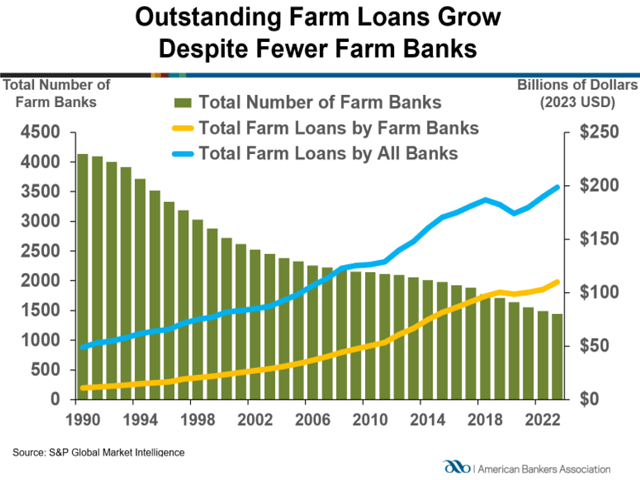

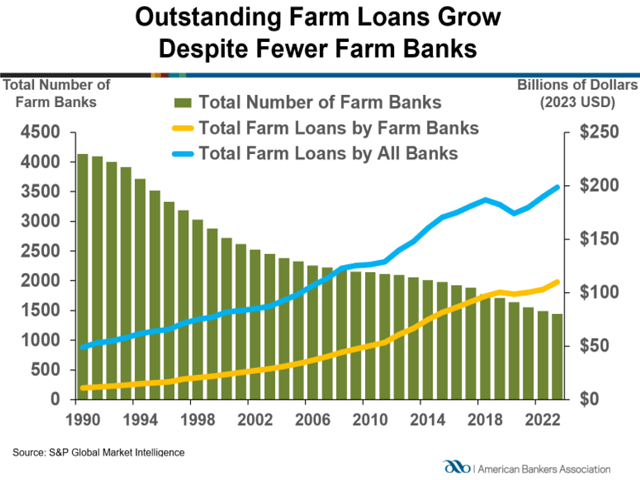

More farmers borrowed money in 2023, resulting in a growing loan business for the nation's farm banks, according to an annual report from the American Bankers Association.

More farmers borrowed money in 2023, resulting in a growing loan business for the nation's farm banks, according to an annual report from the American Bankers Association.

The next Ag Summit Series webinar will discuss strategies and plans to help farmers make the best of a tough year of prices and weather.

Crop insurance purchases for most row-crop growers must be made by March 15. Farmers also need to visit their local Farm Service Agency office to make their ARC or PLC elections for the year.

Crop insurance purchases for most row-crop growers must be made by March 15. Farmers also need to visit their local Farm Services Agency office to make their ARC or PLC elections for the year.

Agriculture Secretary Tom Vilsack pointed to the expansion of crop insurance coverage and the Commodity Credit Corporation as important tools to support farm incomes at USDA's Agricultural Outlook Forum. However, a panel of former USDA chief economists see issues that could...

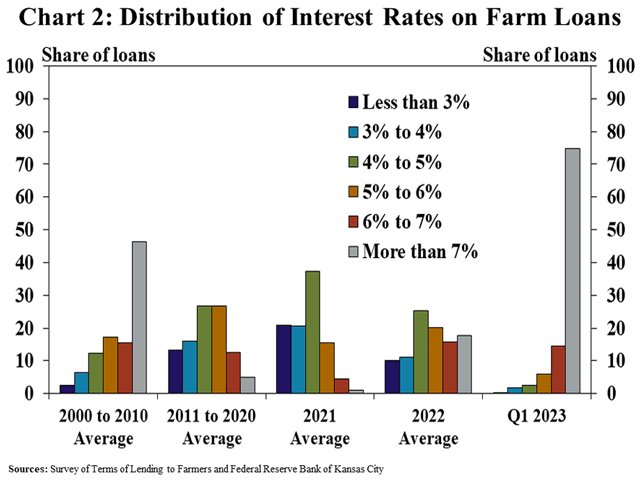

The Fed's challenge in 2024 will be timing. Leaving rates too high for too long could damage the economy, but rates cut too quickly could fuel more inflation.

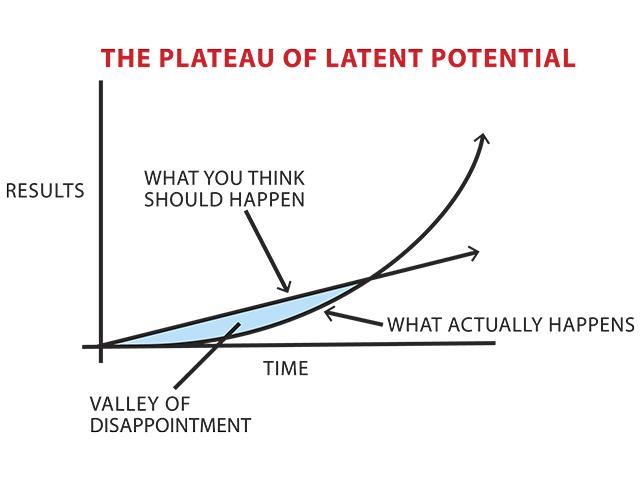

Think about your own and your business's habits that can change. Then do it.

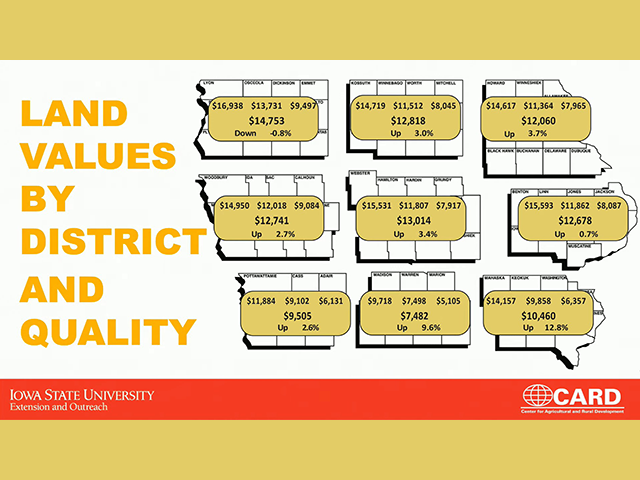

It cost an average of $11,835 to buy an acre of Iowa farmland in 2023, and while that's a record, the 2023 Iowa State University Land Value Survey highlights several trends that suggest a change may be coming to the land market.

Delaying a successor coming back to the farm will give her or him the necessary education, perspective, skills and experience to eventually become a successful leader of the family business.

There's still time to register for Day 2 of the DTN Ag Summit, where DTN Lead Analyst Todd Hultman will share his outlook for the grain markets and DTN Ag Meteorologist John Baranick will discuss the weather factors to watch.

There's still time to register and attend the DTN Ag Summit. Sessions begin at 8:30 a.m. CST and will be available for replay.

The DTN Ag Summit begins Dec. 5 and runs from 8:30-11:30 a.m. CST. Have you registered yet? Here's a little insight into what to expect.

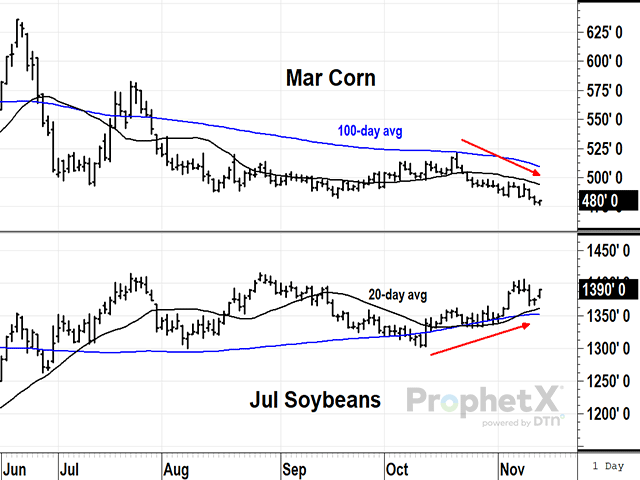

In this week's "In the News" video, DTN Ag Meteorologist John Baranick, DTN Lead Analyst Todd Hultman and I discuss the ramifications of USDA's November WASDE report as well as the growing influence of South American weather on the market.

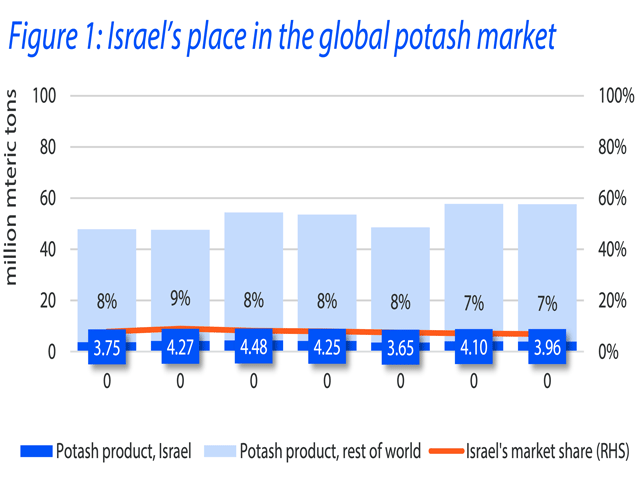

Rabobank inputs analyst Sam Taylor explains that while Israel contributes to global fertilizer supply, the bigger risk to prices is if the conflict expands and drives up oil and natural gas prices.

If you're looking to build a more resilient farm business, The Executive Program for Agricultural Producers (TEPAP) may be the course of action for you.

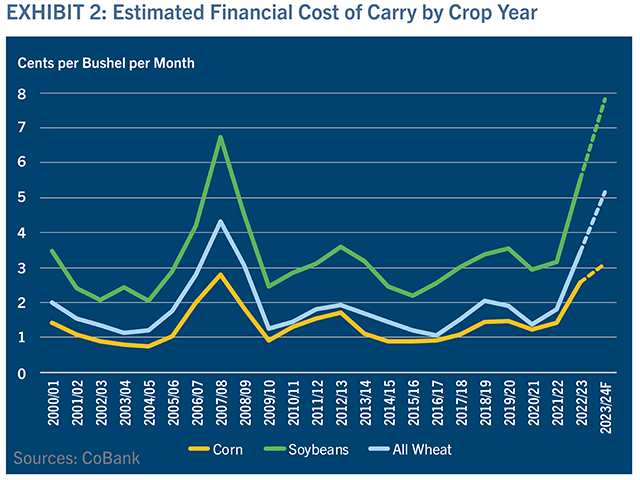

The record cost of storing grain will force elevators to lower cash grain bids and widen basis levels, a new report from CoBank's Knowledge Exchange division argues.

Farmers from six states shared their spring planting experiences, while DTN experts fleshed out expectations for the weather and markets in the months ahead. DTN has extended the registration deadline to view the replay until June 5.

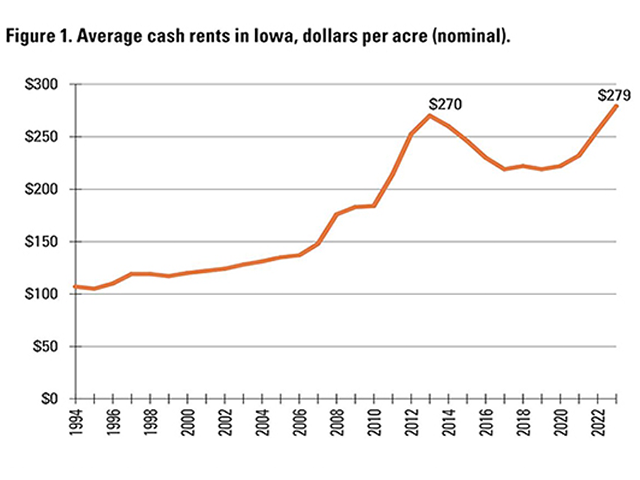

The average cash rent paid for cropland in Iowa climbed 9% to a new record of $279 per acre in 2023. Cumulatively, Iowa cash rents have increased 20% during the past two years, according to a survey of farmers, landowners and other experts.

Fewer and smaller operating notes drove a decline in first-quarter loan volumes, according to a Kansas City Federal Reserve survey of lenders. Higher interest rates are the primary culprit.

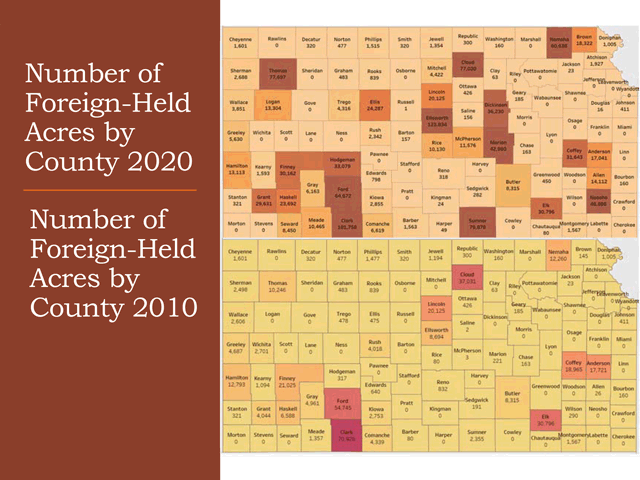

Kansas State University ag economists shared insights into farmland transaction data that underpins the upcoming Kansas Agricultural Land Values report as well as details on foreign ownership of agricultural interests and farmland.

DIM[2x3] LBL[blogs-minding-ags-business-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-minding-ags-business-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]