Technically Speaking

Can Surging Kansas City Wheat Market Extend Bull Run?

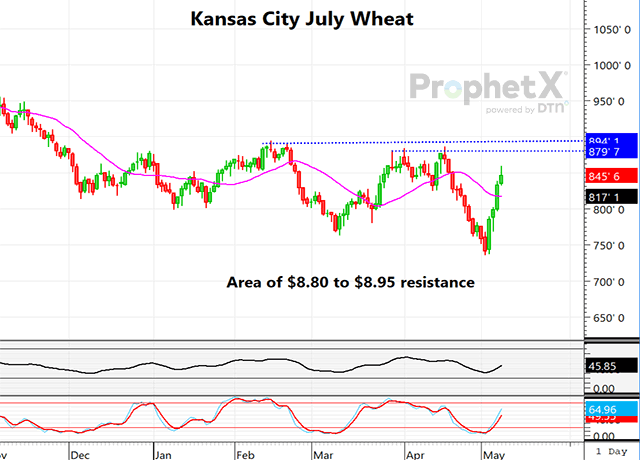

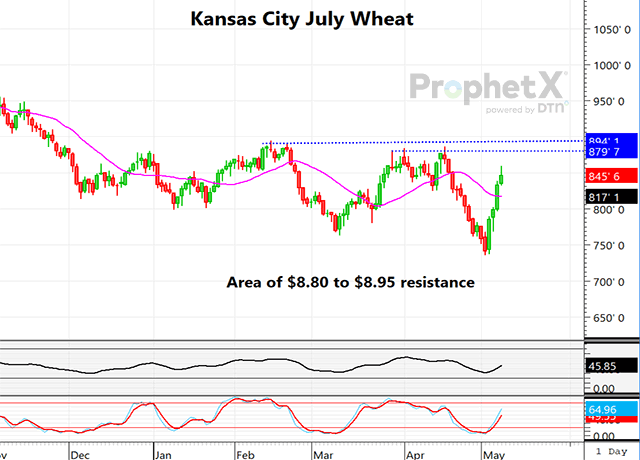

Since the third week in April, KC July wheat had plunged nearly $1.50 per bushel on fund selling tied to the sharp fall in Russian and EU wheat values, as both Russia and Ukraine had captured much of world wheat demand, and the Paris milling wheat market had also plunged. However, in a bounce back, which began four days ago, KC July recovered nearly $1.25 of those losses as of early Monday. With U.S. wheat stocks falling to a nine-year low and world stocks at a seven-year low, the worst U.S. winter wheat conditions in several years were seemingly being ignored by the market. Traders will anxiously wait for Monday's crop progress report to see if there was much, if any, improvement in conditions. However, rains which fell in the driest areas of the HRW belt were likely to be too little and much too late, with abandonment rates expected to be very high. We may find out more following the Wheat Quality Council Tour, set to begin on May 15.

KC July, even after this rally, is far from being overbought, although we could see a short-term downward correction. The next resistance above the current market is not found until KC July gets into the $8.80 to $$8.95 area. With the prospect for the Ukraine shipping corridor to end in 10 days if Russia does not agree, and with lower 2023 production also expected in Russia and Ukraine, and Australia possibly looking at a return of drought if El Nino sets in, it would not be a surprise for the wheat rally to extend. And, by the way, managed-money funds as of last Tuesday were still short a huge 126,000 contracts (630 mb) of Chicago wheat -- a bullish flame waiting to be ignited.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

New-crop December corn has made a nice recovery in the past few trading days, but the planting pace is likely ahead of normal once revealed in Monday's crop progress and the weather ahead looks to be conducive to further progress, while recent rains are improving soil moisture. With U.S. corn export sales and inspections still running from lower than a year ago, and with acres expected to be up sharply from last year, bullish corn traders may have their work cut out. On a further December corn rally, look for the area of $5.50 to $6.00 to be one of major resistance.

These bearish factors listed above are not the only things to impact the market, but there are a few reasons to be cautious on the short side. It would certainly appear the chance for another renewal of the Black Sea Grain Initiative on May 18 is unlikely to happen, taking a sizable portion of Ukraine grain off world markets. There is also the fact that managed-money funds last week added 103,000 contracts of shorts in corn, bringing them to a net of 118,000 contracts prior to the growing season and the usual market-moving May WASDE report. Perhaps more importantly, it is expected that WASDE will be forced to lower the Argentine corn crop, perhaps by another 4 million metric tons (mmt) to 5 mmt (157 to 197 mb) on Friday's report.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .