Technically Speaking

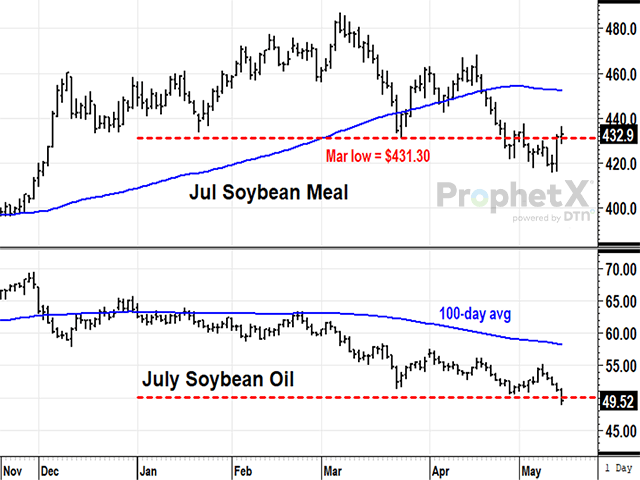

Summer Soybean Meal Prices Resist New Lows

July soybean meal closed up $6.80 at $432.90 in the week ended May 12, 2023, a close that wouldn't draw much attention in a normal week. However, this was a week that saw July soybeans post its lowest close since August 2022 and July soybean oil fall below 50 cents to its lowest weekly July close in over two years. On April 26, prospects for July soybean meal prices also looked bearish after posting its lowest close this year, but feeble attempts to trade lower didn't get very far and closed back above the April breakout on Friday. Fundamentally, it seems likely the reluctance to sell meal is related to Argentina's problems with drought. Even though USDA kept its estimate of Argentina's soybean crop unchanged at 27.0 million metric tons (mmt), the Rosario Grain exchange lowered its estimate to 21.5 mmt or 790 million bushels (mb), the smallest in 23 years. Technically, the reluctance of meal to trade lower is a sign of possible support for old-crop prices, but the trend has not turned higher yet. The weekly stochastic is also close to turning higher but has not confirmed a change in trend yet.

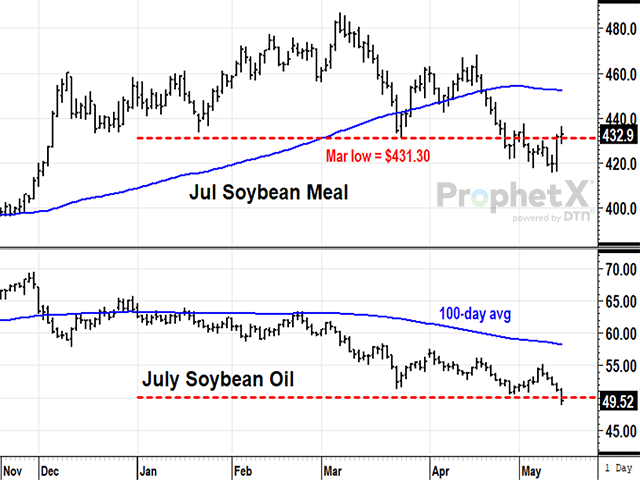

SOYBEAN OIL:Argentina is also the world's largest exporter of soybean oil, but soybean oil prices are not getting the same bullish lift from Argentina's problems that we see in meal. July soybean oil fell 4.81 cents to 49.52 in the week ended May 12, the first weekly close below 50 cents for a July contract in over two years. On Friday, USDA said it expects biofuel demand for soybean oil to be up 8% in 2023-24, but this year's influence from vegetable oil prices has been mostly bearish. Technically speaking, July soybean oil broke below the 100-day average on the first day of 2023 and has remained in a downtrend since. Friday's break below long-term support at 50 cents does not bode well for bean oil prices, but has attracted specs to the short side of the market, holding their largest positions since 2019. For that reason, beware of a possible bear trap in the making.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .