Technically Speaking

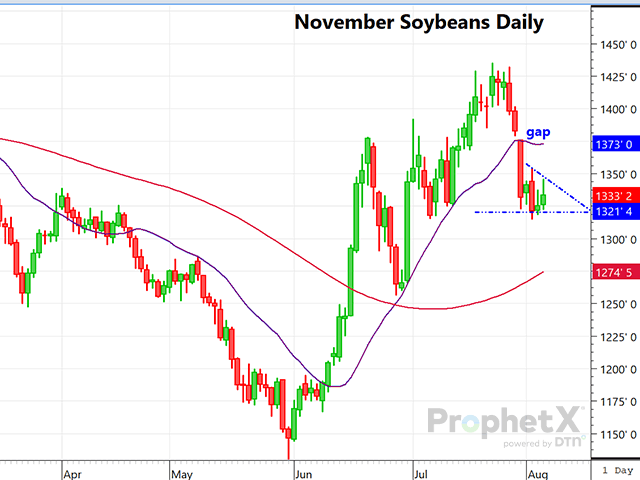

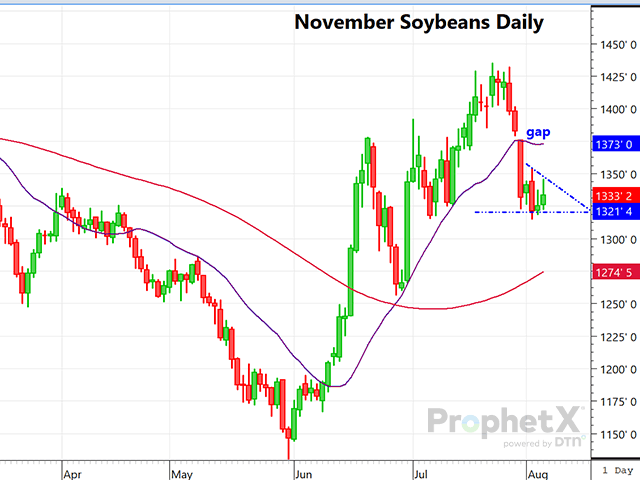

Are November Soybeans Forming a Bear-Flag Chart Pattern?

NOVEMBER SOYBEAN FUTURES:

Following the change in weather pattern, soybeans broke hard. A much cooler-and-wetter pattern has set in and appears like it is here to stay for another two weeks. Funds maintain their net-long soy complex position, making the market susceptible to further liquidation. On the other side of the coin, purchases of new-crop beans from the U.S. have picked up to both China and unknown destinations as U.S. beans become more competitive in the new-crop slot.

A break and convincing close below the bottom trendline of the pattern would suggest lower prices ahead. Early Monday morning, November has dropped below the bottom trendline. However, these chart signals are not an exact science and not always reliable. The fundamentals for beans remain bullish, while the chart looks ominous. It will be interesting to see how the market evolves beyond Monday.

KANSAS CITY DECEMBER WHEAT FUTURES:

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In the past nine trading days, with eight of those closing lower, KC September wheat has plunged $1.68 per bushel. Pressuring wheat markets continues to be Russia's total dominance of world wheat trade. Even though Russian interior values have rallied, FOB offers have moved up by just $10 to $20 metric ton (mt). Egypt came in to buy 360,000 mt last week -- 300,000 mt of that from Russia.

There has really been a dearth of news other than that above to justify wheat's plunge. Over the weekend, Russian-Ukraine tensions rose dramatically with a reported attack by Ukraine on a Russian oil tanker and a major naval base. That could once again ignite buying in the wheat market. On the other side, U.S. wheat demand has continued to be lackluster, with Black Sea and EU offers lower.

KC wheat is approaching oversold and we could see an upward correction, especially if the conflict in Ukraine intensifies even more.

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@DTN.com

Follow him on X, formerly known as Twitter, @mantini_r

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .