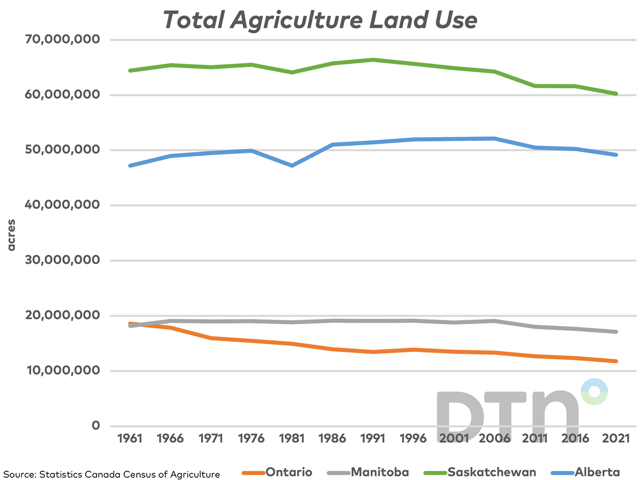

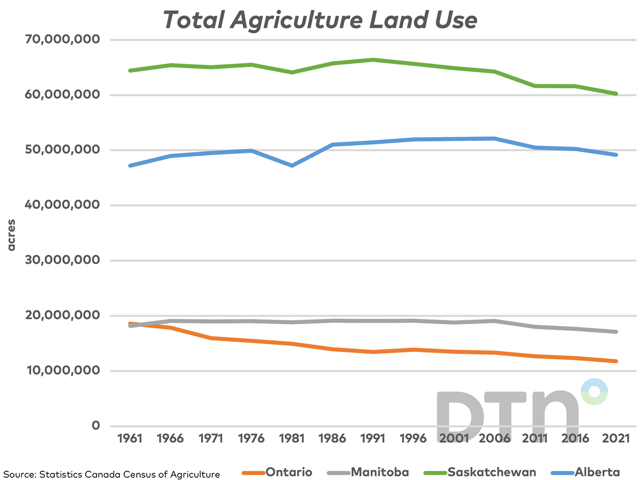

The Canadian Agri-Food Policy Institute released a report this week focusing on the challenges the Canadian industry faces in meeting global demand. Growing land-use pressures were one of the issues presented.

The Canadian Agri-Food Policy Institute released a report this week focusing on the challenges the Canadian industry faces in meeting global demand. Growing land-use pressures were one of the issues presented.

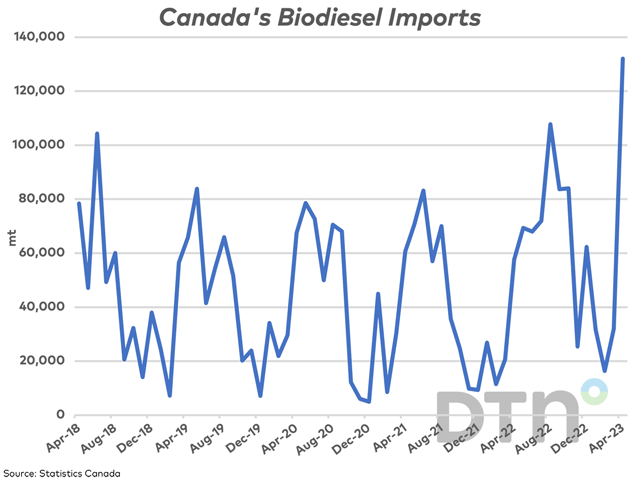

Canada's imports of biodiesel reached a record volume in April.

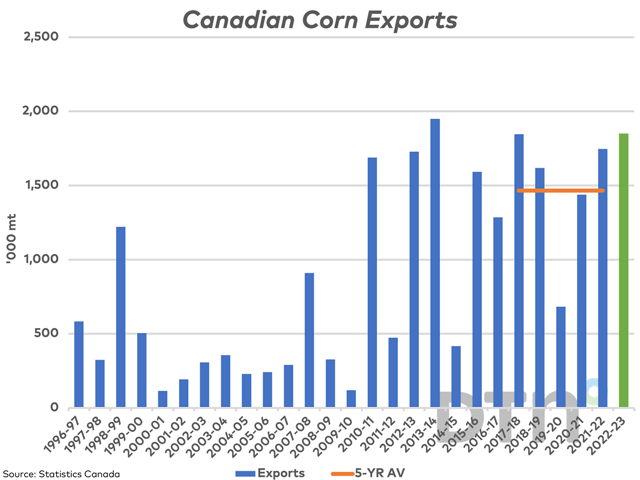

This study looks at Statistics Canada's April merchandise trade data for select crops and crop products.

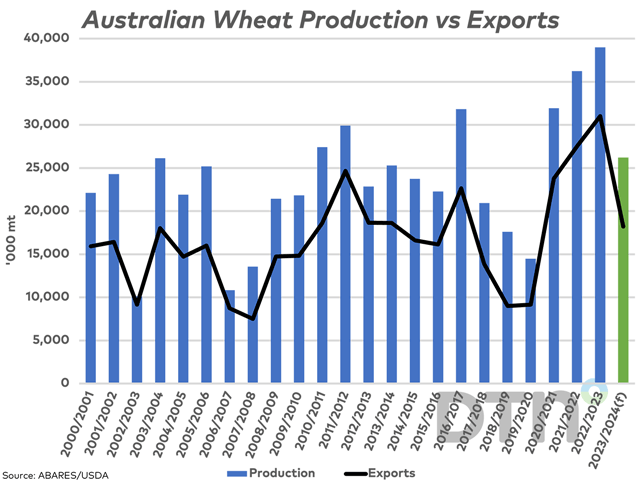

Australia's official estimates point to a forecast 34% drop in wheat production in 2023-24, while in recent years of falling production, the June forecast has overstated production.

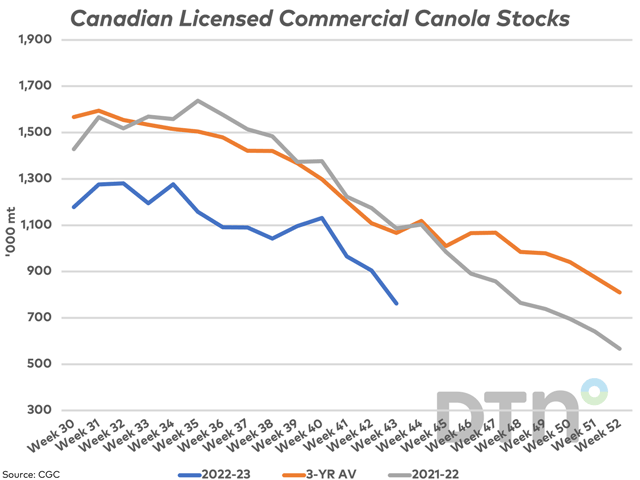

Commercial stocks of canola fell for a third week in week 43, while are the lowest stocks reported for this week in six years. The three-year average shows commercial stocks trending lower through the end of the crop year.

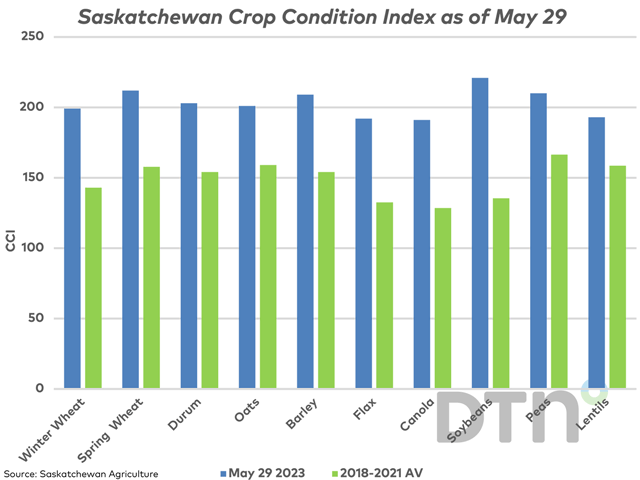

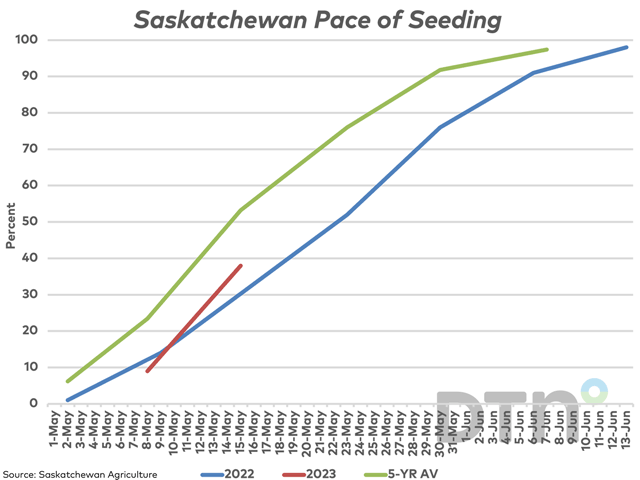

The pace of spring seeding in Saskatchewan is slightly below the five-year average while the first crop condition of the season points to a very favourable start for the crop overall.

Malaysian crude palm oil closed lower for a third straight month, while EU legislation to prevent deforestation is forecast to have a detrimental effect on exporters.

The April canola crush fell from the previous month but remains the second-largest monthly volume achieved this crop year.

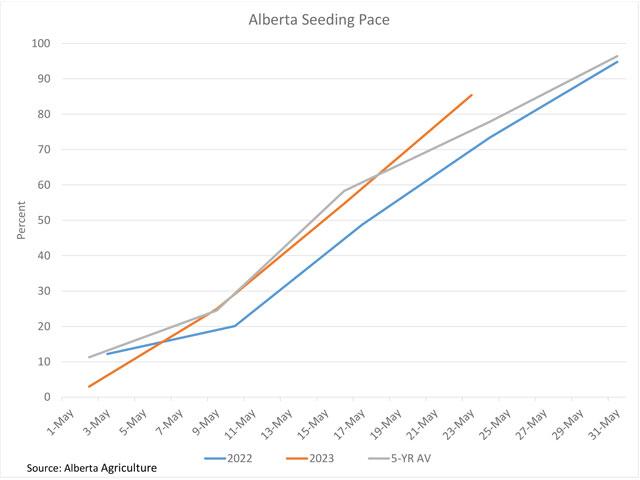

Spring seeding in Alberta is ahead of average as of the recent Crop Report, while emergence is well-ahead of average.

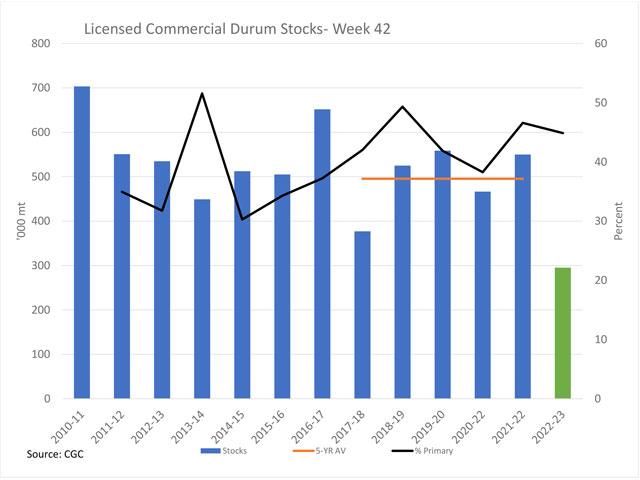

Commercial stocks of durum have tightened for a seventh consecutive week and are well-below average as of Week 42.

The spot Canadian dollar chart shows a double-top formed in the months of April and May, while current trade is near a test of the April low.

AAFC has updated their supply and demand forecasts for 2022-23 and 2023-24, incorporating official data from Statistics Canada. Stocks of principal field crops are forecast to increase year-over-year, although there remains significant differences in AAFC's wheat forecast...

July canola bounced from a fresh low to end back above $700/mt on Tuesday in high volume trade.

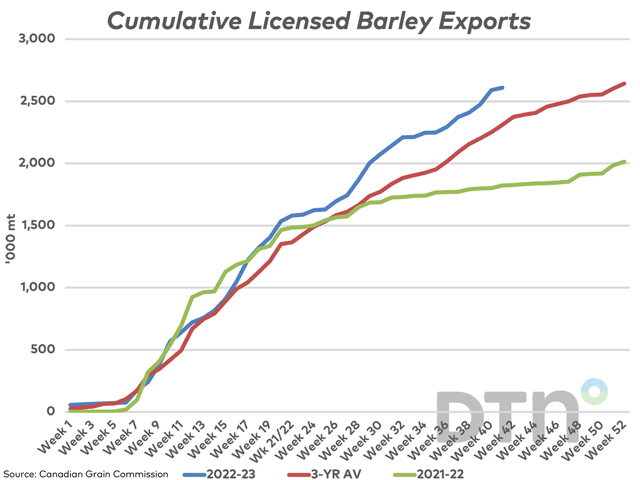

Barley exports tend to slow during the final weeks of the crop year, while Australia is making inroads into China and December corn closed under $5/bushel. The southern Albera market will play a greater role in price discovery during the year ahead.

During the week ending May 15, producers planted 29% of the province's crop, with the most progress seen on the west side of the province. An estimated 38% of the crop is seeded, still below the five-year average of 53%.

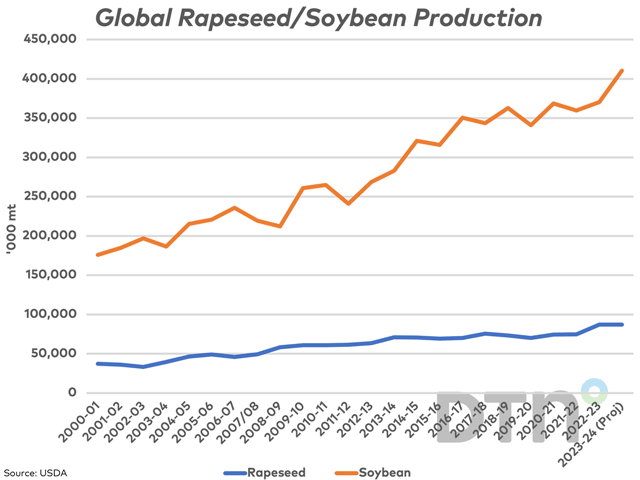

The USDA's first estimate for 2023-24 global soybean production shows a 410.585 million metric ton (mmt) crop grown world-wide, up 11% or 40.164 mmt from the previous crop year, as indicated by the brown line on the attached chart.

The July MGEX hard red spring wheat contract has closed higher for three consecutive sessions and has breached technical resistance in each of the past two sessions.

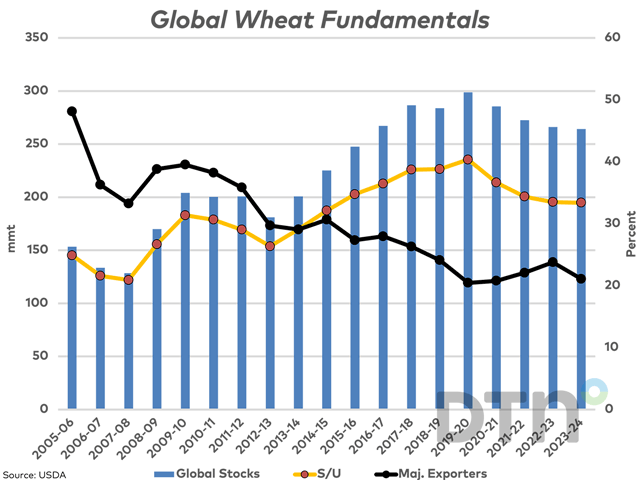

The USDA has forecast global wheat stocks to fall in 2023-24 for a fourth consecutive year, while the tendency is for the first estimate for any given crop year to be overstated.

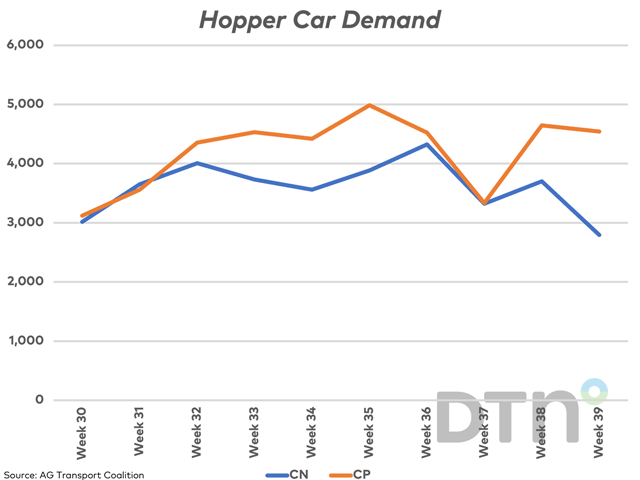

Seasonality factors are contributing to the slowing demand for hopper cars for loading on the prairies, although one CN executive indicates this trend could continue through to new crop.

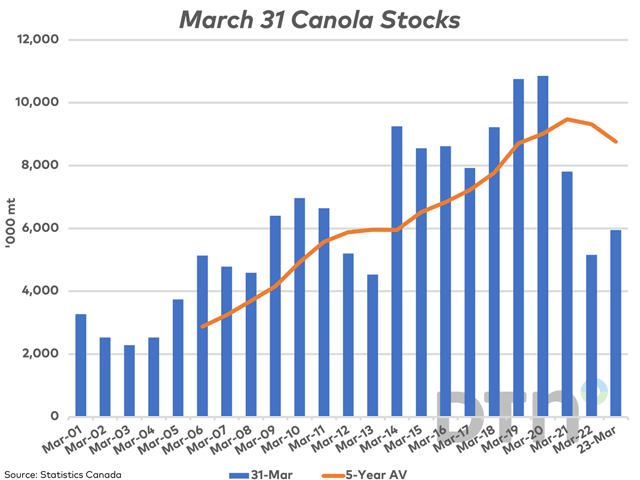

Canola stocks as of March 31 are up from the year-ago level but well-below average for a third year and signal problems due to the current pace of demand.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]