December corn on Monday is under severe pressure again and for about the eighth time is challenging the support area of $4.33 to $4.34. The more a chart point is challenged, the more...

Oil futures edged up Tuesday morning, staying in a narrow band for the fifth consecutive trading day ahead of the July 9 tariff deadline and...

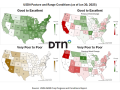

Recent rainfall has significantly improved pasture conditions across major cow-calf producing states, particularly in the Plains region. Nebraska...

Heavy rainfall patterns have complicated life recently for DTN's View From the Cab farmers reporting in from Nebraska and Alabama.

P[] D[0x0] M[0x0] OOP[F] ADUNIT[] T[]

Dana Mantini is a senior market analyst for DTN, and has 30-plus years of experience in the commodity futures industry.

Dana began as a wheat buyer and cash grain merchandiser for major flour millers, General Mills and International Multifoods. He was an independent member of the Kansas City Board of Trade, and spent 15 years as a broker/trader there. He has been hedge desk manager at Koch Industries (Koch Ag), and a commodity broker for Prudential Securities in Kansas City. He joined DeBruce Grain in 2001 as the Hedge Desk Manager, and did all of the futures/options trading, all of the hedging, spreading and initiated and managed a new farm contract program. Facilitated multiple farmer outlook meetings each year. DeBruce Grain managed 140 million bushels of storage capacity, and had 10-consecutive record-profit years before Gavilon acquired DeBruce in late 2010. Dana moved to Omaha in July 2012 to join Gavilon, first as a proprietary futures/options trader and then worked with Gavilon Producer Solutions, writing three times daily market wires, and advising producers on marketing.

It was the love of analyzing, interpreting, educating and writing that drove me to the open analyst position at DTN.

Dana graduated from Amherst College with a major in Economics, where he played baseball and basketball.

He is married to Ruthanne -- a certified pilates instructor -- and has two daughters -- Anna, 19 (sophomore at UNL), and Maggie, 16, (junior at Marian HS).

December corn on Monday is under severe pressure again and for about the eighth time is challenging the support area of $4.33 to $4.34. The more a chart point is challenged, the more...

The early April tariff pause, along with recent positive comments from both Treasury Secretary Scott Bessent and President Donald Trump, have soybean futures well supported in recent weeks...

December corn on Monday is under severe pressure again and for about the eighth time is challenging the support area of $4.33 to $4.34. The more a chart point is challenged, the more vulnerable it becomes with each additional...

New crop December corn futures have been on a tear since the end of March. In that time, December futures rallied 33 cents above the low set on March 31. A look at the weekly chart would show December bumping up against a...