Technically Speaking

Corn, Wheat Prices in Search of Support

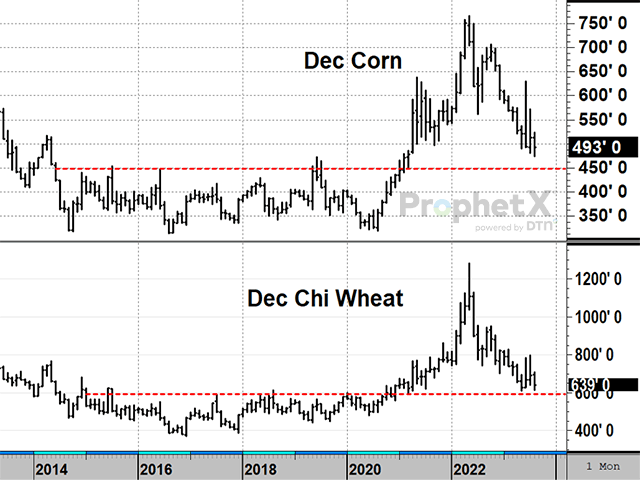

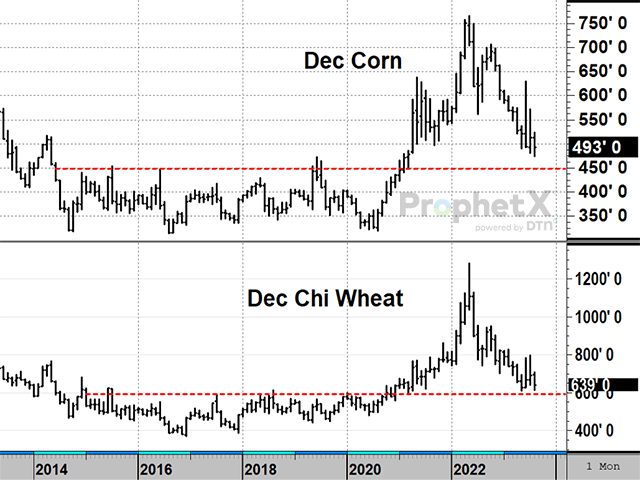

December corn closed at a new 2023 low of $4.75 1/2 on Tuesday, August 15, but bounced back to end the week up 5 3/4 cents at $4.93 on August 18. USDA is estimating a near-record crop of 15.11 billion bushels (bb) and a big jump in ending stocks to 2.20 bb in 2023-24, but the crop estimate is still in question with a dry forecast for the latter half of August. Technically, corn prices are near their lowest level in over two years with harvest lows typically made sometime around early October. From a long-term perspective, $4.50 a bushel was a common source of resistance from 2015 to 2020 when production costs averaged roughly $680 per acre. Now estimated near $890 an acre, it is fair to wonder if this is a situation where old resistance will become the new source of support. So far, the trend for corn prices remains down, but it is interesting commercials are holding 73,174 net longs, finding attractive value at corn's lower prices.

CHICAGO WHEAT:December Chicago wheat closed down 14 3/4 cents in the week ending August 18, ending at $6.39 a bushel. Thursday's close of $6.15 1/4 got close to the May low of $6.08 1/4 before finding support and turning higher Friday. Wheat prices traded below $6.00 from 2015 to 2020, a time when U.S. ending stocks-to-use ratios were near 50% or higher and U.S. wheat production costs averaged near $310 an acre. Now, costs are roughly a third higher and USDA is estimating an ending stocks-to-use ratio of 34% for 2023-24. As with corn, it is fair to wonder if the old resistance level of $6.00 a bushel will be the new support. The FOB export price for SRW wheat of $238 per metric ton is low by international standards, but often has a disadvantage in transportation cost. Technically speaking, the trend in December Chicago wheat remains down, but Friday's higher close was an interesting time for a reversal, happening after prices neared their low of 2023 and have a case for finding support near $6.00. A new one-month high will be more possible after August and, if it occurred, would signal a bullish change in trend.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .