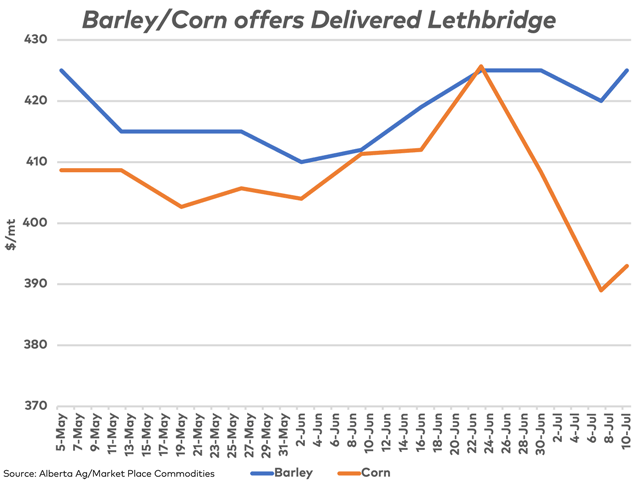

Feed barley prices are moving higher, while interest is growing in U.S. corn.

Feed barley prices are moving higher, while interest is growing in U.S. corn.

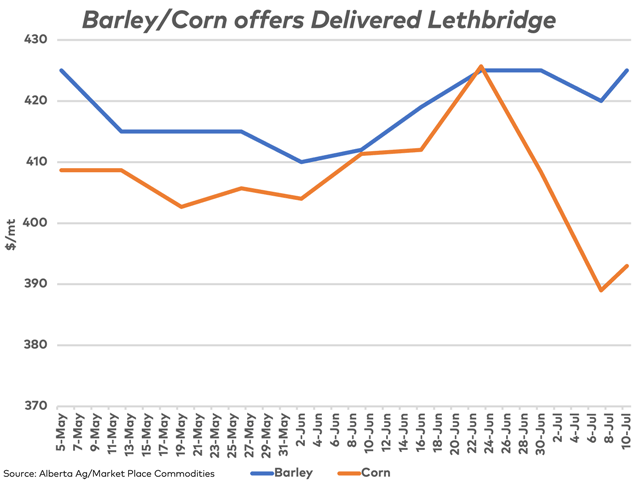

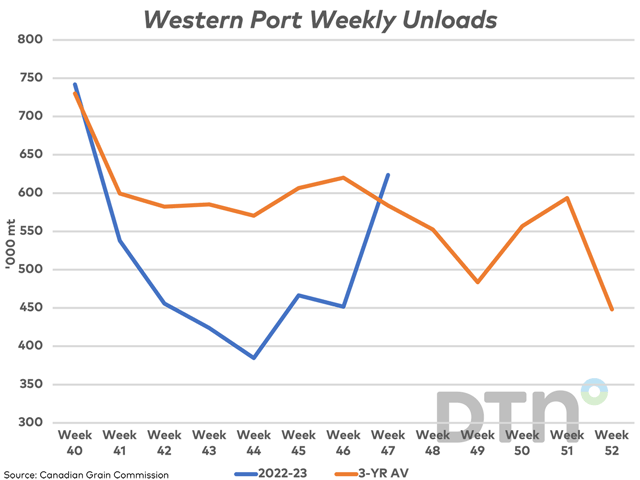

This study looks at producer deliveries into licensed facilities as of week 48 for select crops, while comparing these volumes to the volume available for delivery based on Statistics Canada's official estimates.

Statistics Canada commentary points to waning wheat and canola exports being one factor leading to a shift to a deficit trade balance with the world in May. We look at today's May trade data as it applies to select crops and products.

The canola market has shown volatile trade this week with late-session activity leading to large moves. November closed above resistance on July 5 to reach a three-month high.

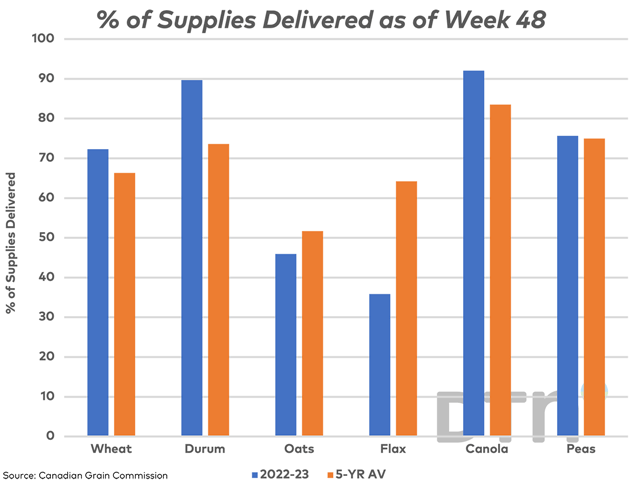

There has been a late crop-year increase seen in demand for cars for loading as well as terminal unloads, seen largely in movement of wheat, durum and canola.

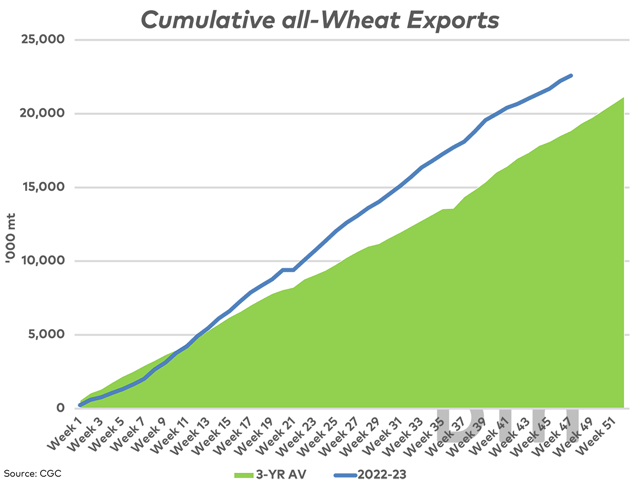

Cumulative Canadian all-wheat exports of 22.586 mmt over the first 46 weeks may suggest that crop year exports are well on the way to meeting or exceeding the current AAFC export demand estimate for 2022-23.

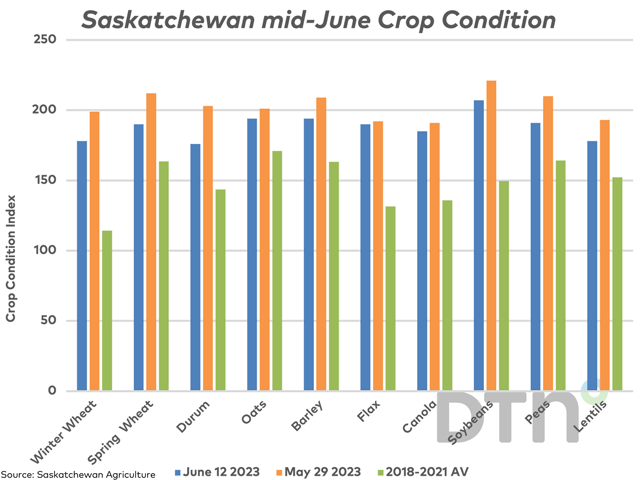

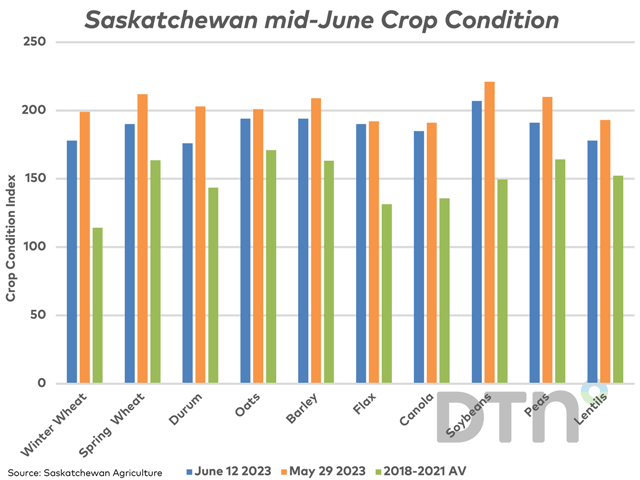

The crop condition for almost all crops is reported to have slipped lower over the past two weeks, with cooler temperatures and precipitation needed.

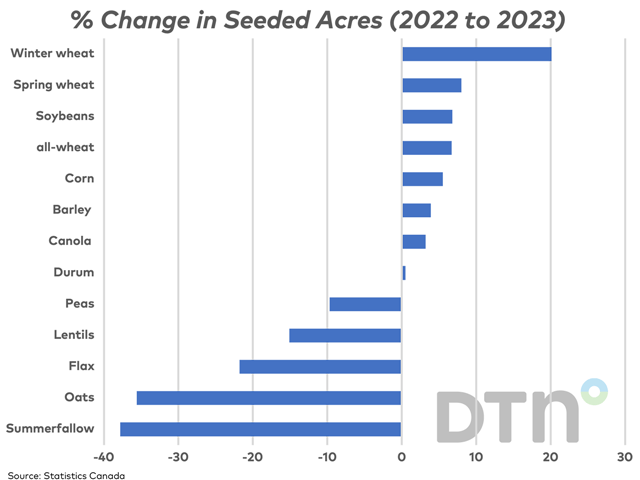

Today's Statistics Canada acreage estimates include year-over-year drops in the area seeded to oats, flax, lentils and peas, while the largest shift was seen into canola acres, which increased close to 500,000 acres from 2022.

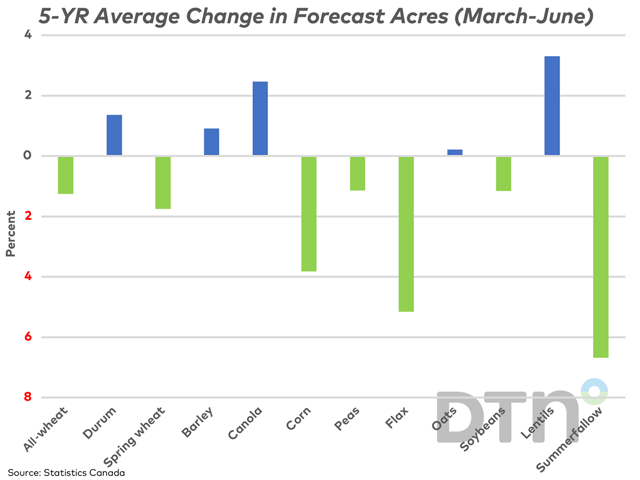

Statistics Canada's June 28 acreage estimates will be a test of a new methodology that saw the initial estimates based on surveys conducted months earlier than normal. This study looks at the tendencies for acres of select crops to be revised higher or lower on average over...

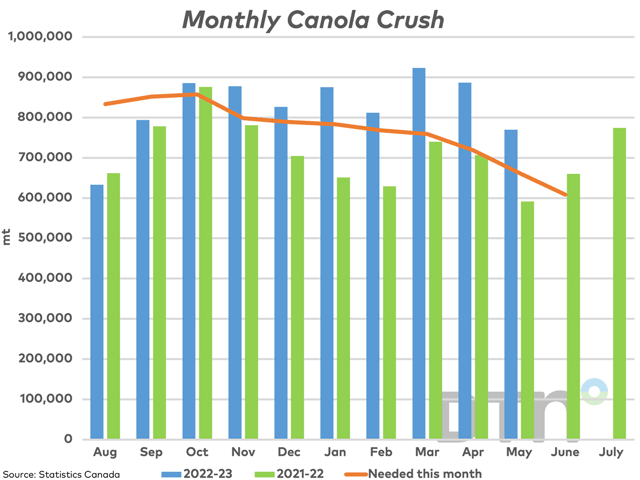

Canada's May canola crush was the smallest in nine months although the cumulative crush remains well ahead of the forecast pace.

November canola posted a modest $5.30/mt loss over the week in sideways trade. Noncommercial traders are seen taking a less-bearish approach to trade.

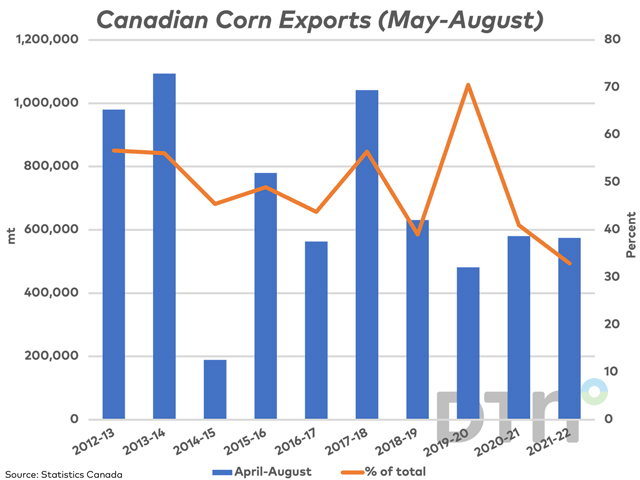

AAFC has revised its forecast for Canada's corn exports higher to a record volume above 2 mmt. Crop year exports tend to be heavily weighted to the final months of the crop year.

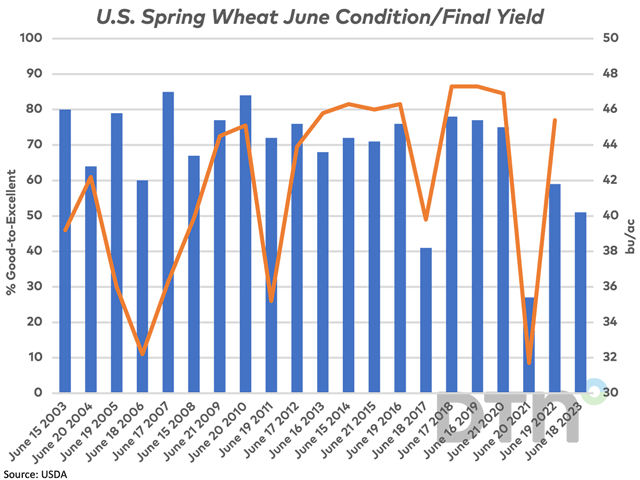

The U.S. spring wheat crop condition was revised 9 percentage points lower to 51% good-to-excellent for the week ending June 18, or the third lowest for this week over the past 20 years.

The December spring wheat contract has breached its 100-day moving average and testing its 61.8% retracement line. Trade is seen consolidating while the most recent data continues to signal a bearish sentiment on the part of speculative traders.

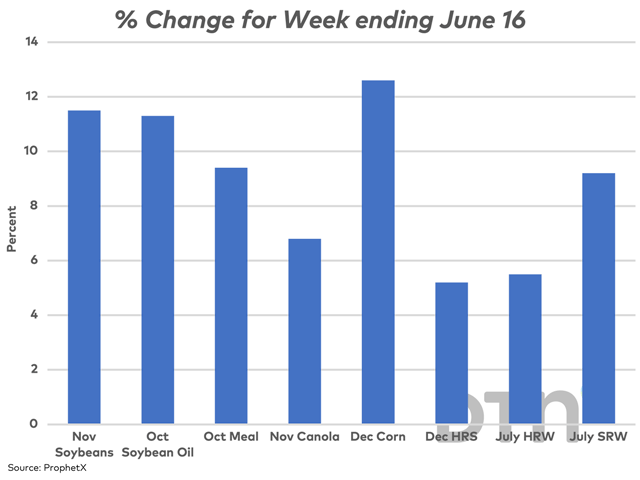

The summer weather market came early this year as the U.S. Drought Monitor shows deteriorating conditions and the seven-day forecast continues to show a lack of coverage for the eastern Midwest. This study looks at the sharp gains realized across select crop and product...

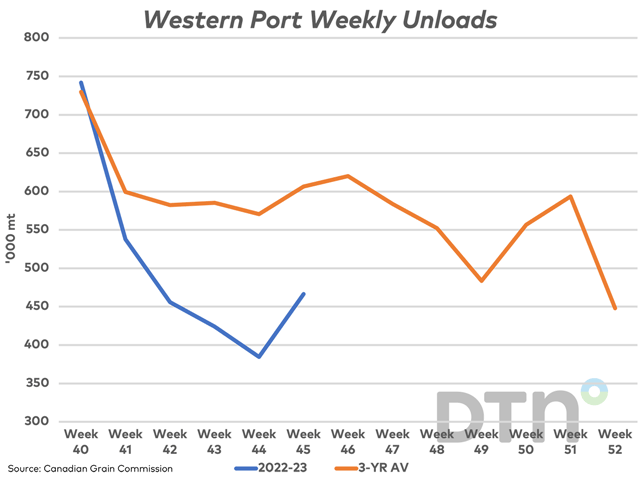

This study looks at the recent trend in western port unloads, while comparing to the three-year average of activity during the remaining seven weeks of the crop year.

Precipitation across Saskatchewan was viewed as spotty during the past week, while topsoil moisture ratings are shown in decline. Crop condition shows only a modest decline overall.

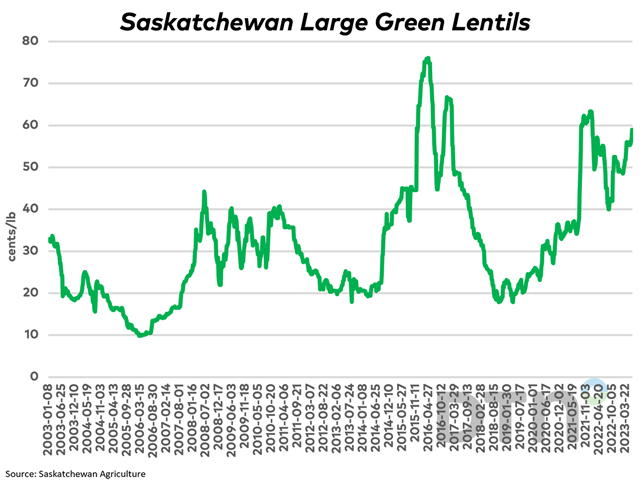

Large green lentil bids are seen nudging higher this week although there are some indications that demand is on the verge of slowing.

The November canola contract continues to move higher, with support from a large bearish net-short position seen in canola futures. Canola's gains have failed to keep pace with rapeseed and soybean oil.

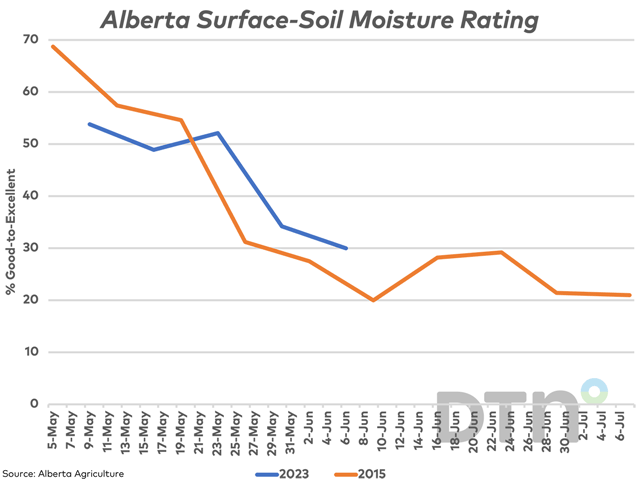

Growing drought is seen in southern Alberta, while rains are seen in the forecast for the next week.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]