Canada Markets

Monthly US Feedstock Data Shows Drop in Soybean/Canola Oil Use

While the growth potential for the biofuel sector remains staggering, in particular renewable diesel production, there are ongoing reminders of competition which will affect both feedstock demand and the type of feedstock use.

Last week there were unconfirmed social media posts pointing to a "surge" in U.S importing biodiesel from Germany and renewable diesel imports from Singapore.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

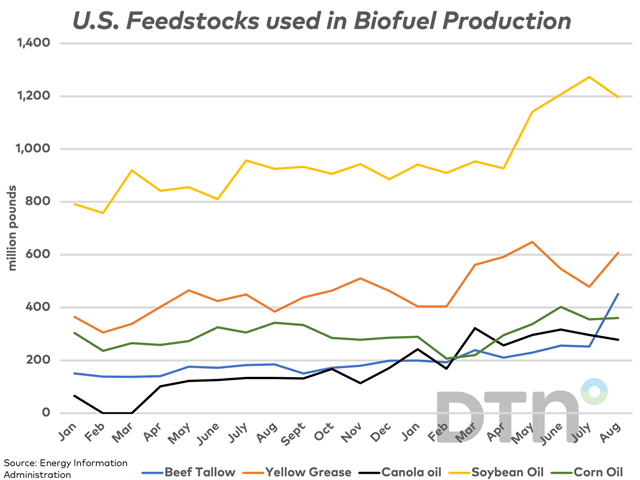

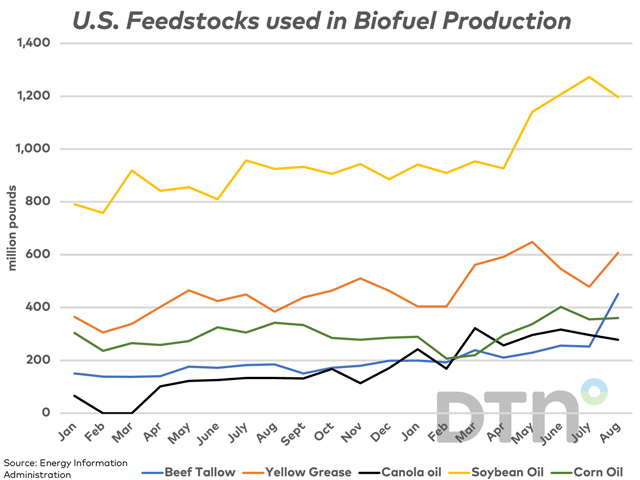

This month's Energy Information Administration feedstock data shows the competitive nature across the feedstocks used. Of the major feedstocks used, as seen on the attached chart, the use of both soybean oil (yellow line) and canola oil (black line) used as a feedstock fell in August, while use of beef tallow (animal fat, blue line), yellow grease (waste fats and oils, orange line) rose sharply. Use of corn oil also increased, but by a modest amount.

Soybean oil use fell for the first time in six months from the record 1.273 billion pounds reported in July. At the same time, use of canola oil reached a high in March of 322 million pounds, while has fallen in three of the five months since March to 278 million pounds in August. Over this period, the use of canola oil fell by 13.7%, the only major feedstock to show a drop, while use of beef tallow increased by 88.7%, yellow grease by 8%, soybean oil by 25.6% and corn oil by 63.6%.

The volume of canola oil use in August of 278 million pounds (126,098 metric tons) is considerable, especially when compared to the 29,483 mt reported for January 2022. Based on an oil content of 43%, 293,251 mt would have to be crushed to generate this volume, or roughly 3.5 million metric tons annually. At the same time, the loss of share should be a concern and may be linked to the recent weakness seen in canola prices.

A last concern is the competitiveness of Canada as a producer of renewable diesel from plants that focus largely on canola oil as a feedstock. The Canada Energy Regulator released a report on May 3 indicating seven renewable diesel plants are either planned or being built, with a goal of lowering the carbon intensity of Canada's fuel supply to meet the Clean Fuel Regulations. Producers using canola oil as a feedstock may face competitive issues and this bears watching.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @CliffJamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .