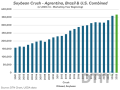

Record crush in South America is required to help the U.S. meet world demand for soybean oil and meal.

Oil futures ended broadly higher Friday, Feb. 6, reversing the previous day's tumble on continued volatility over risks related to Iran.

We kick off the week with February's WASDE report, look forward to seeing you at the National Farm Machinery Show, and will check in on the...

Lotion fresh from the dairy farm can help show your softer side this Valentine's Day.

P[] D[0x0] M[0x0] OOP[F] ADUNIT[] T[]

Mitch Miller has joined the DTN team as the DTN Contributing Canadian Grains Analyst following a long career in the grain and oilseed sector in south-central Manitoba, Canada. He jokes that he has been a primary producer for almost 40 years by necessity but a market analyst and strategist throughout that by passion.

A bachelor's degree in ag economics from the University of Manitoba initiated a lifelong focus on all things management and marketing. Although the decision was made to downsize the farm significantly in 2019, he proudly claims to still have enough acres to seed and cows to feed to remain grounded.

Too young to quit being productive, he hopes to share some of his experience and insight with readers to help with one of the most challenging tasks on the farm -- marketing the production successfully. A six-year span as a commodity broker and a lifelong career involved in the cash market should provide a unique balance from which to draw.

In an attempt to be transparent, he explains his approach to market analysis. Looking for clues from fundamental analysis, technical analysis and from the market participants themselves through the Commitment of Trader reports, a theory on price direction is developed. The more clues supporting the theory, the more confidence in it. That in turn influences the development of a successful marketing strategy. Through this role, he hopes to be able to share those clues as they are identified on an ongoing basis.

Record crush in South America is required to help the U.S. meet world demand for soybean oil and meal.

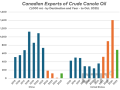

The end results will somehow differ, but the trends found in AAFC's first look at 2026-27 canola should provide comfort with the implication being demand rationing will again be required.

Record crush in South America is required to help the U.S. meet world demand for soybean oil and meal.

The end results will somehow differ, but the trends found in AAFC's first look at 2026-27 canola should provide comfort with the implication being demand rationing will again be required.

The fact that China's canola oil import tariffs remain in place should not be a concern, given the relatively insignificant trade compared to that of canola seed and meal.

Now that USDA has weighed in on crop-specific factors impacting price, it's worth considering macro-economic factors.

Soybean oil yield can have a dramatic impact on total production, with early indications suggesting tighter supplies could be on the horizon.

It's always a worthwhile exercise to prepare a watch list of the factors that need to be monitored while keeping an eye out for the unknown.

May the holidays bring the focus back on what truly is important in life. With that perspective helping to offset the daily stresses one must navigate.

The break in energy prices in December may have contributed to short-term pain for the oilseed complex but it also provides an opportunity to hedge fuel prices going into 2026.

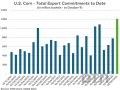

Record-setting U.S. corn export sales are making it somewhat challenging for Canada to compete, while stronger Western Canadian feed production limits the need.

DTN Contributing Canadian Grains Analyst Mitch Miller shares why he was proudest of writing this blog, and the message he gave back in May to the cattle industry that continues to be relevant at the end of the year.

Final production totals from Statistics Canada confirmed yields rose dramatically from the September estimates for most Western Canadian crops while row-crop yields declined thanks to an Eastern Canadian drought.

With corn export commitments to date at a record pace already, what would happen if China returned to the market?

With the help of surging heating oil (ultra-low sulfur diesel) prices, soybean oil appears to be breaking higher from support.