Canada Markets

AMIS Releases Troubling Global Wheat Forecast

United States wheat futures settled mixed on Thursday, with both hard red winter wheat and hard red spring wheat ending lower while soft red winter wheat posted modest gains.

Despite the bullish factors seen in the global wheat market, which includes the ongoing conflict in Ukraine, drought in Argentina, this week's low temperatures across the Central and Southern Plains and tight stocks forecast for the U.S. for 2022-23, there were some troubling signs in today's trade.

The most active Chicago soft red winter wheat contract closed 1 1/4 cents higher on Thursday, reaching its highest trade in more than three weeks and closing above the resistance of a downtrend line drawn from the Oct. 10 high for the first time, with resistance calculated at $7.58 1/4/bu.

March Kansas hard red winter wheat ended 3 1/2 cents lower, having also reached its highest trade in over three weeks. This follows seven consecutive higher closes, with resistance seen at the contract's 100-day moving average at $9.06/bu in addition to psychological resistance at $9/bu. Today's trade formed a bearish outside bar on the daily chart.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

March MGEX hard red spring wheat ended 1 1/4 cents lower, having reached its highest trade in over three weeks this session.

The March/May futures spread has weakened for both SRW and HRS over the four sessions of this week. The March/May inverse has strengthened over the first four days of the week for HRW.

Ahead of this month's USDA WASDE report, the Agricultural Market Information System (AMIS) February report was released today which signals an increasingly bearish view of the global balance sheet for 2022-23 wheat. AMIS is made up of the G20 members plus Spain and seven additional exporting or importing nations, while indicating that "participants represent a large share of global production, consumption and trade volumes of targeted crops, typically in the range of 80-90%."

This month's estimates include a 12.6 million metric ton increase in their forecast for global wheat production for 2022-23 to 793.7 mmt, up 15.7 mmt or 2% from their forecast for 2021-22. While the agency's forecast was revised slightly higher for both trade and utilization, ending stocks were revised 5.3 mmt higher from their December estimate to 305.4 mmt.

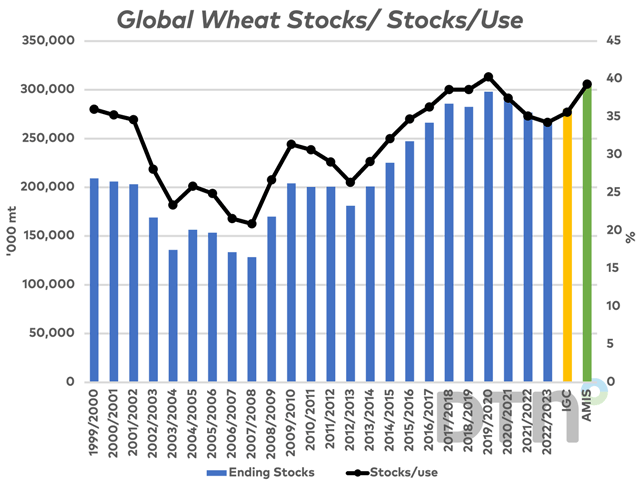

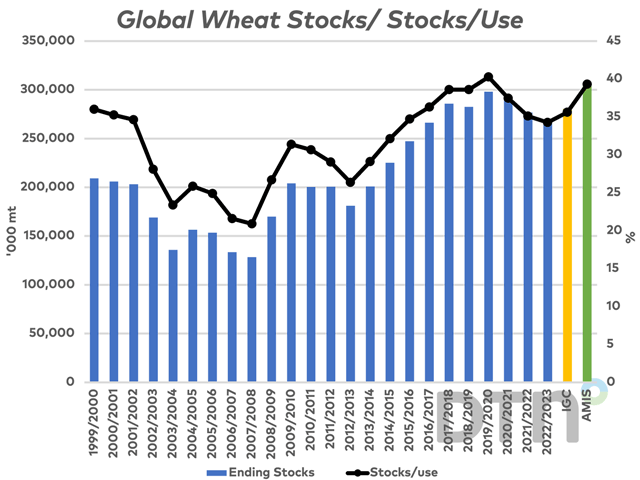

As seen on the attached chart (blue bars), the USDA's January WASDE report estimates global stocks falling for a third consecutive year to 268.4 mmt, the lowest estimated stocks in six years. The difference in stocks between this forecast and today's AMIS estimate is 37.011 mmt, or a volume that is 1.5 mmt larger than Canada's record all-wheat crop produced in 2020.

As a percentage of estimated use, the AMIS stocks/use is calculated at 39.3%, above the 34.3% currently forecast by the USDA.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .