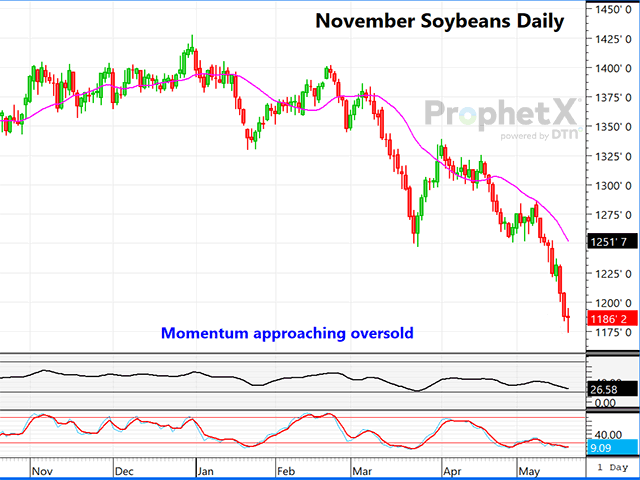

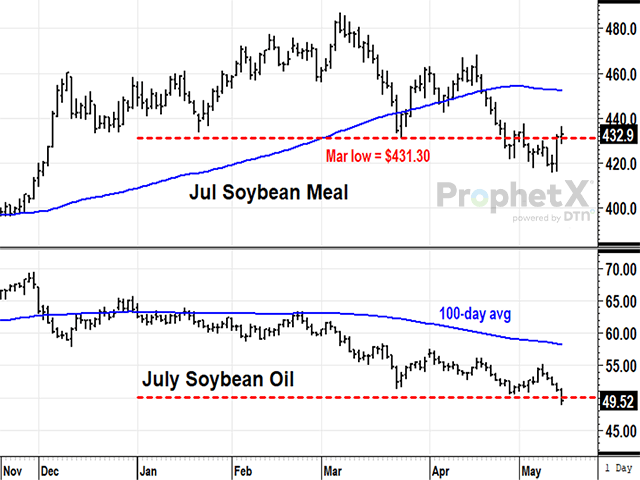

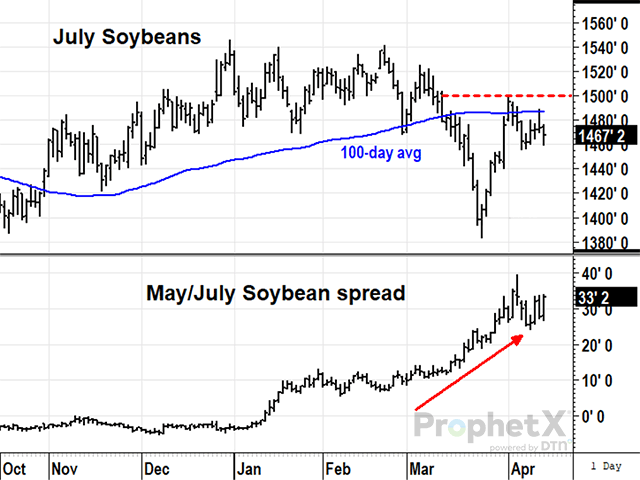

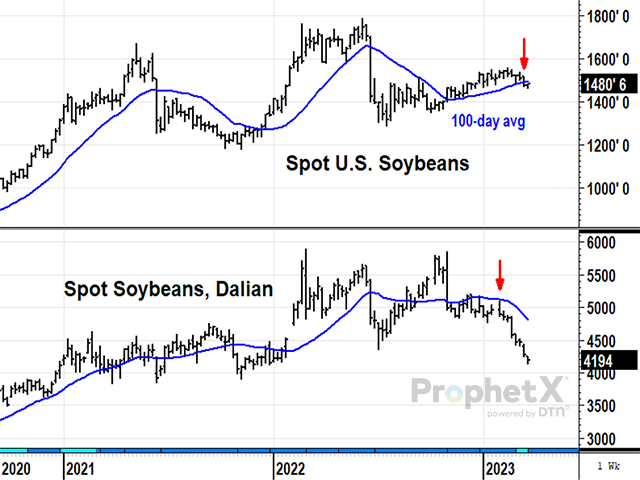

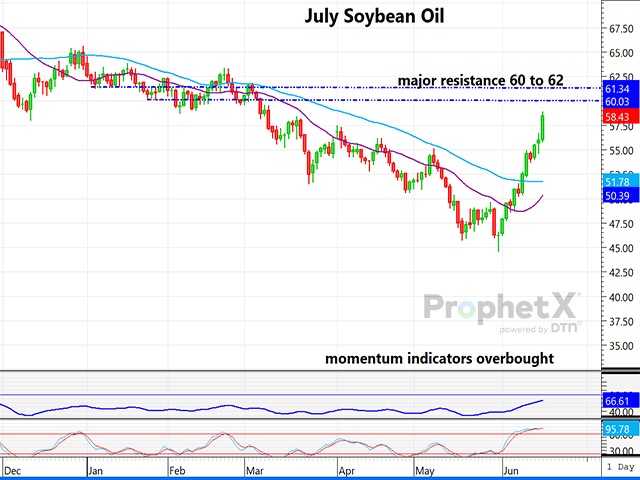

Soybeans and soybean oil have been on a parabolic tear to the upside of late. Granted, there are some weather and fundamental issues, which are valid and have driven these gains. However, short term, both markets have become very overbought, and likely due for a...