Canada Markets

Noncommercial Traders Hold Record Short Positions in Canada's Largest Crops

As North America's largest stock indices reach record highs, the latest CFTC data shows traders aren't willing to part with their bullish stance on grain futures.

The latest report released Jan. 19 and for the week ended Jan. 16 shows noncommercial traders or speculators increasing their bearish net-short position in all three wheat markets, corn, soybeans, soymeal, and canola. One exception is soybean oil, where the bearish net-short position was pared for a third consecutive week.

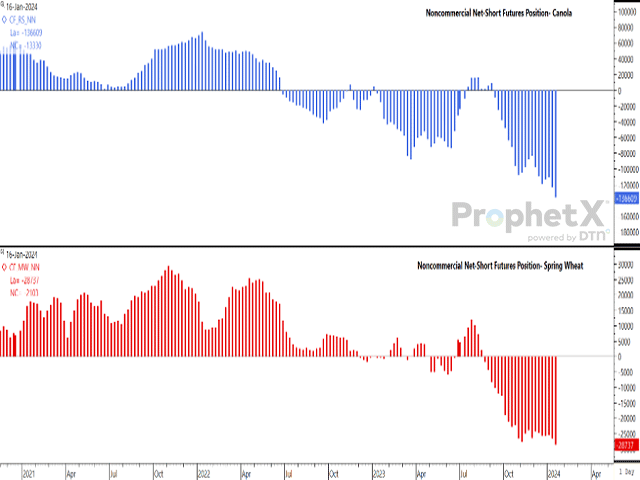

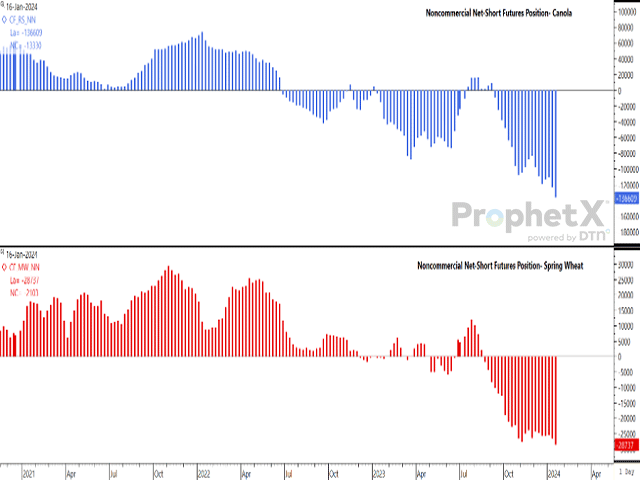

Two crops reached record-large net-short positions in the latest week's activity -- MGEX spring wheat and ICE canola.

Since Aug. 1, or the start of the Canadian 2023-24 crop year, the week ending Jan. 16 marks the sixth time a record-large net-short position has been reached, while the third time a record spring wheat futures position has been reached. This week marks the second time both have reached a record large net-short on the same week, with the first being the week ended Oct. 31.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The net-short position in canola futures increased by 13,342 contracts or 10.8% to 136,609, a second consecutive weekly increase. The same week saw the noncommercial short position in spring wheat futures increasing by 2,103 contracts or 7.9% to 28,737 contracts.

As we've been saying for some time, this market may remain poised for a short-covering rally, as we have seen in Jan. 22 trade. Anything that has the potential to make noncommercial traders short has the ability to move this market quickly and bears watching.

CANADA MARKETS BLOG UPDATE

On Jan. 3 we reported that 436 Saskatchewan Viterra staff covered by the Grain Services Union Locals 1 and 2 were poised to strike. Since then, Viterra has presented a revised offer, and on Jan. 19, both sides provided news releases indicating the most recent offer has been accepted by union members.

The union has stated, "While the changes in the final offer achieve part of what members were looking to gain, it doesn't go far enough. Members will continue to press the company during the term of the new agreement to address their concerns."

The next phase of the process is to implement the changes found in the latest offer.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .