Canada Markets

Speculative Wheat Traders Grow Increasingly Bearish

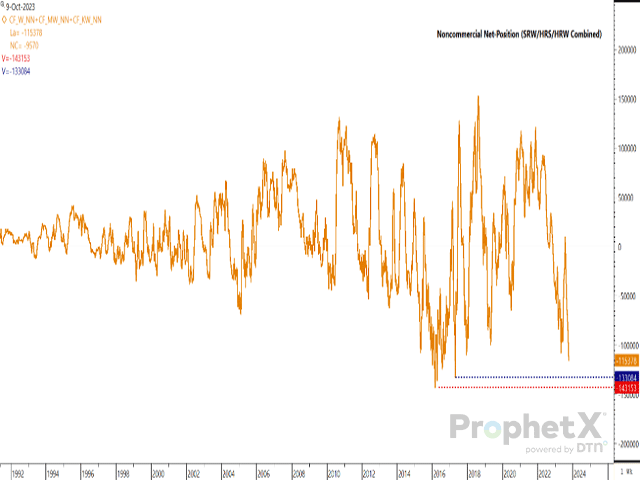

According to the CFTC's Commitment of Traders report as of Oct. 10, noncommercial traders or speculators have grown increasingly bearish for wheat during the week, adding to net-short positions while holding the third largest net-short position on record when data for all three U.S. wheat classes are combined.

The CFTC reported speculative traders increasing their bearish net-short position in soft red winter wheat for a fifth week, an increase of 6,347 contracts to 67,694 contracts net-short, the largest bearish position seen in 17 weeks.

Weekly data also shows the net-short position in Kansas City hard red winter wheat futures growing larger for a third week, up 1,008 contracts to 26,418 contracts net-short, or the largest since the week ending July 6, 2020. The largest bearish net-short position was reached at 36,041 contracts net-short reached in April 2019.

The noncommercial net-short position in spring wheat increased for the seventh consecutive weekend to 21,266 contracts net-short, or the largest seen since Aug. 10, 2020. The largest net-short position on record was reported at 22,979 contracts net short, reached in the week ending May 18, 2020.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As seen on the attached chart, when the three positions are combined, the net-short position is 115,387 contracts net-short, the largest bearish position seen since the combined net-short of 133,084 contracts reached in April 2017, and the combined 143,153 contracts reached February 2015 for the largest combined net-short on record.

One could argue that this data may have bullish implications for the wheat market and a sudden scare or catalyst could lead to sudden buying interest. If we look back at four consecutive lows reached on the attached chart, we see:

-- After reaching the April 2017 low of 133,084 contracts net-short as of April 2017, the combined noncommercial position reached a net-long position within two months.

-- After reaching the December 2017 low of 109,776 contracts net-short, the chart shows a return to a net-long within two months.

-- After reaching an April 2019 low of 99,168 contracts net-short, the chart shows a return to a net-long position in just over one month, and

-- After reaching the June 2020 low of 64,775 contracts net-short, the chart also shows a return to a noncommercial net-long position in roughly two months.

While the past will not necessarily explain the future, there are a number of factors that bear watching. Headlines today alone point to the potential for a lack of protein wheat in the European market, while the University of Illinois Farm Policy News quotes Bloomberg that states "Heavy rains will hit parts of China's biggest grain producing areas in the next 10 days," slowing the planting of winter wheat.

Dry conditions remain for much of Australia and Argentina, although DTN forecasts are pointing to increased chances of precipitation for Argentina this weekend and into next week.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .