Technically Speaking

June Cattle Prices Overcome Latest Stumble, Turn Higher

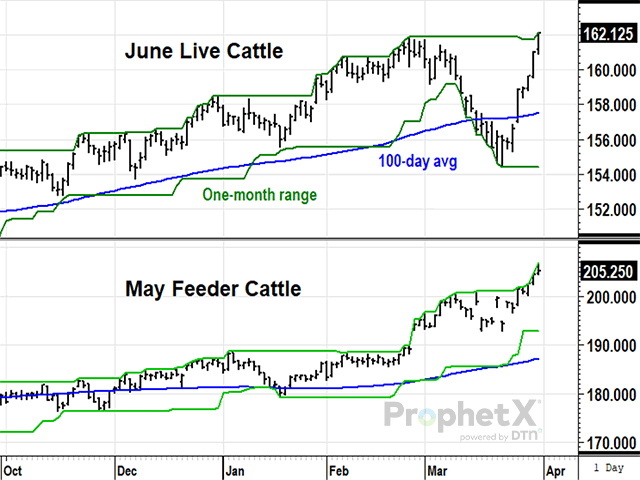

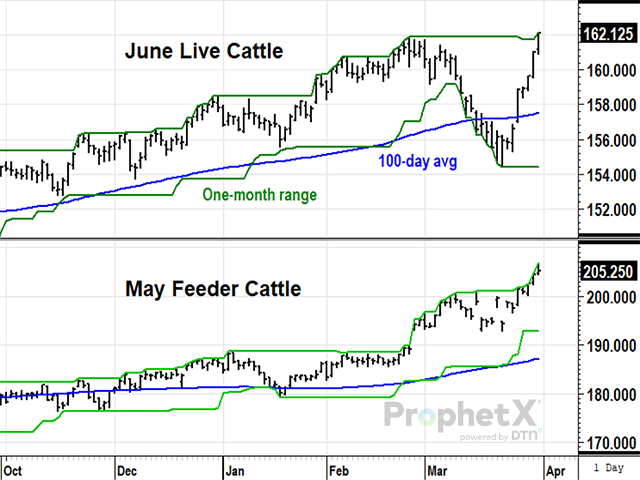

June live cattle closed up $1.12 Friday, March 31, and were up $5.52 for the week, ending at a new contract high of $162.12. Friday's close was the highest price for a June contract since 2014 as packers continue to struggle to find the supplies they need each week. The upward path of cattle futures was disrupted in mid-March after three U.S. banks failed and raised concerns among traders about the shakiness of the financial system. Friday's CFTC data showed noncommercial net longs in live cattle fell 46,755 over three weeks to 64,698 contracts as of March 28, a significant shakeout of specs from the long side of cattle. This week's live sales in the South were mostly at $167, up $4 from a week ago and a strong sign that demand remains bullish for limited supplies of available cattle. After a brief visit of June prices below the 100-day average in March and shakeout of spec positions, the trend in live cattle has turned up again.

FEEDER CATTLE:May feeder cattle closed up 80 cents at $205.25 Friday, ending the week up $7.70. Compared to live cattle prices, we're starting to see a more bullish performance in feeder prices, relative to live cattle prices. Feeder prices held up better in the month of March, not losing their uptrend while U.S. banks were failing in mid-March and also ended at a new contract high. The interesting thing historically is that when cattle inventory fell in 2014, feeder cattle prices starting surging relative to live cattle in September 2013 and the surge lasted until feeder prices peaked in October 2014. For now, the trend in spot feeder cattle is up with strength relative to live cattle prices noted.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .