Canada Markets

Canada's Consumer Price Index Continues to Cool

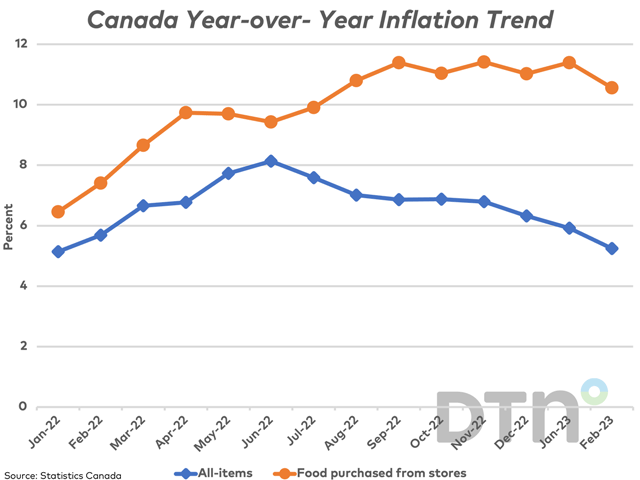

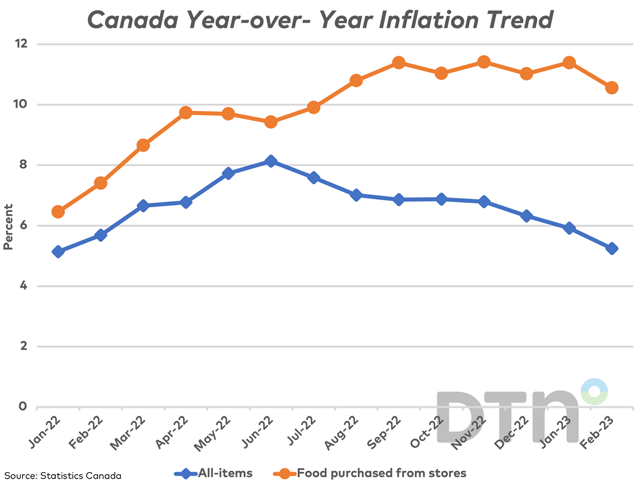

Statistics Canada reported the country's Consumer Price Index increased by 5.2% year-over-year in February, which compares to a 5.9% increase in January. The pace of price increasing is seen decelerating, falling in seven of the past eight months since reaching a high of 8.1% in June 2022.

The February CPI was reported lower than the 5.4% expected by economists, while is the largest month-over-month drop seen since April 2020 and prices are expected to continue to decelerate in the months to come. The Globe and Mail reports that Bank of Montreal chief economist Doug Porter said, in a note to clients, "With inflation subsiding on both the headline and core measures, the Bank of Canada is in a less awkward position than many others during the recent financial turmoil. That is, there's really no underlying reason for the Bank to hike further." This has led to weakness in the Canadian dollar, which has weakened 30 basis points against the USD on Tuesday for its first lower close in four sessions.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As seen on the attached chart, the year-over-year price inflation for food purchased from grocery stores has fallen from 11.4% to 10.6% in February, the lowest reported in seven months, but two-times the rate of overall inflation and highly visible by Canadians. February represents the seventh consecutive month that grocery inflation has remained above 10%.

Statistics Canada points to supply constraints tied to unfavourable weather, increased costs for feed, energy and packaging.

While the year-over-year increase across several food groups is seen slowing, examples of food categories where year-over-year prices are seen accelerating include cereal products, which have gained 14.8% year-over-year, and fruit, fruit preparations and nuts, which have increased 11% year-over-year, up from January levels. A quick look at categories where prices remain sticky or slow to correct include vegetables, up 13.9% year-over-year, and bakery products, also up 13.9%.

Challenges remain for the government to reign in food prices at a time when higher interest rates are adding costs across the system, while a $15/metric ton increase to the carbon tax is slated for April 1 and the Clean Fuel Standard, viewed by many as "the second carbon tax," to add further costs to gasoline and diesel used in transportation starting on July 1. Canadian dollar weakness is also adding to the cost of imports, while could become even more problematic should the U.S. choose to hike rates while the Bank of Canada puts rates on hold.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .