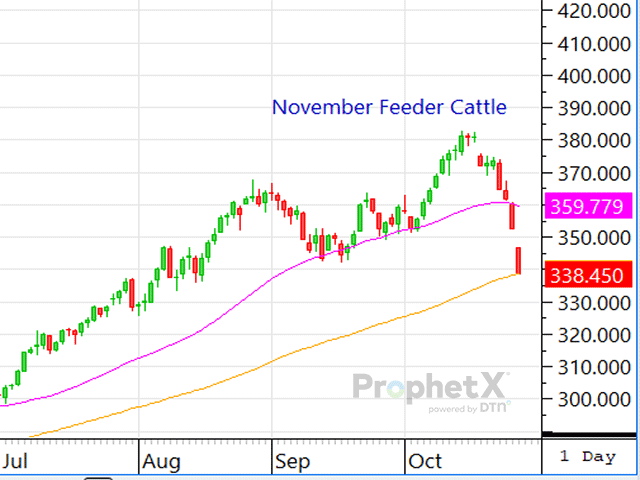

Although the fed cash cattle market performed exceptionally last week and traded $1 higher in the South and $7 higher in the North, cattle contracts closed lower on Monday as too many external pressures weighed negatively against the marketplace.

Although the fed cash cattle market performed exceptionally last week and traded $1 higher in the South and $7 higher in the North, cattle contracts closed lower on Monday as too many external pressures weighed negatively against the marketplace.

Despite financial struggles forcing consolidation and collaboration, farmers remain determined to continue their legacy and food production mission.

Record domestic use despite high prices has resulted in the need for increased supplies (including record imports) and limited exports.

The cattle market may have a bullish outlook for 2026, but that's not to say it's invincible. Whether it's external pressures from greater economic challenges or whatever news headline seems to break for the day -- the market is chock full of risk and volatility, just like we...

Friday's USDA Cattle Inventory report was entirely bullish. Producers should expect another rallying year where the story remains mostly the same. Limited supplies amid robust demand will likely push prices even higher.

The cattle complex is trading higher at Monday's start of the week following the strong trade last week in the fed cash cattle market. But traders will be closely monitoring what comes of this upcoming Friday's Cattle Inventory report as it will unveil what's happening with the...

A daughter's idea to bring her cow to visit care center residents, especially former farmers, brought immense joy. Simple acts of kindness can brighten lives.

There are plenty of bullish factors to point to in the marketplace. Even so, the market seems a tick stagnant as traders are waiting for undeniable fundamental support to surface.

Charged and on fire about the bullish outlook for 2026, the cattle complex has taken an aggressive start to the New Year.

With this week being another holiday-shortened week for New Year's Day, it's likely that the cattle complex will trade in a lackadaisical holiday manner again this week.

More than anything, I believe traders' positive interaction throughout the marketplace on Monday again shows hard evidence their core desire is to push the contracts higher as they know and understand the market's long-term, bullish fundamental position.

With packers able to buy over 103,000 head in last week's fed cash cattle market, it's likely the recent rally the fed cash cattle market has seen will subside until after the New Year holiday.

Given that the futures complex is up against stiff resistance, the market could be hard-pressed to trade higher unless substantial fundamental support develops.

A passion for building lifelong skills through showing cattle is a privilege to share with a family member.

Even with Ag Secretary Rollin's positive remarks, traders still need to see fundamental support before they'll likely advance the contracts anymore.

I personally believe the reduction of throughput will only push the herd build-back that much further out as yet another level of confidence has been eroded from the market.

Without strong support from boxed beef prices or the fed cash cattle market, the cattle complex could trade steady at best this week as traders yearn for stronger fundamental support.

A combination of technical and fundamental clues suggests the worst should be behind the cattle market with it now time to try to rebuild confidence along with price.

As long as beef demand remains strong as it's been, the board continues to show good faith, and no new unexpected headlines develop that could affect the cattle complex, the market may be slowly gaining some footing following the steep decline it endured just a couple weeks...

Should the markets really be driven by traders' reactions to news headlines as opposed to tangible fundamental developments? While the cattle complex has been losing money during the last seven trading days, boxed beef prices have continued to trade higher.

DIM[2x3] LBL[blogs-harringtons-sort-cull-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-harringtons-sort-cull-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]