Technically Speaking

Somethings Has to Give: Soybean and Oil Markets Appear Overdone

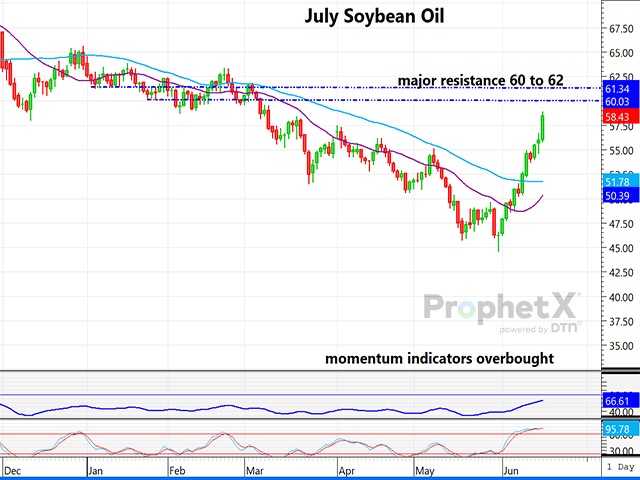

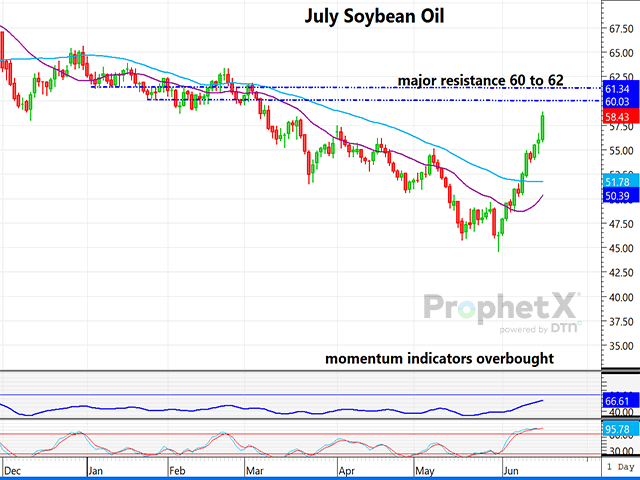

July soybean oil has been on an upward tear since the end of May, rallying over 14 cents per pound at Thursday's close. Rising biodiesel production, the soaring soybean market and the continued fall in Argentine soy production estimates have been instrumental in the meteoric rise. Also playing a factor is the fact that the previous break was fueled by the fund liquidation of their long in bean oil.

In another bullish twist for veg oils, the anticipation for the El Nino weather pattern to lead to drought in Malaysia and Indonesia does not bode well for palm oil production. The slide in Argentina's soybean crop continued on Thursday, June 15, with the Rosario Exchange dropping production another 1 mmt to just 20.5 mmt (919 mb). That is a full 4.5 mmt (165 mb) lower than the recent WASDE estimate, and likely will cut into Argentina's soy oil exports. Hence, the strength in U.S. soybean oil.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

However, the bean oil futures market has become very overbought, as has the soybean market, especially new-crop November. I would expect sometime in the next few days that we could see a correction in both the soybean and soybean oil markets. However, we are in a full-blown, and atypical early weather market, and volatility will continue to remain high.

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@DTN.com

Follow him on Twitter @mantini_r

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .