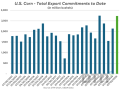

With corn export commitments to date only being exceeded once in the last 25 years (and barely), the USDA should be increasing its export estimate again on Friday.

Oil futures settled higher on Friday, rebounding from a 2% decline in the previous trading session, after the International Energy Agency...

ADM asked a federal court to exclude expert witness testimony in an ethanol market manipulation lawsuit, challenging the reliability of a regression...

The DTN View From the Cab farmers continue to eye the weather and the challenges, but sweet corn makes things better as long as you can keep...

P[] D[0x0] M[0x0] OOP[F] ADUNIT[] T[]

Mitch Miller has joined the DTN team as the DTN Contributing Canadian Grains Analyst following a long career in the grain and oilseed sector in south-central Manitoba, Canada. He jokes that he has been a primary producer for almost 40 years by necessity but a market analyst and strategist throughout that by passion.

A bachelor's degree in ag economics from the University of Manitoba initiated a lifelong focus on all things management and marketing. Although the decision was made to downsize the farm significantly in 2019, he proudly claims to still have enough acres to seed and cows to feed to remain grounded.

Too young to quit being productive, he hopes to share some of his experience and insight with readers to help with one of the most challenging tasks on the farm -- marketing the production successfully. A six-year span as a commodity broker and a lifelong career involved in the cash market should provide a unique balance from which to draw.

In an attempt to be transparent, he explains his approach to market analysis. Looking for clues from fundamental analysis, technical analysis and from the market participants themselves through the Commitment of Trader reports, a theory on price direction is developed. The more clues supporting the theory, the more confidence in it. That in turn influences the development of a successful marketing strategy. Through this role, he hopes to be able to share those clues as they are identified on an ongoing basis.

With corn export commitments to date only being exceeded once in the last 25 years (and barely), the USDA should be increasing its export estimate again on Friday.

The price you pay for record-high values is the anxiety and volatility that inevitably goes with them. That is one situation where technical analysis helps. With the past outlook being so...

With corn export commitments to date only being exceeded once in the last 25 years (and barely), the USDA should be increasing its export estimate again on Friday.

The price you pay for record-high values is the anxiety and volatility that inevitably goes with them. That is one situation where technical analysis helps. With the past outlook being so important to the livestock industry, it's...

Love them or hate them, participants other than those directly involved with a commodity use futures markets for various purposes. In the coming months, commodity index traders could be the best hope there is for higher grain...

The soybean market has shown very few signs of concern recently but given how little room there is for production shortfalls, Monday's acreage update should take on added importance.

Bullish fundamental and technical factors have driven canola prices sharply higher from their March lows. Charts show there should be room to run yet before hitting significant resistance. Closely watched are the differences in...

With all three U.S. wheat markets displaying bottom formations, other spring wheat areas being lost to corn at a greater rate than expected this year, and drought conditions impacting spring wheat areas on both sides of the U.S...

With strong exports and tight domestic stocks despite increased production, the recent market disappointment about a lack of concrete progress on biofuel support should not be mistaken for an end to potential gains.

Feeder cattle's dramatic rise to record highs is certainly cause for celebration in the short term -- and anxiety for long-term planning.

Feeder cattle's dramatic rise to record highs is certainly cause for celebration in the short term -- and anxiety for long-term planning.

Record low U.S. oat ending stocks and close to that in Canada for both old and new crop are sure to keep markets on edge and very sensitive to weather risks in the coming months.

If AAFC is wrong on its assumption that Statistics Canada past production estimates are incorrect for canola, then carryover could fall to unreasonably low levels given a negative Feed, Waste and Dockage total is not acceptable.

The soybean market is sure to see increased weather-related volatility in the year ahead following a much-lower-than-expected new-crop ending-stocks estimate.

Funds continue to aggressively sell old-crop corn (regardless of bullish fundamentals for it) as if that corn were facing the more bearish new-crop fundamentals.

With no revision higher to past production estimates, canola stocks remain uncomfortably tight.

China clearly used the tariffs that it had imposed on canola oil and meal imports as a trade advantage, completely dominating the canola seed export market in March.

With other spring wheat area being lost to corn at a greater rate than expected this year, the Minneapolis wheat premium to Chicago is poised to gain.

The Canadian dollar appears to have left a multi-decade low behind in February with a sharp rally off support. Long loonie risk management should now be a concern.

With yet another contract low set in Kansas City wheat and close to it in Chicago, the wheat/corn spread may be the best hope for a rally.

Various funds rushed back into the corn market with the underlying corn fundamentals of exceptional demand not changed, resulting in a $0.49/bushel rally in two weeks.

The canola market is finally acknowledging the tight supply situation that has been months in the making. At least it's early enough to encourage seeded area but is it too late to ration demand?