Technically Speaking

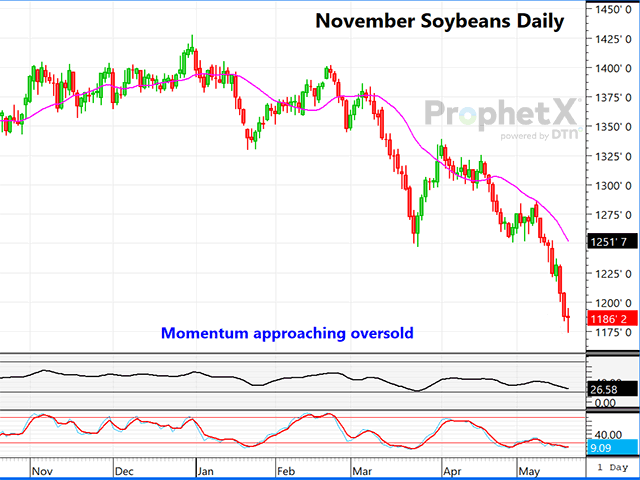

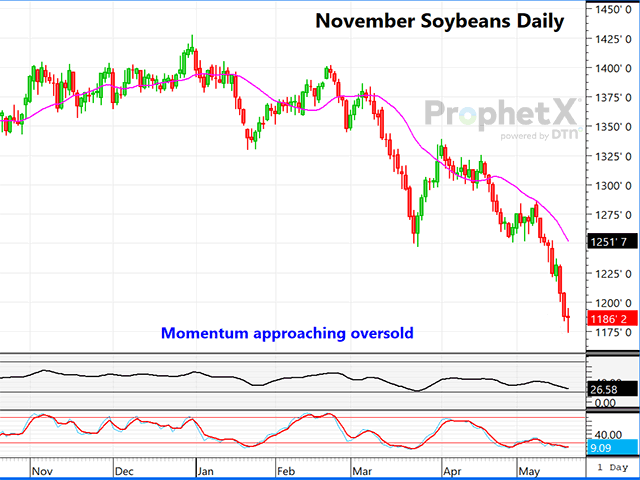

Could November Soybeans Be Near a Short-Term Bottom?

Brazil's record haul on soybeans -- estimated to be a huge 5.7 billion bushels (bb) -- has weighed on our futures market, as has USDA's May production report which suggested a record U.S. soy crop, assuming good weather. That's a huge assumption with the crop only 50% planted as of a week ago. There are still troubles in the Northern Plains, and especially North Dakota, slowing planting progress and putting yields and acres at risk.

U.S. soybean ending stocks are estimated to rise 120 million bushels (mb) to a more comfortable 335 mb. However, just a one bushel per acre (bpa) loss in yield has the potential to shift that number by close to 80 mb. Also, USDA appears to be too optimistic with their 27-million-metric-ton (mmt) estimate of Argentina's soy crop, with the Rosario and Buenos Aires exchanges in the 21.5 mmt to 22.5 mmt camp. Also, funds have liquidated all their soybean longs by now and may even be positioning short ahead of the growing season -- a dangerous proposition. Both relative strength and stochastics are flashing oversold and November is getting close to insurance coverage levels. However, sitting in the background is the always changing financial picture, with many still looking for recession, and the banking crisis likely not totally solved.

It sure seems that maybe November soybeans have been beaten up enough, at least in the short term. We shall soon see. If Thursday's November bean close is higher, it will be a good start.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As in new-crop soybeans, the spot bean oil July contract has been on a straight path downward, falling to the lowest level in two years. However, as in beans, technical momentum indicators are approaching an oversold level, which may hint a correction is near.

Bean oil seems to have the same potentially bearish background issues soybeans have -- some poor economic news out of China, suggesting that their economy may not be as strong as earlier thought, and of course outside market pressures, where visions of recession have sent crude oil down again. However, with the addition of more renewable biodiesel capacity coming online and the prospect the Argentine soy crop could possibly be as much as 4 mmt to 5 mmt lower than what the WASDE report indicated, the potential for U.S. soy product demand could easily be enhanced. Keep an eye on July soybean oil for signs of a turnaround. Early Thursday trade was a good start, but we are a long way from the close.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

**

Register today for the upcoming DTN Ag Summit Series event, "Crop Updates From the Field." We will visit with farmers from across the country, talk about the latest dicamba and pesticide news and discuss DTN's latest weather and market outlooks. The program begins Tuesday, May 23, at 8:30 a.m. CDT. We understand if you're too busy to attend live. It will be available for replay; however, you must register before the May 22 deadline to gain access. Registration is free, and you can find more details here: www.dtn.com/agsummit

Dana Mantini can be reached at Dana.Mantini@DTN.com

Follow him on Twitter @mantini_r

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .