Canada Markets

Bullish and Bearish Data in IGC's Durum Forecast

The International Grains Council's Grain Market Report for October continues to point to an overall bullish situation for global durum, although changes made to this month's forecast may put chances of a price rally for Canadian durum further out of reach.

First, the global supply and demand table shows an upward revision to 2023-24 opening stocks from 6 million metric tons in September to 6.6 mmt in October, a 600,000 metric ton increase. This still remains tight, down 800,000 mt or 10.8% from the previous year.

The forecast points to a modest month-over-month 100,000 mt drop in global production to 31.3 mmt, which they call a "more than two-decade low." Total global supplies were revised higher by 600,000 mt to 37.9 mmt this month, down from a 41.2 mmt estimate for 2022-23 and a 43.9 mmt estimate as recent as 2020-21.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Global use was revised 400,000 mt higher to 33.9 mmt, down 2.1% from the previous crop year. As a result, closing stocks were revised 200,000 mt higher this month to 4.1 mmt, the tightest stocks in over 30 years while reflecting a modest easing of the tight situation reported a month earlier.

The IGC revised higher their forecast for exports from both Russia and Turkey, while reducing their forecast for Canada's export potential. Turkey's exports to date are estimated at 1 mmt, while this month the IGC revised higher their forecast for Turkey's export potential by 500,000 mt to 1.7 mmt. Weekly European Union trade statistics show durum imports over the first 16 weeks of the E.U. crop year at 885,667 mt, up by a whopping 400% from the same period in the previous crop year, partially tied to crop problems in Europe, but also linked to the huge, unexpected supplies available for export from Turkey.

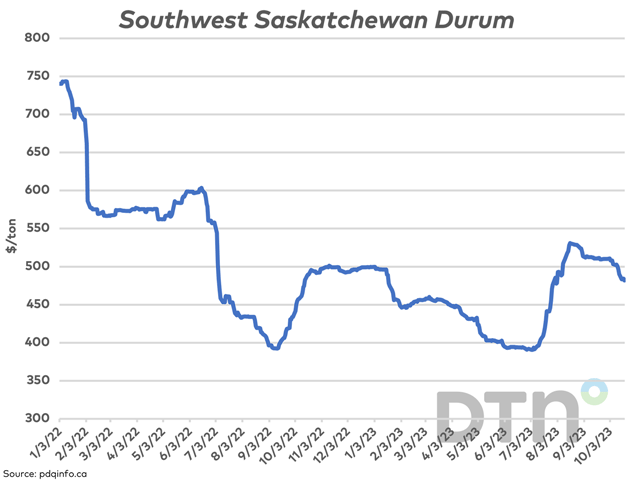

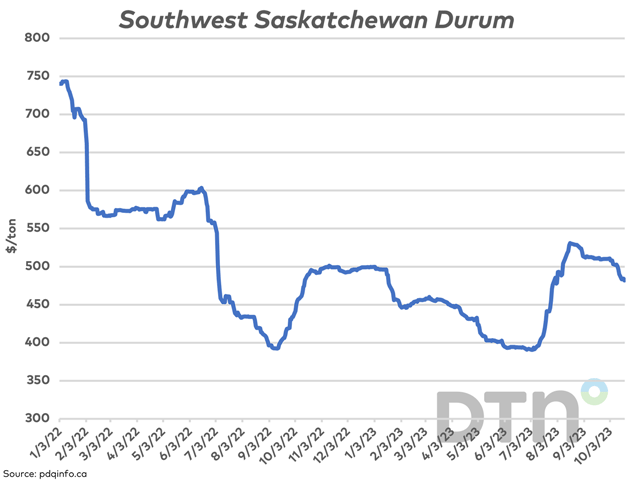

While cash data varies slightly across the prairies as reported by region by pdqinfo.ca, the Southwest Saskatchewan bid fell to a low of $481.78/mt on Oct. 19, while falling a further $3.12/mt to $478.66/mt on Oct 20. This is close to a full retracement to the $477.74/mt reported for August 1, or the first day of the 2023-24 crop year.

Pricing opportunities may present themselves later in the crop year after Turkey and Russia have deleted export supplies and especially if dry prairie weather lingers into next spring. At the same time, nothing is assured, and sellers must consider their risk tolerance when it comes to storing durum.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .