Packers have slowly been able to build up supply, which is hindering the fed cash cattle market trade. However, thus far, that has not affected the feeder cattle market as buyers continue to...

Nearby delivery month crude oil futures rose nearly $2 on Wednesday, after Israel accepted a ceasefire with Gaza and despite the Energy...

Weather conditions continue wetter than previously expected for July, so good for crop growth, but bearish for commodity futures prices. We'll...

The DTN View From the Cab farmers continue to eye the weather and the challenges, but sweet corn makes things better as long as you can keep...

P[] D[0x0] M[0x0] OOP[F] ADUNIT[] T[]

ShayLe Stewart is the newest member of the DTN analysis team (September 2019), and comes with deep roots in the beef industry.

Based in the high mountain cattle country near Cody, Wyoming, Stewart leads coverage in all areas of livestock and meat production, and brings a true boots-on-the-ground perspective to a livestock marketing world that gets increasingly difficult to navigate.

ShayLe grew up on a cow-calf and haying operation in south-central Montana, where her passion for the beef industry led her to Colorado State University, ultimately to an internship with the United States Cattlemen's Association. Her experiences following markets for USCA were the springboard for her self-produced Cattle Market News website and Facebook outlets. Those weekly reports were a reliable source of compressed, easy-to-understand, digestible market information.

While her background is in the ranching West, ShayLe comes with a solid list of market contacts from around the country. Talking each week to sale barn owners, feed lot managers, and other industry experts, she is able to ask the questions that cattlemen need answered in order to find clarity in a complex and dynamic market.

ShayLe and her husband, Jimmy, run a registered herd of Sim-Angus females, and host an annual bull sale in Powell, Wyoming.

Packers have slowly been able to build up supply, which is hindering the fed cash cattle market trade. However, thus far, that has not affected the feeder cattle market as buyers continue to...

Record high cattle prices come with more volatility. You'll never outthink the cattle market, but you can have a plan to deal better with it.

Bids were offered throughout the day in both regions, but packers weren't overly aggressive in this week's cash market.

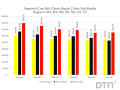

Steers weighing between 500 and 740 pounds traded $38 to $66 per hundredweight (cwt) more last week on the Corn Belt Classic video auction, compared to prices seen in 2024.

Packers have slowly been able to build up supply, which is hindering the fed cash cattle market trade. However, thus far, that has not affected the feeder cattle market as buyers continue to buy calves at record-high prices.

Record high cattle prices come with more volatility. You'll never outthink the cattle market, but you can have a plan to deal better with it.

May placements are expected to be down in Friday's June 1 USDA Cattle on Feed report, which means the trade is likely to view the report as bullish, according to DTN Livestock Analyst ShayLe Stewart.

When the cattle market's two biggest factors (its technical and fundamental indicators) work against each other, then turmoil, volatility and uneasiness should be expected.

What cattlemen will keenly watch this week is Superior's Corn Belt Classic Sale, and the Cattle on Feed Report on Friday.

Following last week's unbelievable surge in both the fed cash cattle market and the futures complex, traders are hopeful support will allow the market to trade higher again this week.

Be aware of what the contracts are legally allowed to do, and how that could affect your commodity assets.

USDA's May 1 Cattle on Feed report on Friday is expected to be neutral to somewhat bullish, with pre-report estimates predicting all three major categories to be lighter than a year ago.

Holiday-shortened weeks always throw a kink into the market's normal trading rhythm; but with some technical and fundamental pushback at hand, the market will likely remain hesitant to move much higher until after the Memorial Day...

With packers having built up some supply during the last three weeks, and with the upcoming Memorial Day holiday, it's likely fed cash cattle prices could trade steady this week.

Although it was exciting to see the cattle contracts trade sharply higher amid bullish news headlines, market participants can't forget the gaps in the chart will eventually be filled in.

If you look at the cow-herd data over multiple cycle spans, you'll see time and time again, while the cycle does typically ebb and flow, the build back following a period of liquidation usually...

Packers were able to buy up some supply last week in the fed cash cattle market. But if they continue to run reduced kill schedules, how are boxed beef prices going to fare?

Last week, the cattle complex performed nearly flawlessly as fed cash cattle prices reached all-time highs, feeder cattle prices were higher, and the futures contracts ran to new contract highs.

With turnout season nearing, prices at feeder cattle sales have been sharply higher in the countryside over the last two weeks.

Beef demand may be exceptional and could even increase seasonally through the Memorial Day weekend, but it's going to take a lot of market support for traders to remain steadfast and focused amid any more trade chatter that...

The wide range of estimates for March placements in Thursday's April 1 USDA Cattle on Feed report could raise some concern in the markets, according to DTN Livestock Analyst ShayLe Stewart.

Whether it's because of tariff concerns, consumers wanting to tighten their spending budgets, or simply because Easter isn't a major beef dish holiday, pinpointing the exact reason why boxed beef prices were pressured last week...

Most market moves are overdone because of emotional knee-jerk reactions in the market and we never help our own operation or our own bottom-line by making similar emotional decisions. When the market seems to be moving too...