Technically Speaking

Currency Headwinds Turn Bullish For US Crop Prices

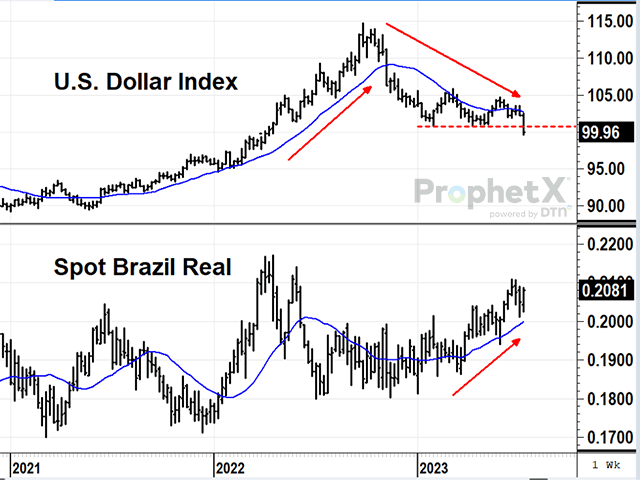

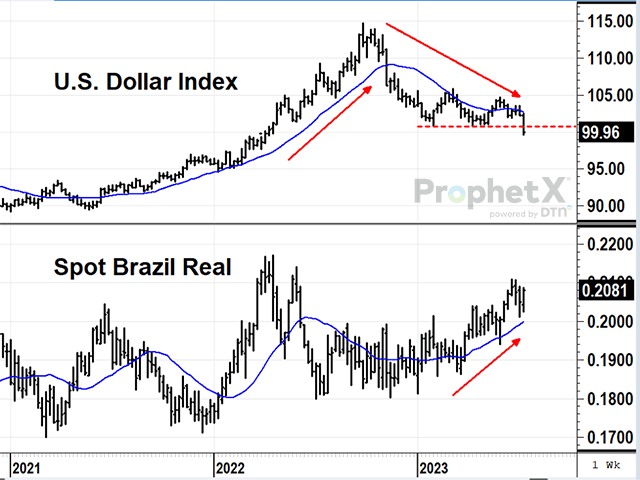

You may recall last summer December corn and November soybeans sold lower in late June and early July, largely because of the bearish influence of outside markets. Traders were concerned about the impact of higher interest rates and a rising U.S. Dollar Index and bailed out of their long positions in corn and beans. Now, one year later, the latest inflation readings are easing and the U.S. Dollar Index has turned lower. On Friday, July 14, 2023, the U.S. Dollar Index ended at 99.96, down 2.31 on the week and at its lowest close in over a year. Friday's new low is a bearish change in trend for the U.S. Dollar Index and is apt to have some bullish influence on U.S. commodity prices in general, as it makes imports of U.S. goods more affordable for foreign buyers.

BRAZIL'S REAL:While the U.S. Dollar Index is on a downward trend, Brazil's currency, the real, has been chopping steadily higher in 2023. The August real finished at 20.81 cents Friday, up 0.31 cent on the week and near its highest prices in 2023. According to Reuters, Brazil's central bank expects Brazil's real GDP to be up 2.0% in 2023, while inflation remains under control, reported at 3.2% in June from a year ago and a much more attractive currency alternative to Argentina where inflation is expected to reach 142% in 2023. FOB prices of both, corn and soybeans are currently cheaper in Brazil than in the U.S., due to recent achievements of record production with another year of record corn production in process. The recent combination of a lower U.S. dollar and higher Brazilian real, however, will have some impact in making U.S. import prices more competitive than they would otherwise be. For now, the Brazilian real remains in an uptrend.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .