Technically Speaking

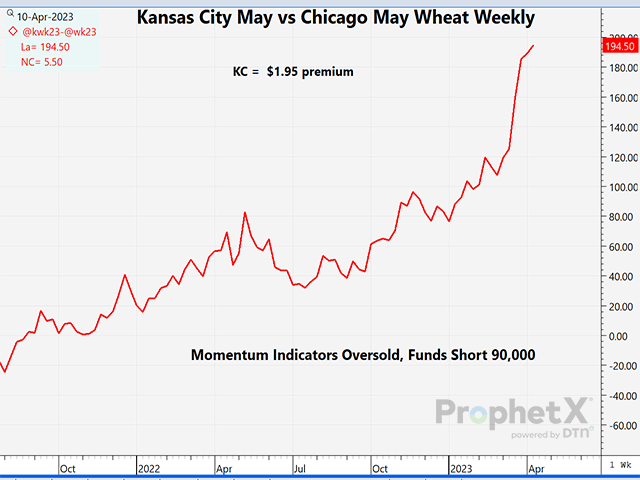

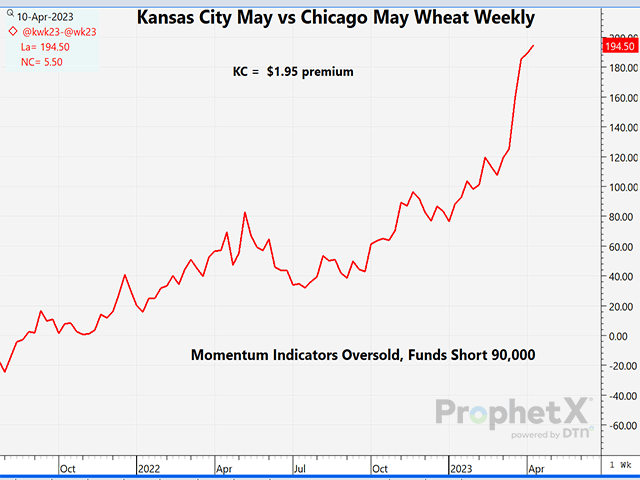

KC Wheat Rises to $1.95 Premium to Chicago, Which May Be Overdone

As recently as September 2020, the KC versus Chicago wheat spread saw KC trading at a nearly 70-cent discount to Chicago on a weekly chart. Even in November 2021, that same spread showed even money. However, a devastating drought had taken hold in the southwestern Plains, including parts of Texas, Oklahoma, Kansas, and southern Nebraska, giving us the worst winter wheat rating in many years. Much of the soft red wheat areas in the Delta and East have been blessed with plentiful rain. That has encouraged traders to buy KC and sell Chicago on a spread basis, driving the spread to heights not before seen. The drought has not let up in at least Kansas, the No. 1 hard red winter producer. Add to that the lowest U.S. wheat ending stocks in 15 years, and there is little reason to be bearish KC wheat. However, for two reasons, this spread could once again narrow. Momentum indicators on the spread are getting very overbought, but more importantly, managed money funds were still short 90,000 contracts of Chicago wheat as of last Tuesday. Once the funds decide to cover the balance of that short position, I think we will see Chicago gain as spreaders take profits.

DECEMBER CORN FUTURES:Don't sleep on December corn futures. Although this is a chart that does not have a reliable buy signal or oversold situation just yet, December is nearing a major area of support. With much of the U.S. seeding ahead and following the huge drought-induced loss in Argentina, the recent China buying, and the potential for Russia to not agree to an extension of the Black Sea Grain Initiative, there are multiple reasons to be optimistic at least in the short-term. Granted, longer-term expectations are for a sharp boost in corn acres, but with a full growing season ahead, and expectations for U.S. corn to dominate export circles to midsummer, December corn futures may be a bullish sleeper.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@dtn.com

Follow him on Twitter @mantini_r

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .