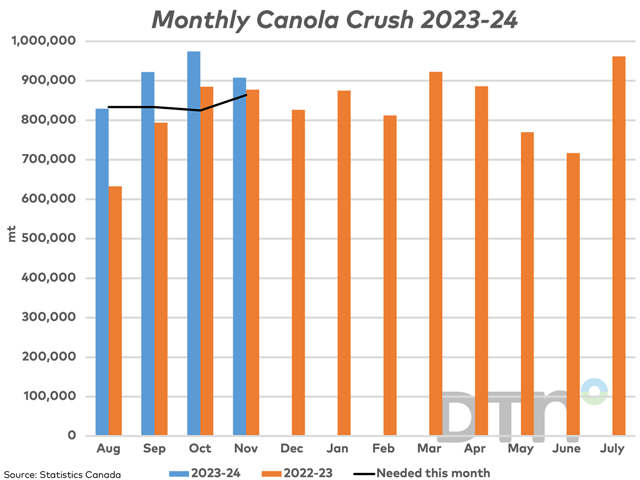

Statistics Canada reported 908,261 metric tons (mt) in November, down from the record 974,376 mt crushed in the previous month. This is above the 877,405 mt crushed in the same month in 2022-23, as well as above the 863,781 mt needed this month to stay on track to reach the current Agriculture and Agri-Food Canada (AAFC) crush forecast of 10.5 million metric tons (mmt), a forecast that was revised 500,000 mt higher this month. This volume is 5.8% higher than the three-year average for this month.

Over four months, the cumulative crush is calculated at 3.634 mmt, 13.9% higher than the same four-month period in the previous crop year, while 11.8% higher than the three-year average for this period.

Statistics Canada data shows the cumulative oil content at 42.3%, while the monthly crush produced an oil content of 42.6%, the highest monthly extraction rate seen since August 2021, or 27 months. The Canadian Grain Commission's analysis as of Nov. 30 is showing an eastern mean oil content for 2023 of 43.8% and a western mean oil content of 43.6% for No. 1 Canada Canola.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A ProphetX chart approximating the move in the ICE Canola Board Margin Index shows a mean index of $230.61/mt calculated for October, which compares $219.89/mt for the previous month, calculated using December product futures and January canola future. The incentive to crush remains high.

Crush demand for canola will begin to grow in 2024, with a Richardson plant expansion at Yorkton, Saskatchewan indicated to open in March. Fresh demand continues to appear, with an announcement this week of a modest Manitoba government financial contribution towards front-end engineering costs for a sustainable aviation fuel (SAF) project at Portage la Prairie. This plant would use the feedstock generated from crushing millions of metric tons of canola and/or soybeans.

Statistics Canada's November report also includes 153,144 mt of soybeans crush in Canada over the month, down from the previous month. This volume is up 1.3% from the same three-month period in 2022-23 and 3.2% higher than the three-year average for this date. The current pace of crush is very close to the pace needed to reach the government's 1.9 mmt crush target for 2023-24.

The oil content calculated for November soybeans is 17.5%, which is the lowest monthly percentage calculated in available Statistics Canada data going back to 2015. Over three months (September-November), the average oil content is calculated at 18%, down from the 2022-23 average of 18.9% and the three-year average of 18.7%.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @CliffJamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .