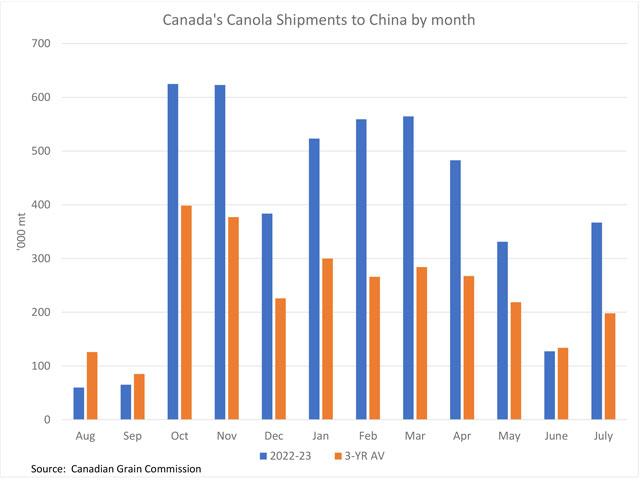

The USDA recently revised higher their estimate for China's 2022-23 canola/rapeseed imports, while over the past three years, the months of October and November have been the months where the largest volumes were shipped.

The USDA recently revised higher their estimate for China's 2022-23 canola/rapeseed imports, while over the past three years, the months of October and November have been the months where the largest volumes were shipped.

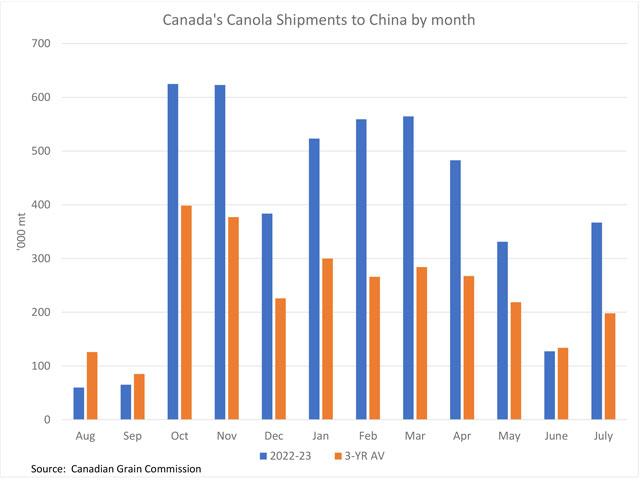

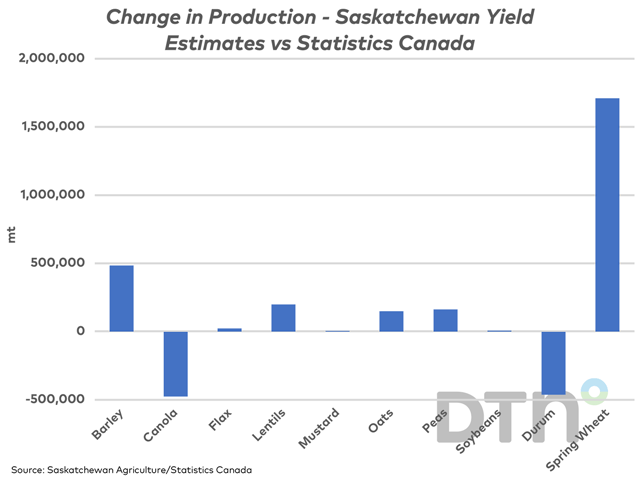

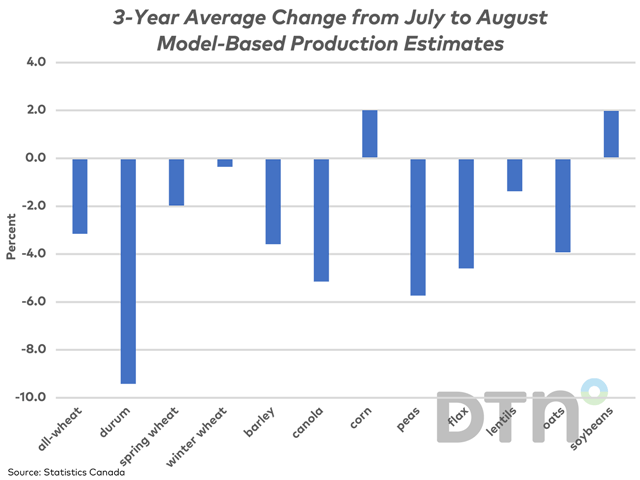

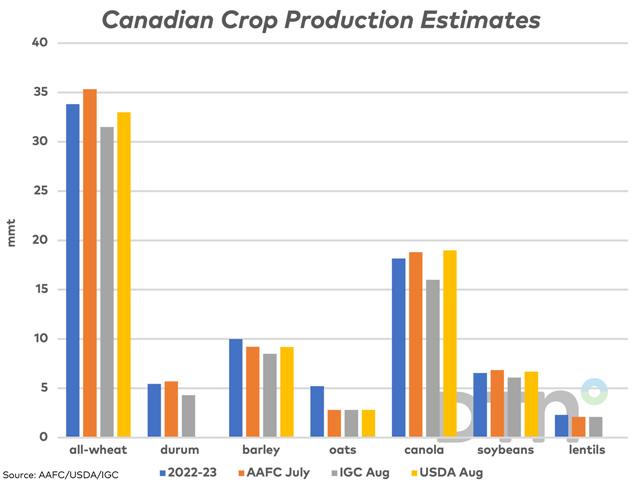

The largest changes in Statistics Canada's September production estimates, based on August model data, consist of an upward revision for spring wheat production, a lower revision for durum production, a lower revision for canola and a higher revision for corn.

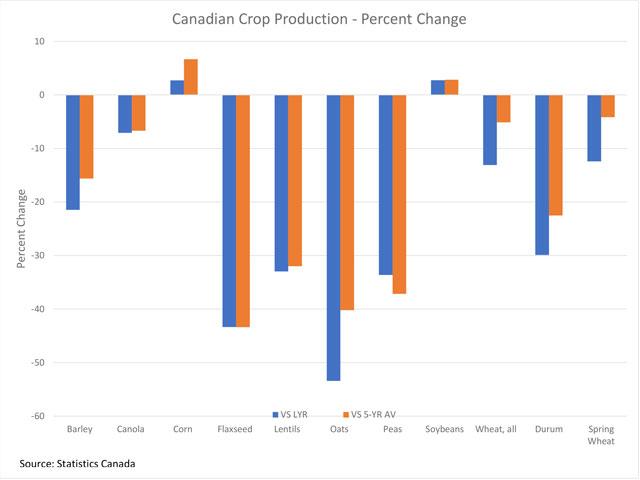

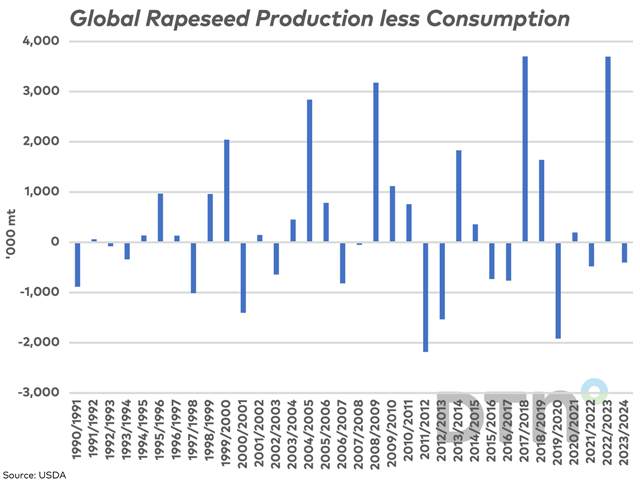

USDA forecasts show the largest year-over-year drop in global canola/rapeseed production in 23 years, while global consumption is to rise to a fresh global record in 2023-24.

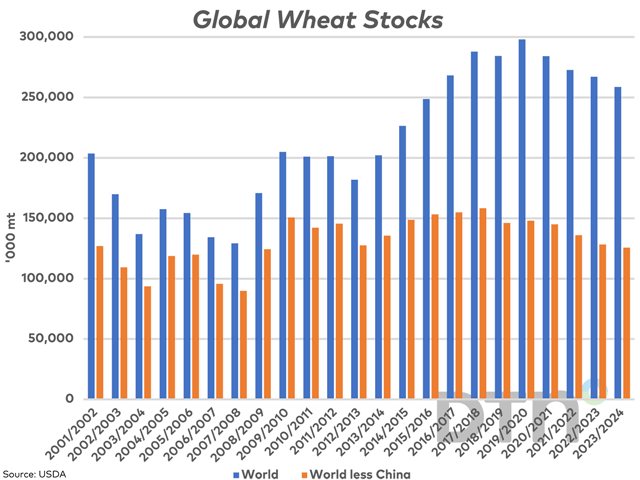

Wheat futures rose on Sept. 12 following bullish global estimates released by USDA.

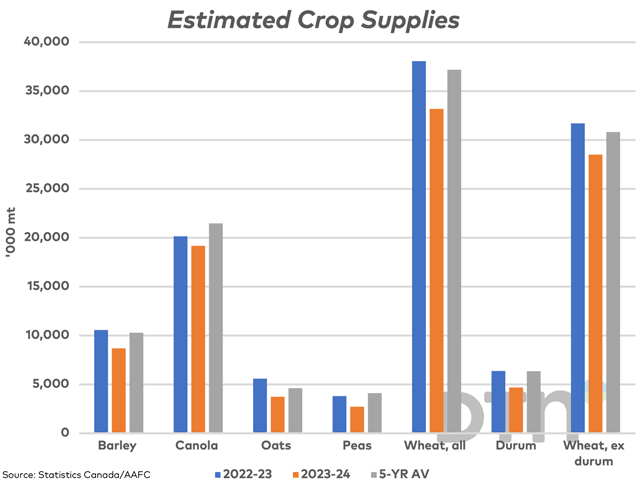

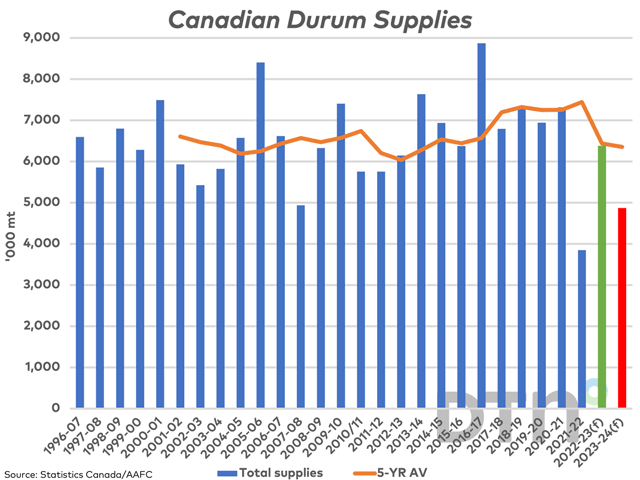

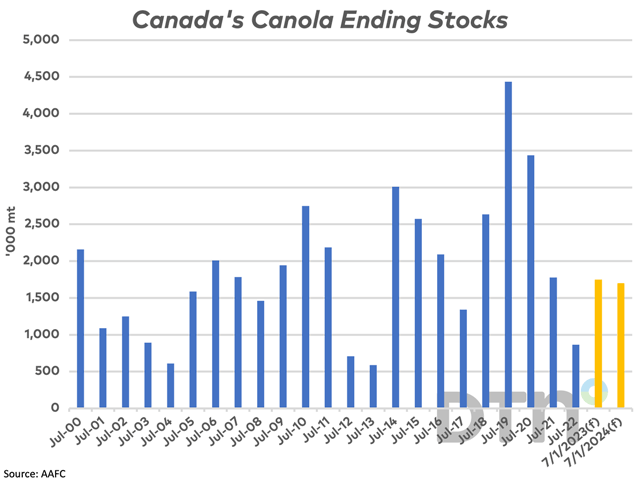

Statistics Canada's initial production estimates as well as July 31 stocks estimates are added to AAFC's estimates for imports to calculate crop-year supplies for 2023-24. These are compared to estimated supplies for 2022-23 and the five-year average.

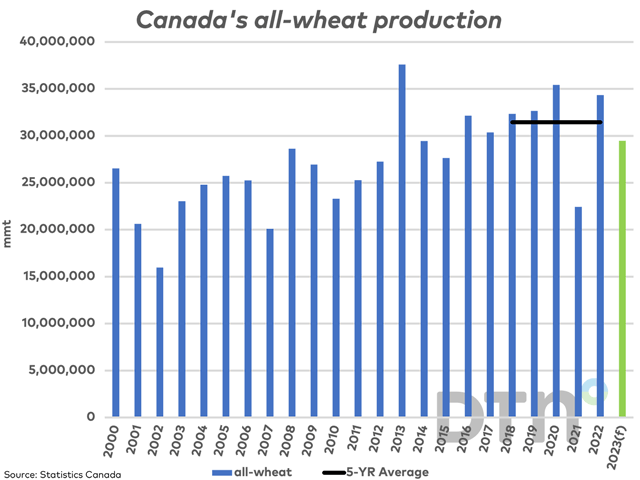

Saskatchewan Agriculture's first yield estimates for 2023 point to a larger crop than Statistics Canada's first model-based estimates would suggest.

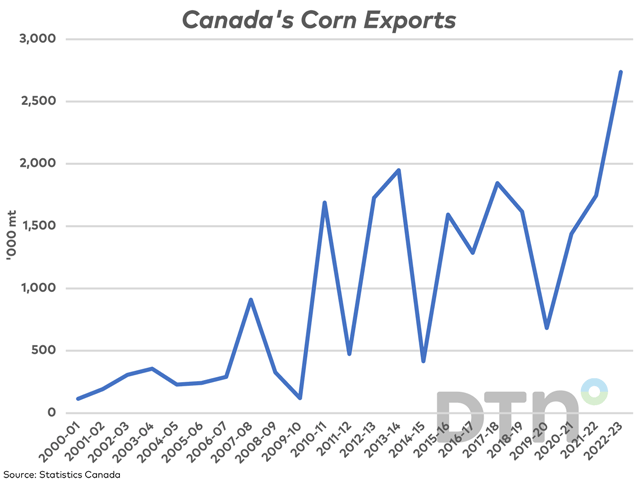

Today's Statistics Canada's July trade data shows activity for the final month of the 2022-23 crop year for all crops except corn and soybeans.

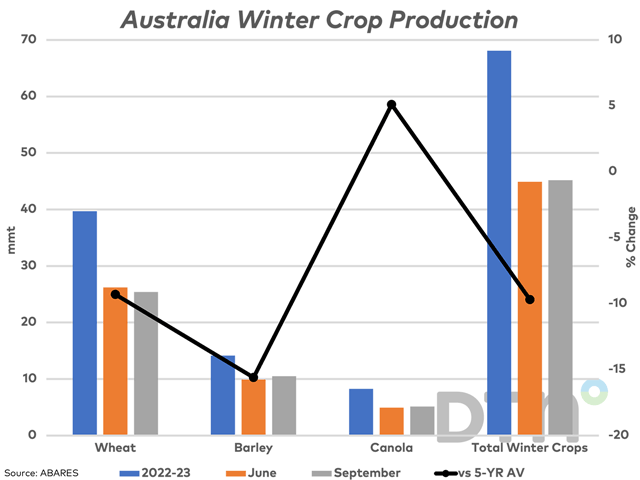

Australia's winter crop is forecast to fall 33.6% from the previous year with crops in southern regions faring well while northern growing areas are facing unfavorable conditions.

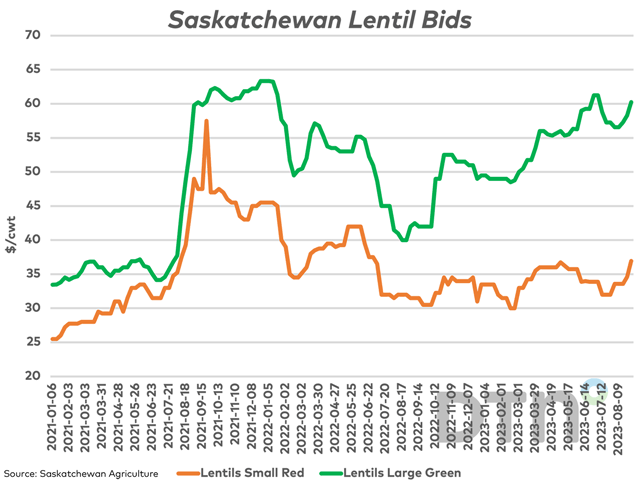

Both large green lentil and red lentil bids delivered to Saskatchewan plants have shown strength over recent weeks. This week's Statistics Canada production estimates based on July model data came in below trade expectations for lentils, leading to uncertainty.

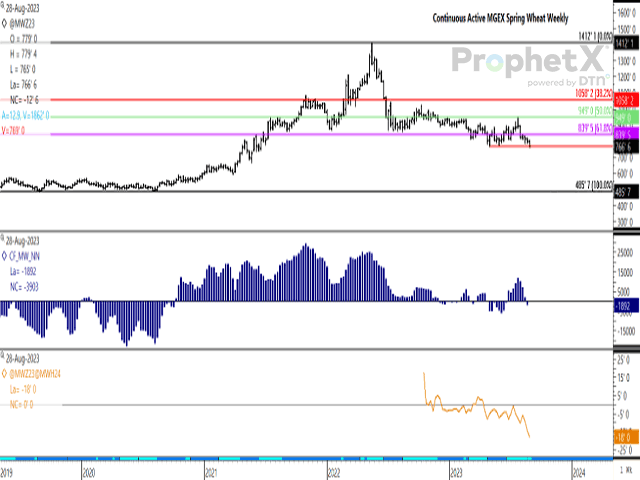

Today's move in the December MGEX contract resulted in the lowest trade on the continuous active chart since June 2021 or more than two years.

Canada's durum supplies will tighten for the second time in three years, while global buyers take note.

As expected, Statistics Canada's first crop production estimates point to bigger crops in eastern Canada and smaller crops in the West.

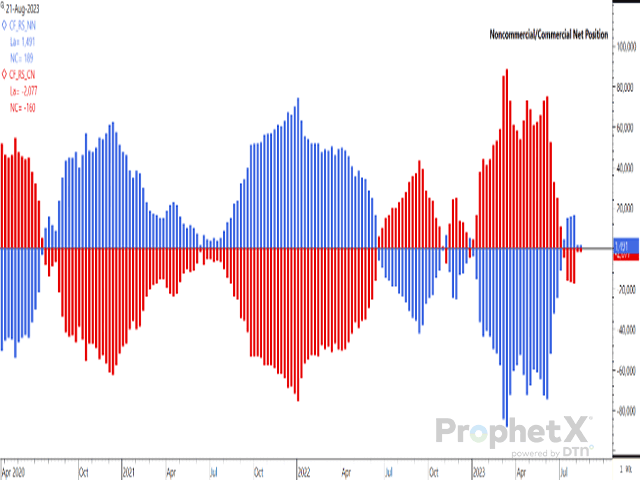

As of Aug. 22, the CFTC reported very modest net futures positions held by commercial and noncommercial traders of canola.

The Aug. 29 Statistics Canada crop production estimates are based on July model data and will be followed by a Sept. 14 report based on August data. During the last three years, most crops tend to be revised lower from one report to the next.

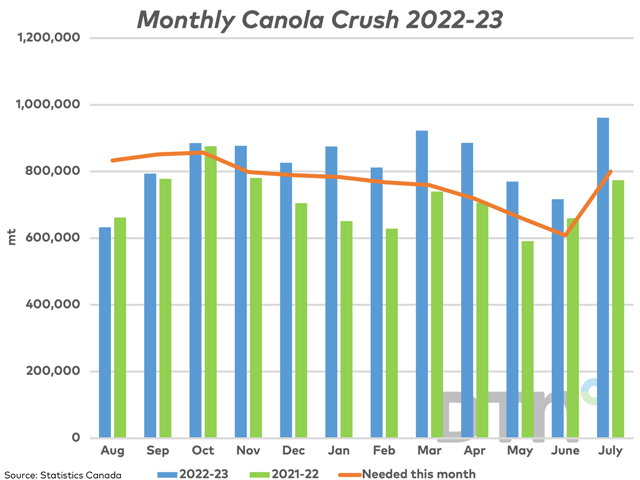

Statistics Canada reported the July canola crush at the highest monthly volume ever, while 2022-23 crush was the third highest on record.

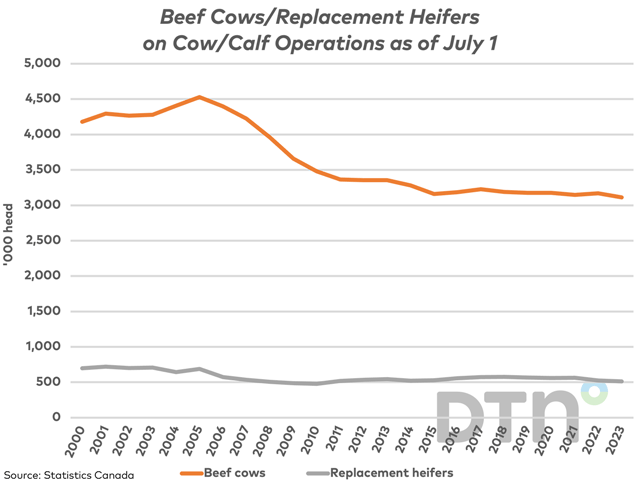

As of July 1, Statistics Canada has estimated lower numbers for cattle, hogs and sheep.

November canola settled lower for the first time in seven sessions while below $800/mt. The session's low found support above the contract's 20-day moving average.

AAFC made some million metric ton revisions this month, with adjustments to wheat, durum and canola balance sheets.

This week's monthly International Grains Council Estimates include a lower revision for Canada's grain production forecast, while noting that there may be more cuts to come.

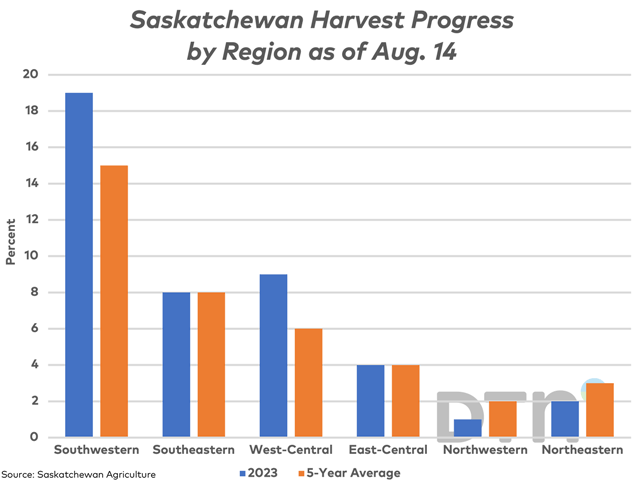

An estimated 9% of the Saskatchewan crop is off as of Aug. 14, which compares to the five-year average of 8%. Activity is noted across the province's six regions.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]