December corn, though volatile, is showing some technical and fundamental reasons for another run at higher prices, despite Friday's weak action and Monday's early weakness.

December corn, though volatile, is showing some technical and fundamental reasons for another run at higher prices, despite Friday's weak action and Monday's early weakness.

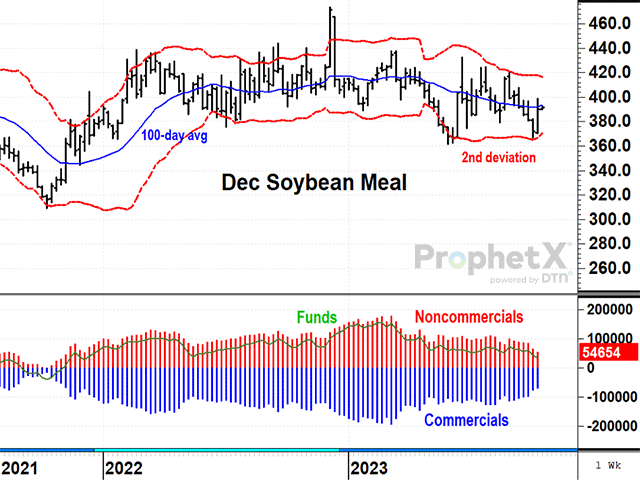

After a bearish performance in September, followed by a new three-month low in early October, December meal found support and helped give soybean prices an unexpected lift.

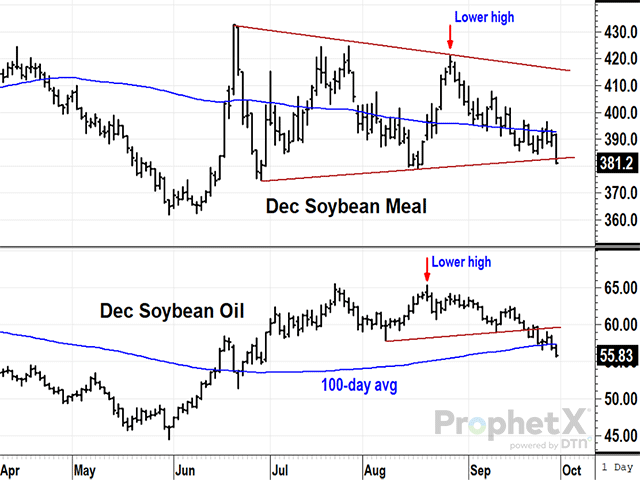

A summer of bullish crush incentives for soybeans is losing appeal in late September as both products broke recent support.

A summer of bullish crush incentives for soybeans is losing appeal in late September as both products broke recent support.

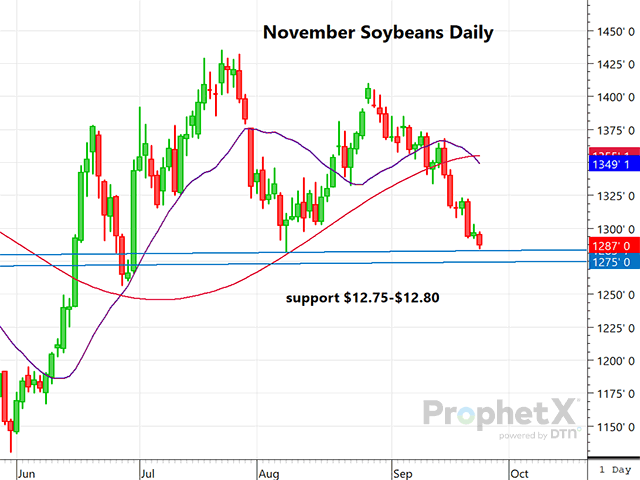

A look at November soybeans and KC December wheat.

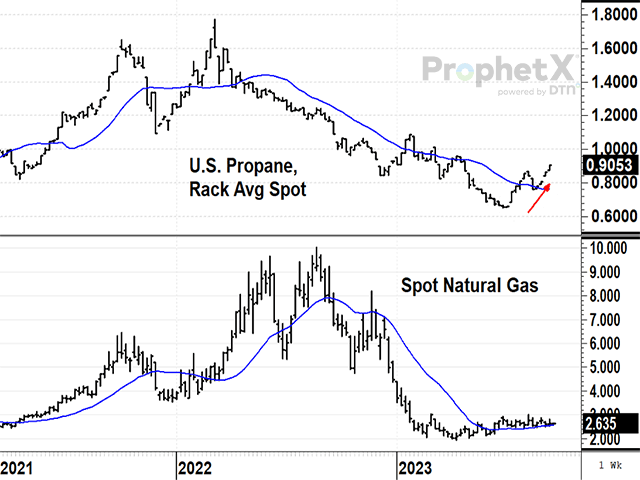

Natural gas prices are staying cheap this fall, but propane prices have already started turning higher.

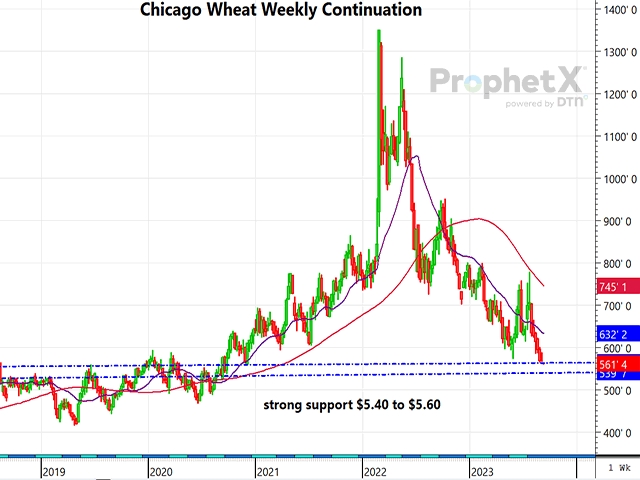

Chicago wheat futures are becoming oversold and there may be some bullish signs appearing.

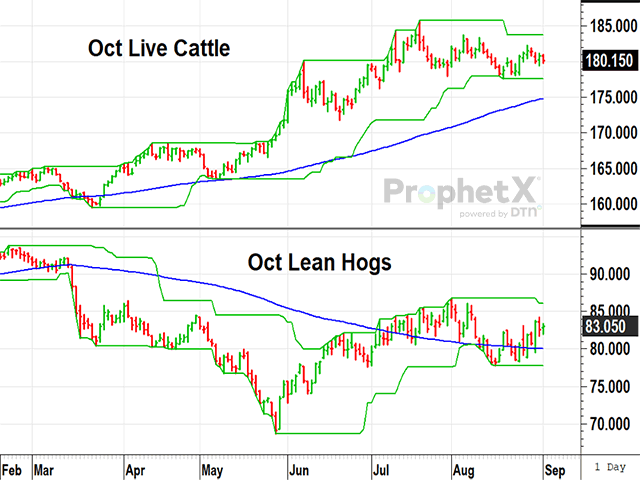

October contracts of live cattle continue to trade near all-time highs, while lean hog prices show signs of turning higher.

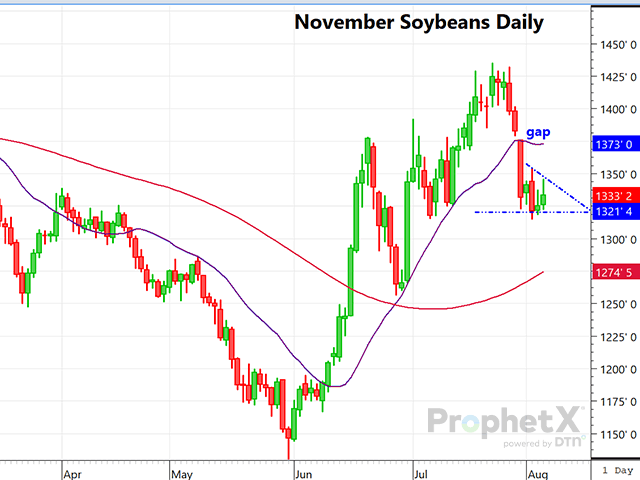

In the past 15 trading days, November soybeans have soared $1.28 per bushel on thoughts of declining yield potential.

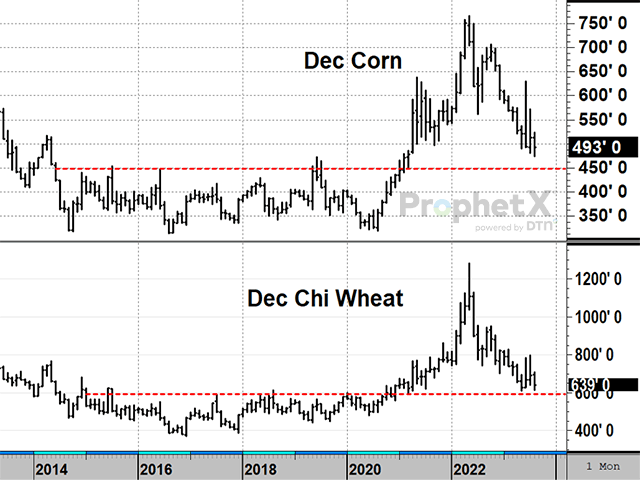

December corn and December Chicago wheat are both lower so far in 2023 but may be getting close to long-term support.

December corn futures have plunged 91 cents per bushel just since July 24. Granted, timely rains in July and early August have certainly turned around what, at one point, looked to be a potential disaster. But could the market be pricing in too much of a bearish outlook at a...

In the past seven trading days, new-crop November beans have plunged close to $1.17, gapping lower at one point last week. In the past four days, we have seen November trade back-and-forth in a sideways consolidation pattern. Where will soybeans go from here?

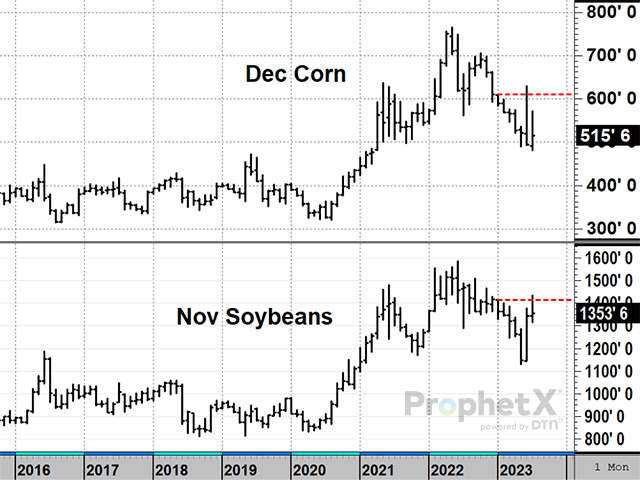

With one day left in July, both December corn and November soybeans have encountered resistance at the upper end of their summer ranges.

Minneapolis September wheat, spurred on by recent heat and dryness in spring wheat regions and the escalating port attacks in Ukraine, has broken out above the April high into new ground. However, it appears that there is plenty of resistance just above.

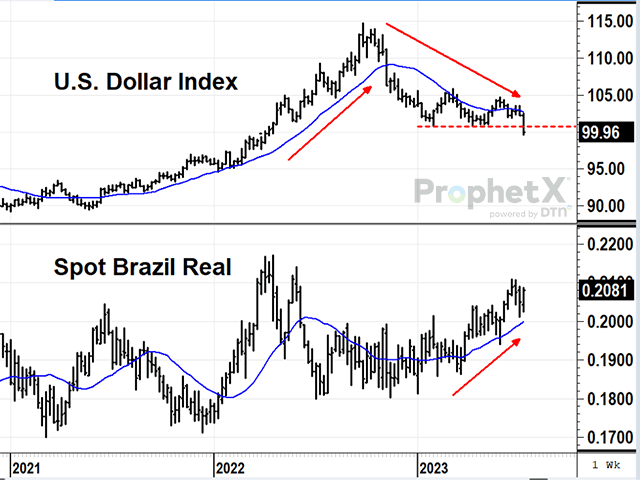

Last summer's rising U.S. dollar and anticipation of higher interest rates pressured grain prices lower but have now changed course. This summer's falling dollar could make traders more friendly again to the long side of grains.

After falling hard in the past 10 to 11 trading days, December corn is flashing conflicting signals. Trying to guess which way the market will go is a tall task.

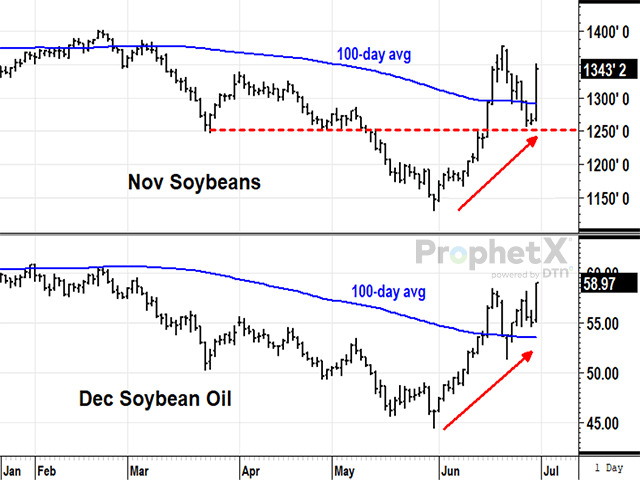

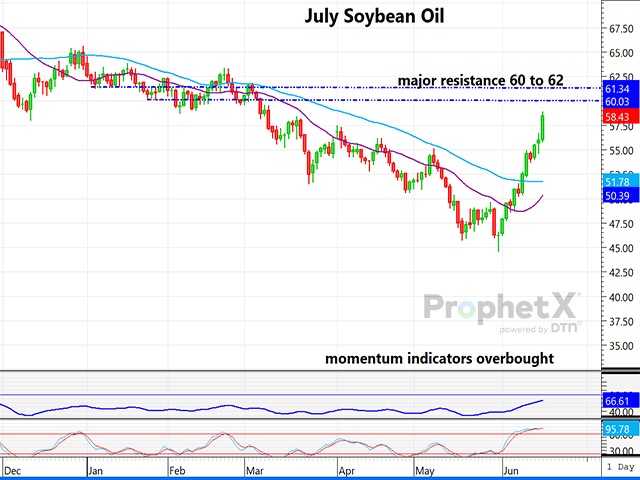

Even before USDA revealed a lower-than-expected soybean planting estimate on June 30, soybean oil and soybeans were showing unusually bullish behavior.

Chicago July wheat gapped higher last Wednesday and rose above a long-term trendline that dates back to October, and above the 100-day moving average. However, at midmorning Monday the market is acting a bit top-heavy.

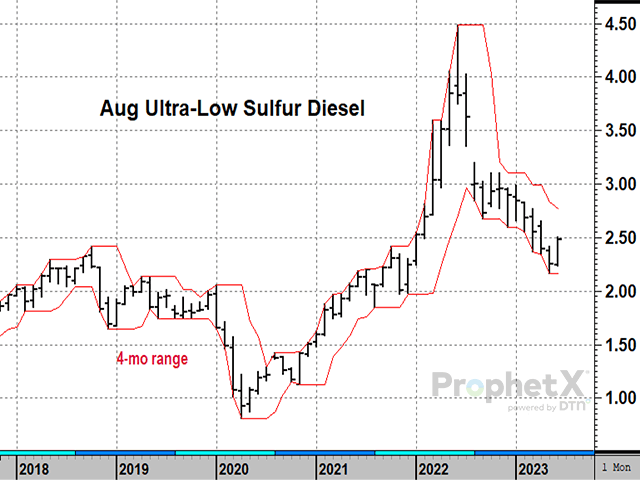

Quick reversals in momentum suggest diesel and gasoline prices may be poised to trade higher.

Soybeans and soybean oil have been on a parabolic tear to the upside of late. Granted, there are some weather and fundamental issues, which are valid and have driven these gains. However, short term, both markets have become very overbought, and likely due for a...

DIM[2x3] LBL[blogs-technically-speaking-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-technically-speaking-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]