Statistics Canada released March 31 grain stocks estimates Tuesday, which included a revised methodology for estimating farm stocks.

Statistics Canada released March 31 grain stocks estimates Tuesday, which included a revised methodology for estimating farm stocks.

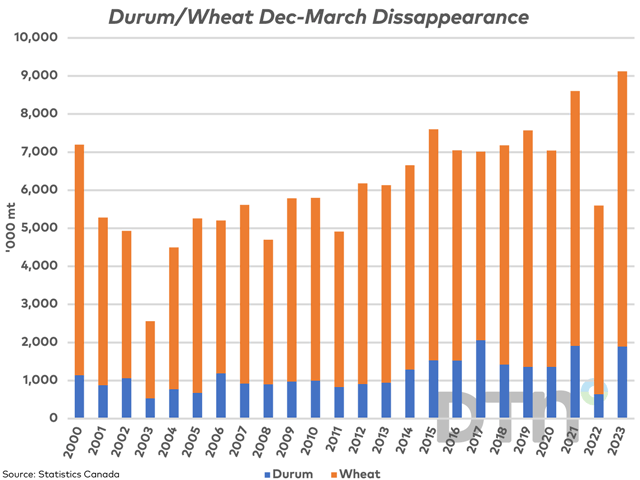

Estimates for the area seeded in Alberta as of May 2 point to the slowest start since 2018.

The high for December hard red spring wheat on May 5 has tested the 50% retracement of the move from the April high to the May low. The latest week's CFTC data shows noncommercial traders adding to their bearish positions, although late-week trade points to a sudden change...

March Statistics Canada merchandise trade data points to an overall drop in exports of farm, fishing and intermediate food products. Here we look at monthly trade data as it relates to miscellaneous crops and crop products.

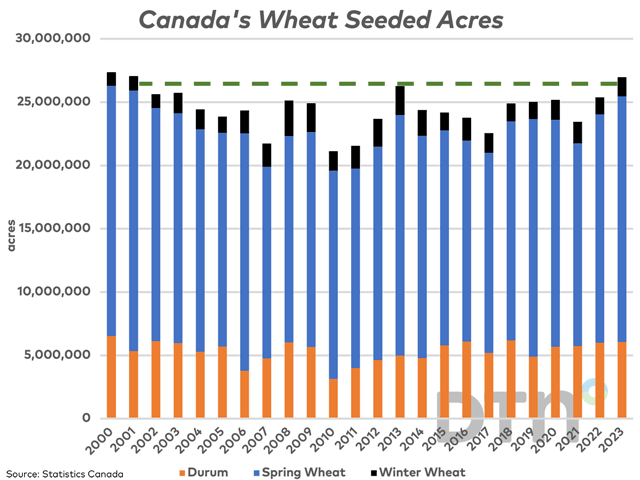

The continuous December HRS-HRW spread is seen consolidating and is trading at a level that is below average for this date. A number of factors are at play, but an above-average Canadian spring wheat acreage forecast for 2023 may be easing concerns.

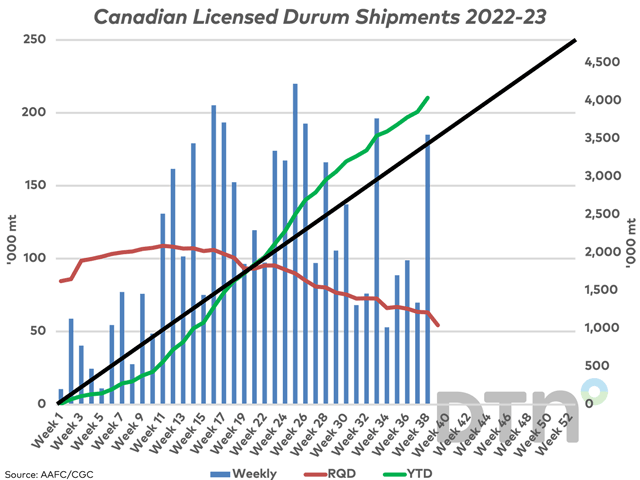

The CGC reported favourable durum exports for week 38, which were the highest in five weeks and the fifth highest seen this crop year.

November canola is testing support and at a crossroads.

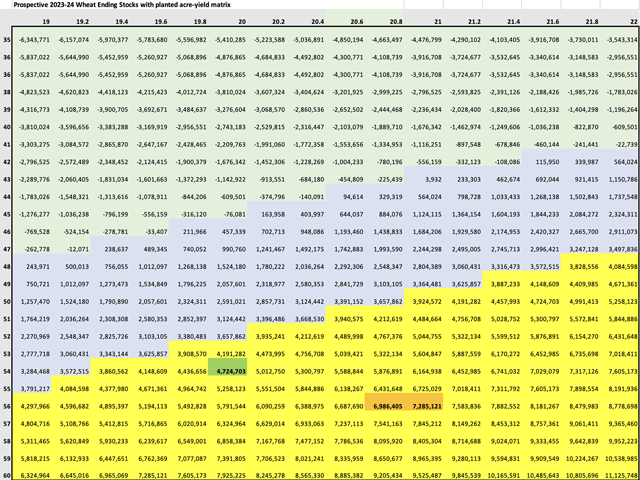

This study looks at prospective ending stocks for Canadian wheat (excluding durum) given a matrix of seeded acres and yield, based on current AAFC assumptions for 2022-23 carryout, demand and harvested acres.

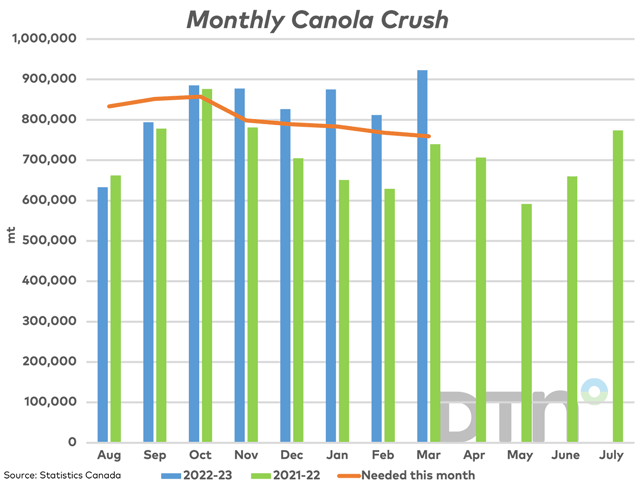

Statistics Canada reported a huge canola crush above 900,000 mt for the month of March, the largest in two years.

Statistics Canada reports all-wheat acres rising to the highest area since 2001, while canola acres are forecast up only slightly from 2022. Here is a summary of today's report.

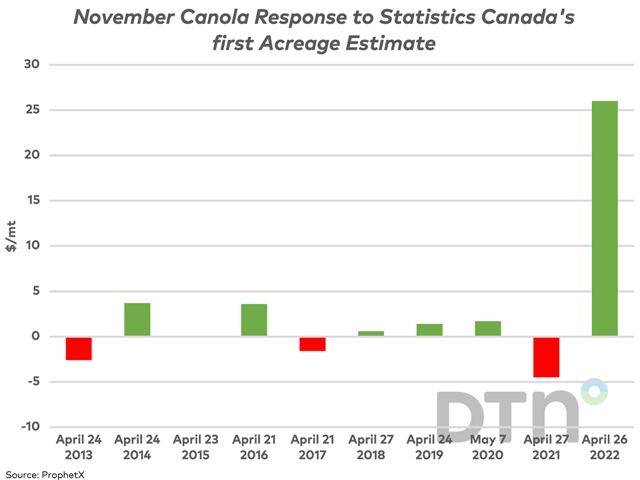

A significant move in the new-crop November contract is not common following Statistics Canada's first acreage estimates of the season, although one only has to look back one year for the last time this happened.

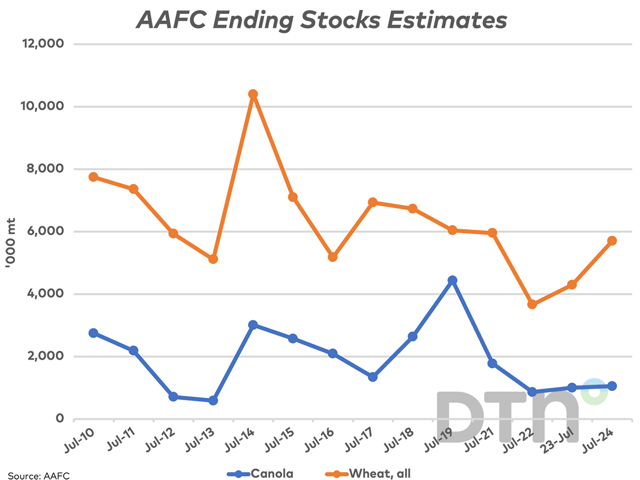

This month's AAFC forecast includes a higher revision for wheat exports in 2022-23 and a lower revision for canola exports.

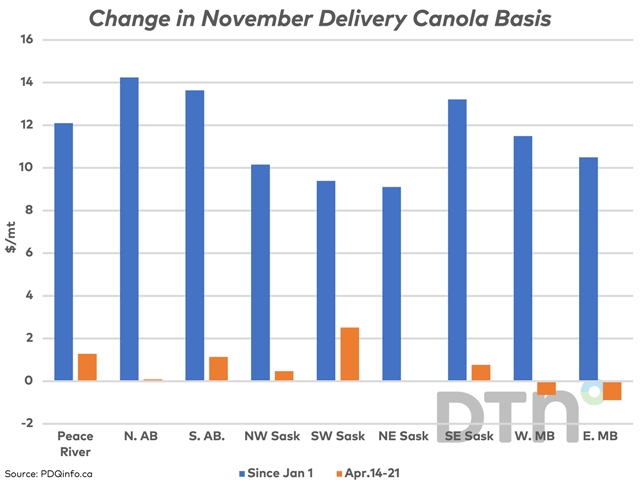

Ahead of Statistics Canada's 2023 planting intentions, to be released on April 26, canola basis has shown strength since Jan. 1 and over the past week across most of the nine prairie regions monitored by pdqinfo. This week's strength was also accompanied by a higher close for...

The November canola has faced sharp losses during two sessions but still remains poised to close higher over the week after four sessions of trade.

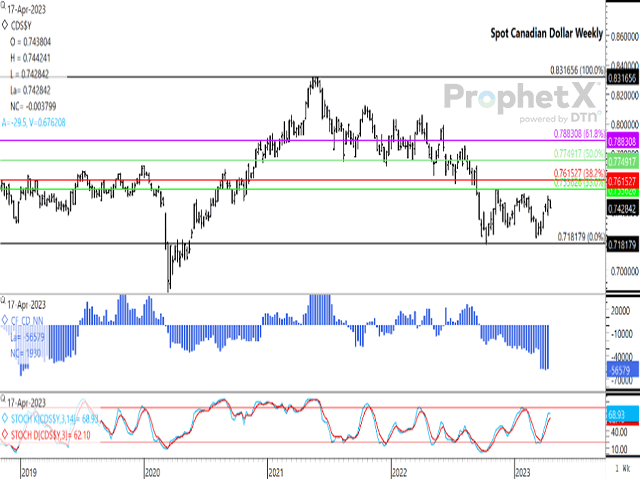

The spot Canadian dollar weekly chart is showing lower highs and lower lows as two successive rallies have failed to lead to test previous highs.

After closing lower for seven of eight consecutive sessions, the December hard red spring wheat contract has close higher for three consecutive sessions and testing resistance.

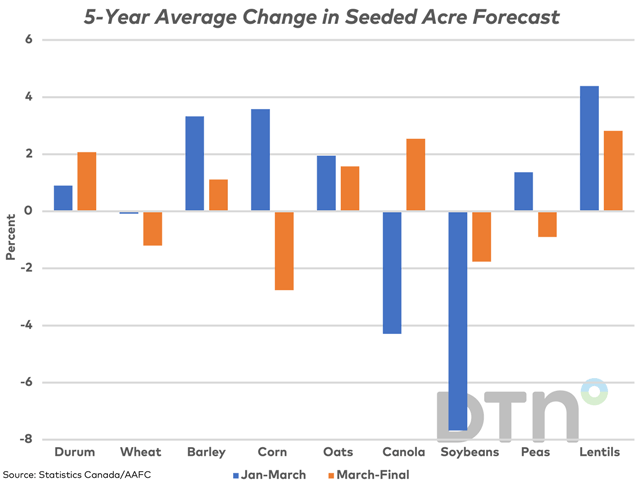

Today's blog looks at the historical change in the seeded acre forecast for select crops from the unofficial estimates released on January to the March intentions report, along with the change in forecast from the March report to the final acres reported in Statistics Canada...

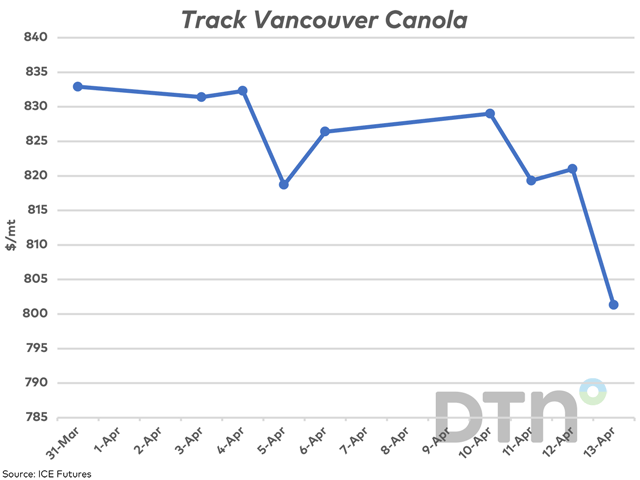

Recent weakness in canola futures has been accompanied by weakness in the track basis reported by the ICE Exchange.

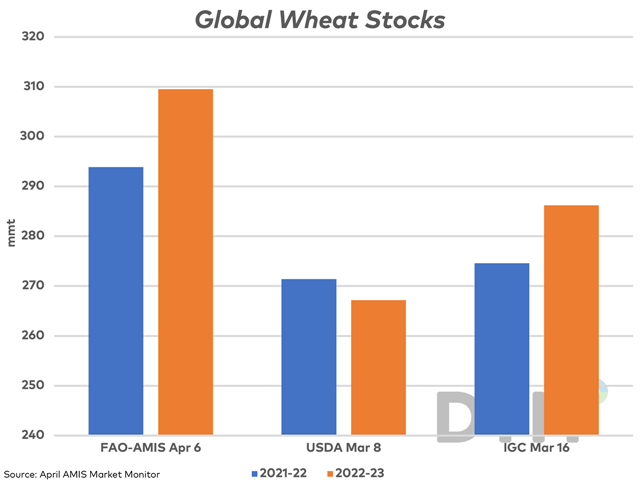

Today's AMIS Market Monitor release shows both AMIS and the IGC forecasting a year-over-year increase in global wheat stocks for 2022-23, while the USDA's March forecast includes a drop in stocks.

Statistics Canada released February merchandise trade data on April 5, while this study looks at the month's activity for select crops and products.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]