Technically Speaking

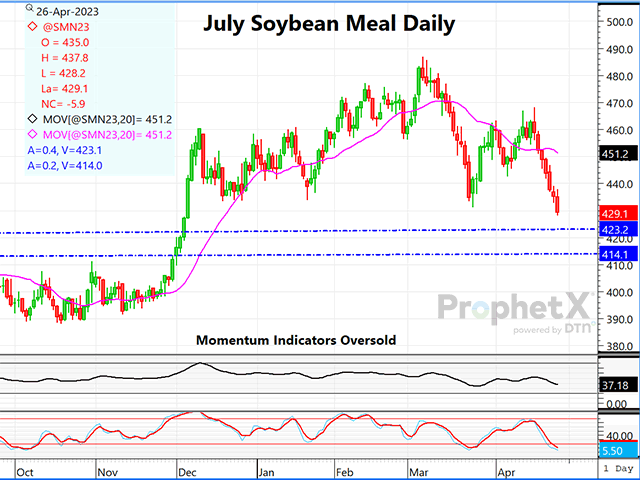

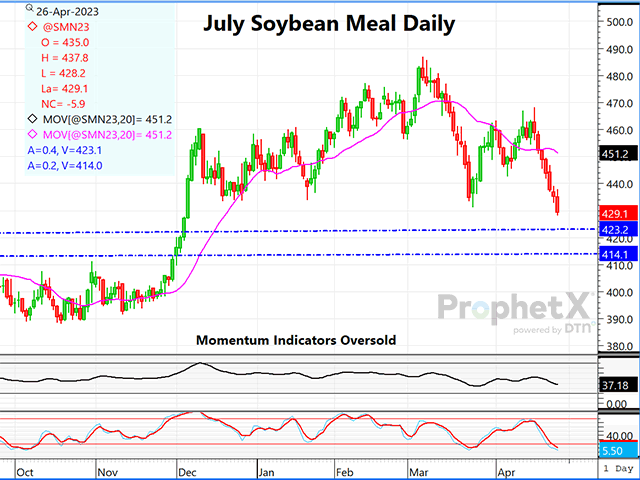

July Soybean Meal: Long Liquidation May Be Nearing End

JULY SOYBEAN MEAL:

For the past seven days July soybean meal futures have closed lower. Just since March 7, July soymeal has plunged nearly $60 per ton. By now, it is very likely funds have liquidated the lion's share of their net-long position. Momentum indicators are flashing oversold, the Argentine soybean crop may actually be as much as 5 million metric tons (mmt) lower than the USDA has penciled in, and the Brazilian soy harvest is nearing completion (95% done). Those all seem to be valid reasons why we could see the soybean meal market turn around soon. With Argentina's soy crop ultimately being somewhere close to 26 mmt (955 mb) lower than early season projections, and with the U.S. growing season straight ahead, and ending stocks at a seven-year low, this is no time to be bearish on the soy complex. Look for the area of $415 to $423 to be solid support on further weakness, and possibly an upward correction to start soon after.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@DTN.com

Follow him on Twitter @mantini_r

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .