Canada Markets

Thunder Bay Grain Stocks Ahead of Spring Shipping Season Opening

As we welcome the spring equinox, a welcome sight is the break-up on the Great Lakes and the start of the spring shipping at Thunder Bay. On March 17, the Canadian Coast Guard posted an advisory on social media that icebreaking will take place in the Port of Thunder Bay on March 22 with a warning to keep clear.

Last year, Tim Heney, CEO of the Thunder Bay Port Authority, told The Chronicle Journal that "In an inland port city, the first ship into port brings with it a feeling of spring and revitalization after a cold winter." (https://www.chroniclejournal.com/…)

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The port's Top Hat award goes to the first vessel to cross Lake Superior to open the shipping season. During the past five years, the arrival of these laker vessels has ranged from March 24 in 2017 to March 30 in 2022. A separate award is granted to the first salty or ocean-going vessel, with April 4 in 2022 the earliest date seen in recent years.

Following two weeks of no grain unloaded at Thunder Bay in week 29 and week 30, activity has increased with 21,700 metric tons unloaded in week 31 and 55,100 mt unloaded in week 32. The Daily Network Status Report indicates that week 34 unloads should ramp up quickly with more than 1,400 cars on track.

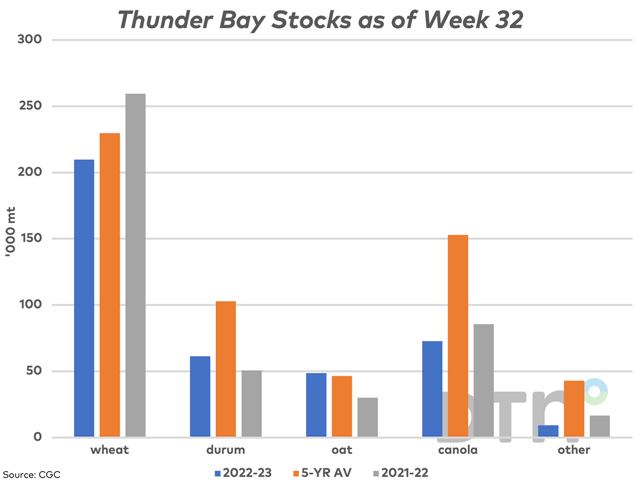

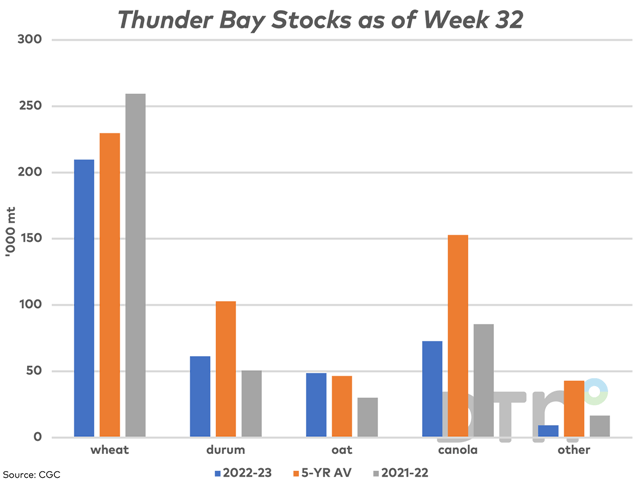

Week 32 grain stocks in-store Thunder Bay, covering activity for the week ending March 12, shows a volume of 402,000 metric tons. This is down 9.1% from one year ago and down 30% below the five-year average.

As seen on the attached chart, only the volume of oats held in-store Thunder Bay licensed handling facilities as of week 32 are above the year-ago volume and the five-year average. Inventory of the largest crops, wheat and canola, are seen below the year-ago volume and the five-year average.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .