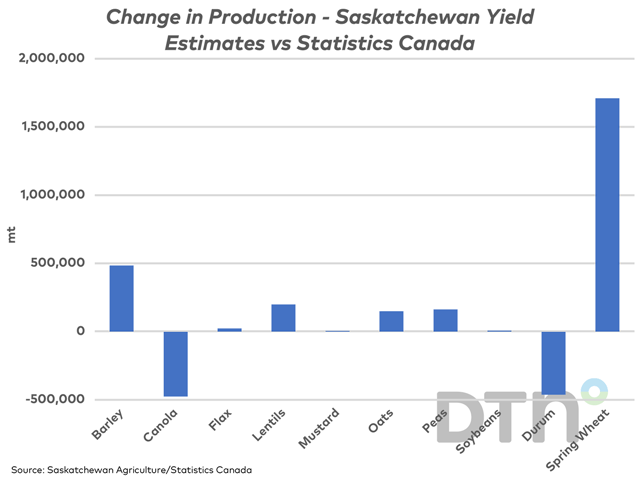

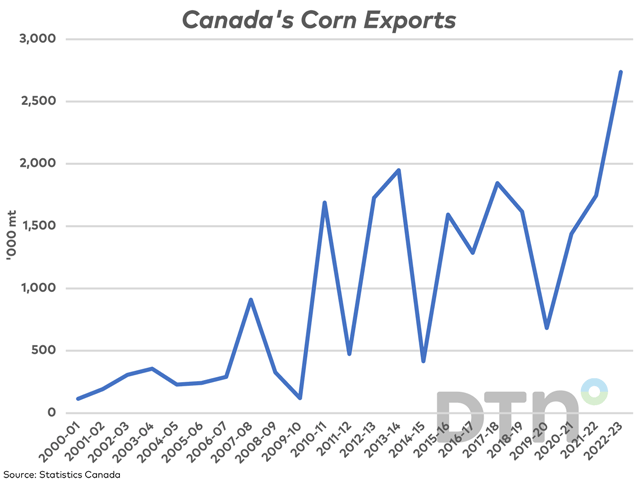

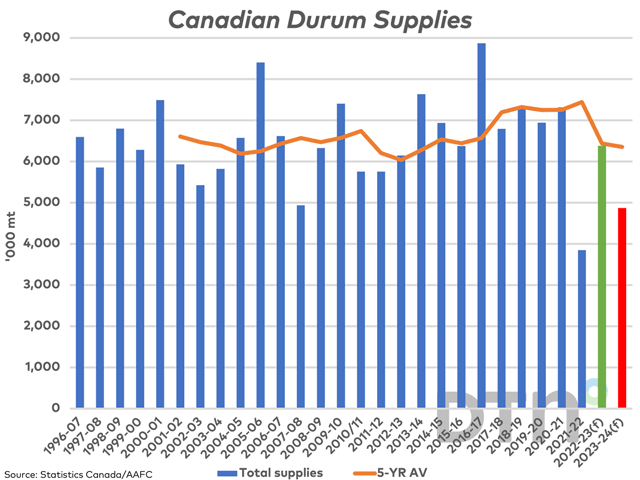

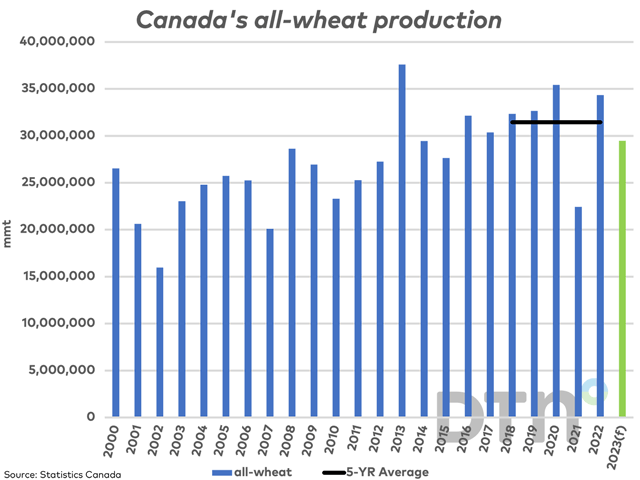

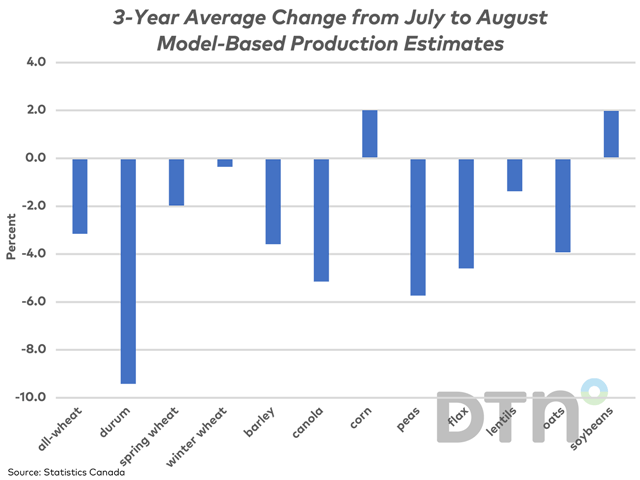

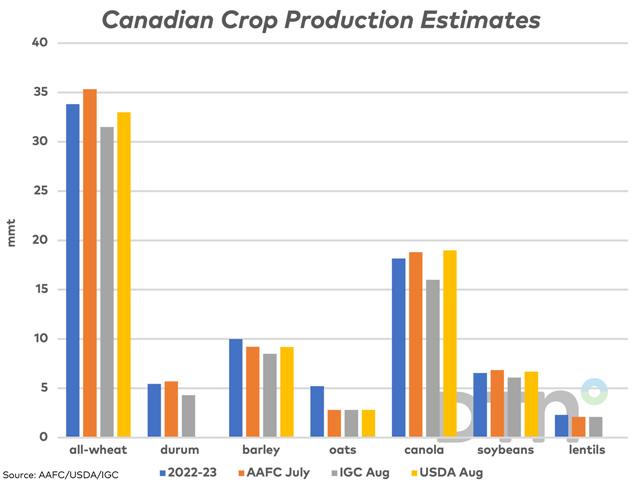

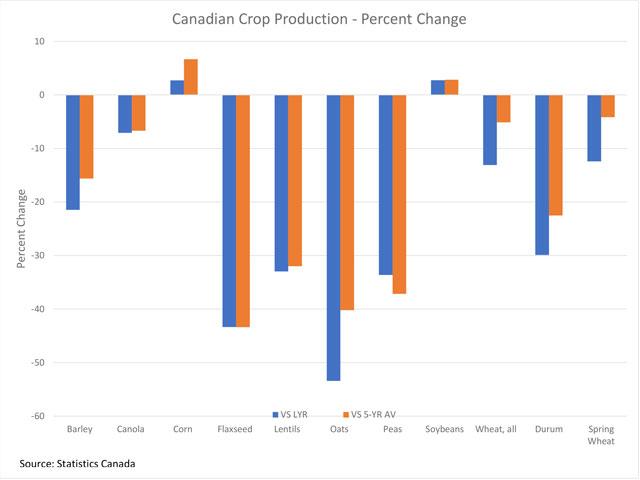

The largest changes in Statistics Canada's September production estimates, based on August model data, consist of an upward revision for spring wheat production, a lower revision for durum production, a lower revision for canola and a higher revision for corn.