Statistics Canada released February merchandise trade data on April 5, while this study looks at the month's activity for select crops and products.

Statistics Canada released February merchandise trade data on April 5, while this study looks at the month's activity for select crops and products.

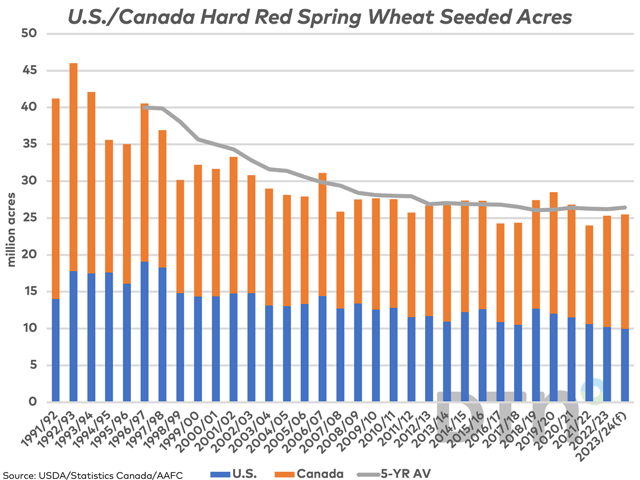

While the USDA has estimated hard red spring wheat acres to fall to the lowest in decades, early unofficial forecasts from Canada's government shows an increase in acres offsetting acres lost in the U.S. forecast.

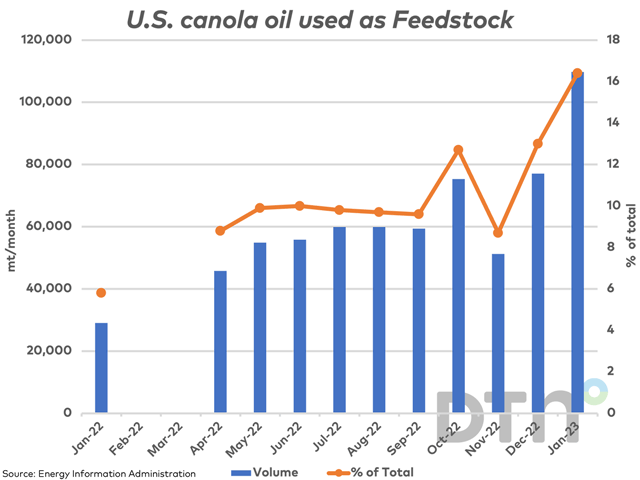

Canola oil as a feedstock for U.S. biofuel production is showing significant growth from year to year and month to month, while we are in early stages of planned expansion.

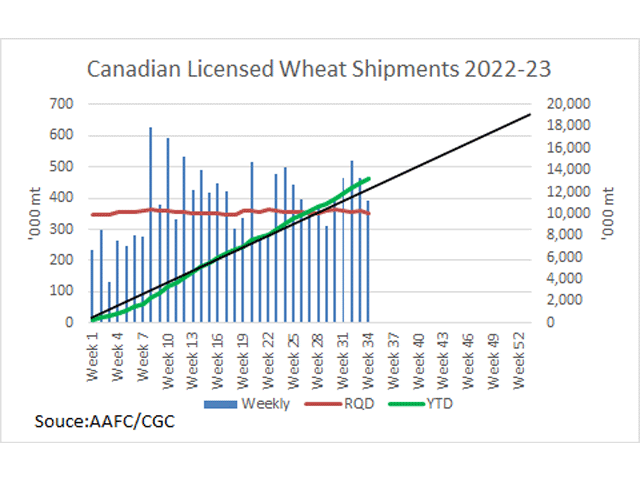

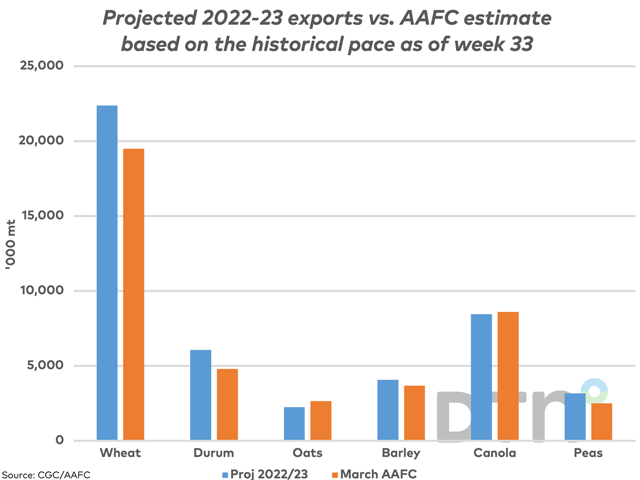

Weekly wheat exports (excluding durum), have exceeded the weekly volume needed to reach the current AAFC export forecast for 2022-23 for five consecutive weeks.

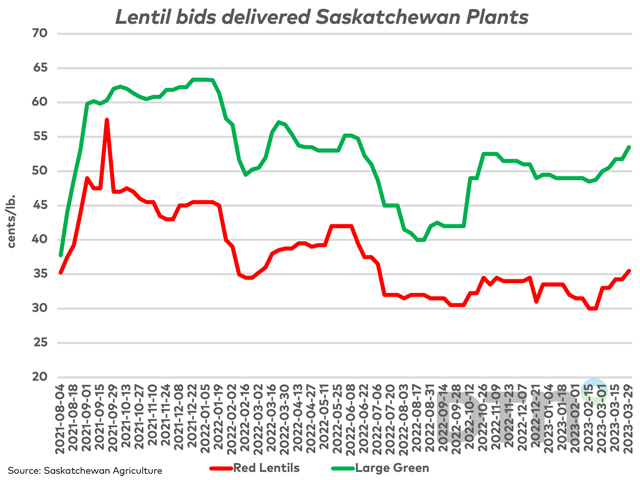

Large green lentils and red lentils reached a crop year high over the week ending March 29.

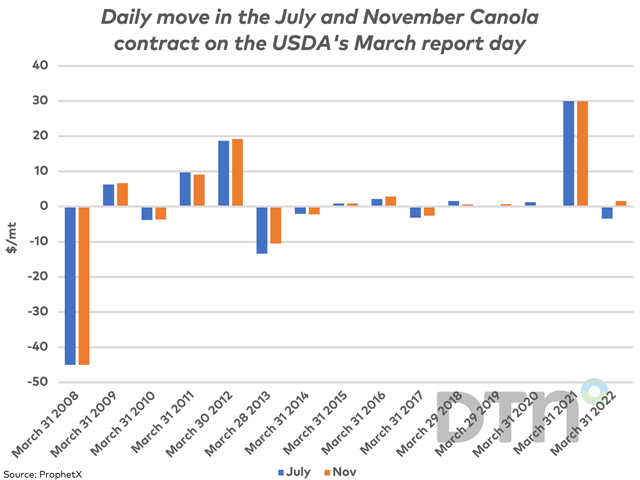

This study looks at the daily move in the July and November canola contracts following the release of the USDA's March Quarterly Stocks report and Prospective Planting reports during the past 15 years.

Ahead of this week's USDA reports, new-crop MGEX spring wheat futures are seen moving above resistance.

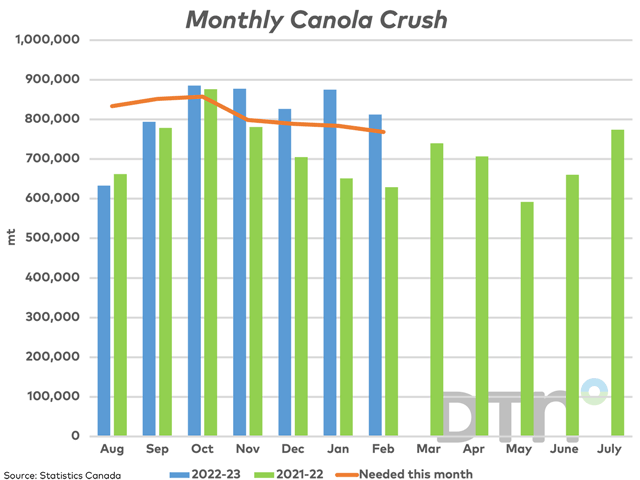

Statistics Canada reported the February canola crush at a volume that was the lowest reported in five months, despite wide crush margins, while the cumulative pace is ahead of the pace needed to reach the current AAFC demand forecast.

This study looks at cumulative licensed exports for select crops as of week 33, while projects crop year exports based on the historical pace of movement.

Soybean oil for May delivery has faced a sharp drop this week, breaching potential support levels.

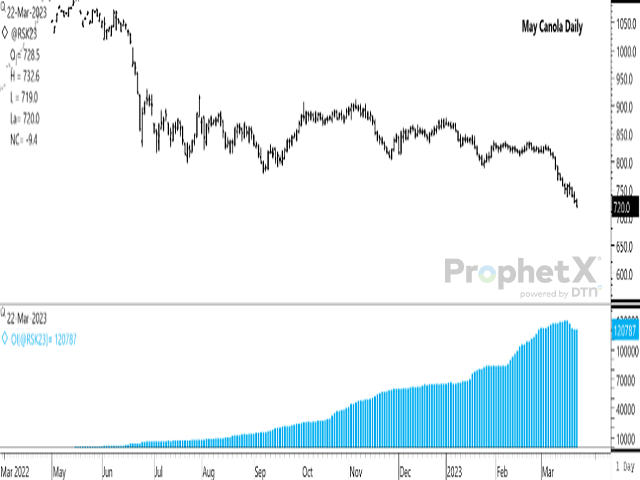

The May canola contract open interest is the highest ever for this week and trade during the month ahead could prove volatile.

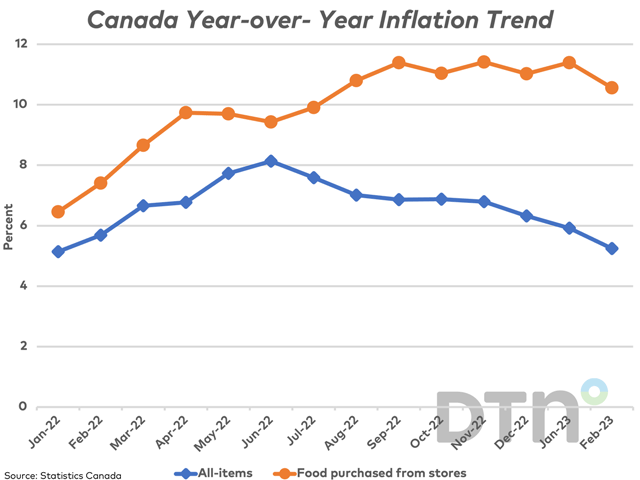

Canada's Consumer Price Index fell more than expected in February, while food inflation, particularly food purchased in grocery stores, remains stubbornly high.

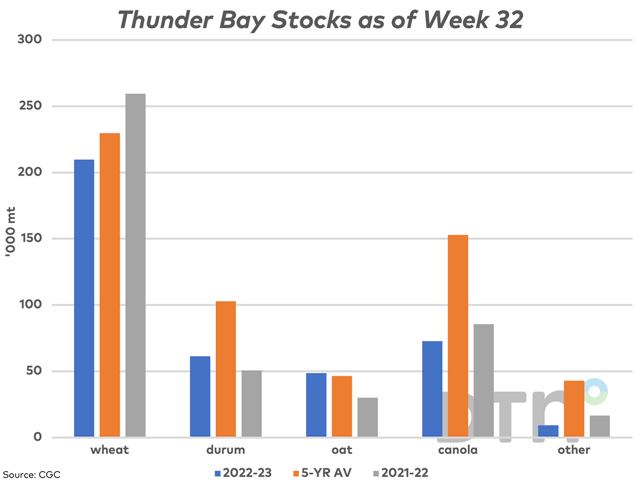

As we near the start of the 2023 shipping season in Thunder Bay, grain stocks in licensed storage are seen below average.

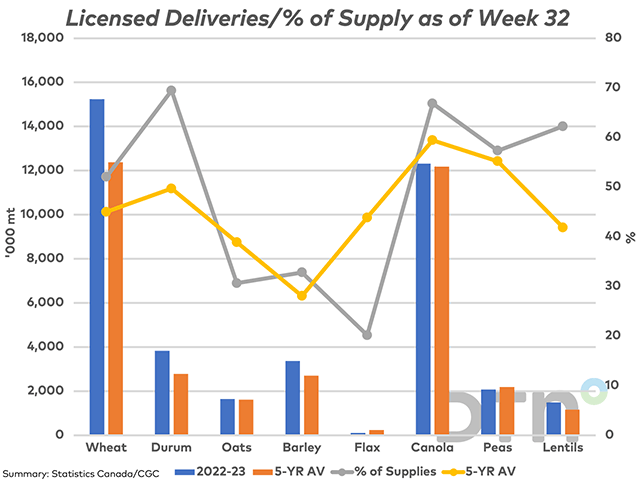

This study looks at deliveries of select crops into licensed facilities over 32 weeks, along with how this compares to the volume of grain available for delivery for this crop year and on average over the past five years.

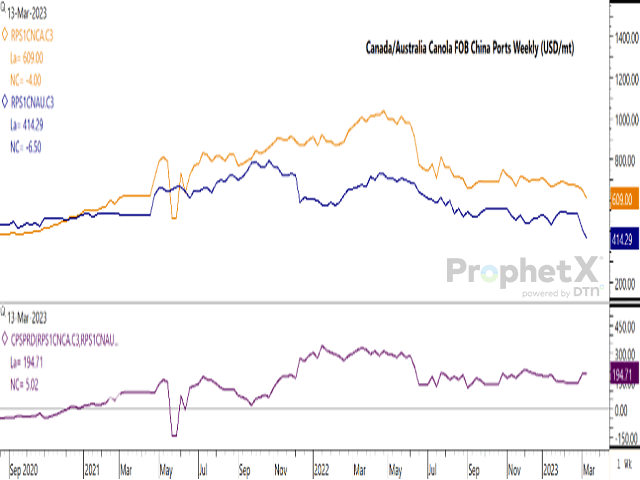

Canola futures surged to a higher close on March 16 while ProphetX data shows the price of Australian canola falling at a faster rate than canola in the Chinese market.

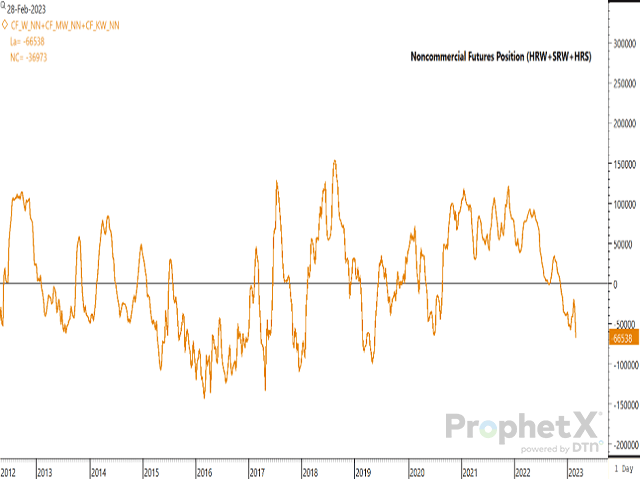

CFTC data as of Feb. 28 shows noncommercial traders adding to their combined net-short position of hard red spring wheat, hard red winter wheat and soft red winter wheat.

Today's lower close for canola was an eighth consecutive lower close for the May contract, while the continuous active weekly chart shows a breach of a September low resulting in a breakout from a sideways range traded since June 2022.

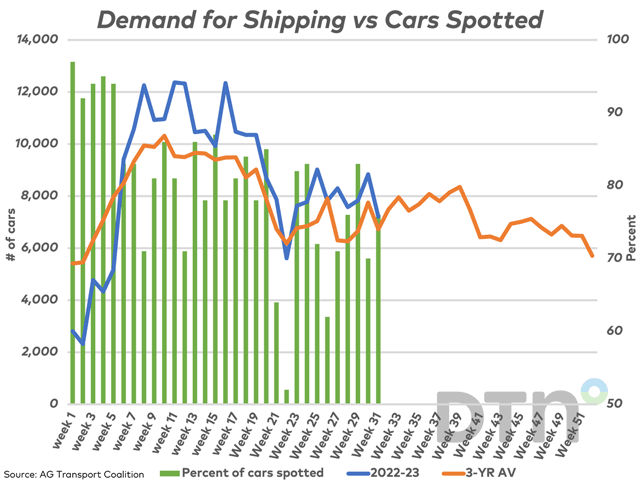

Demand for hopper cars for loading was light in week 31 while a spring high is seen in week 39 according to the three-year average. Canada's two major railways continue to spot well below the number of cars wanted during the week wanted.

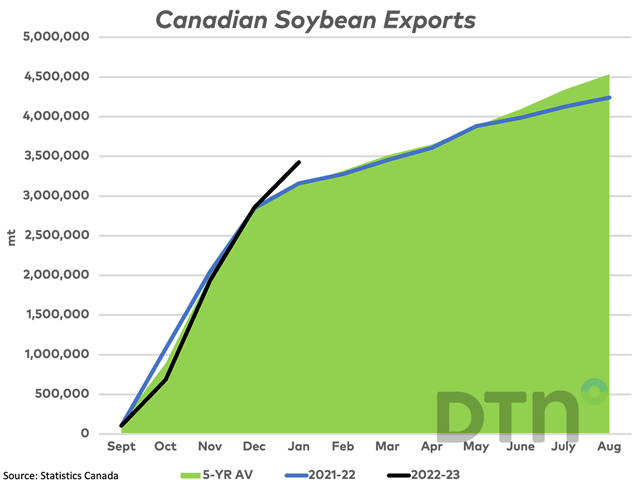

Canada's January soybean exports are reported at the lowest level seen in four months while cumulative exports are well ahead of the 2021-22 pace and the average pace of movement.

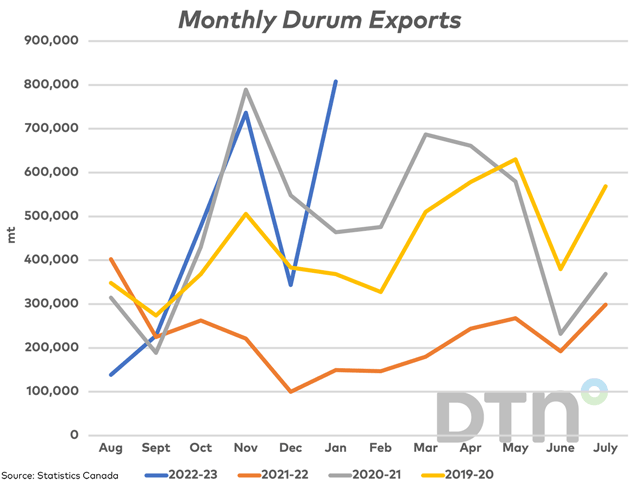

Canada exported 808,123 mt of durum in January. Exports volumes to the largest buyers are up, while shipments are seen to an increased list of importing nations.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]