Minding Ag's Business

Average Iowa Cash Rent Sets Record in 2023 at $279 Per Acre

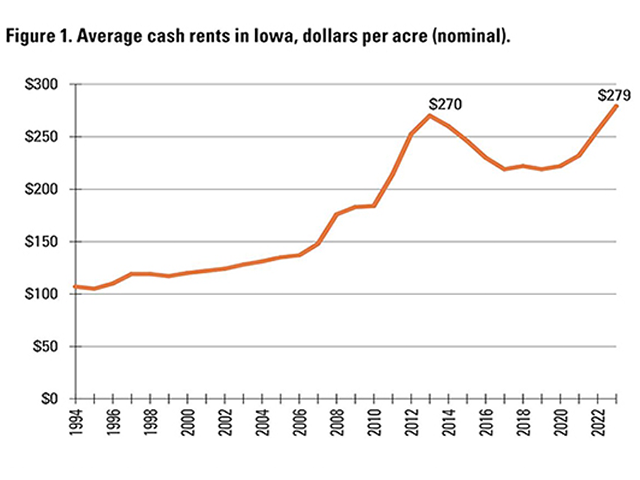

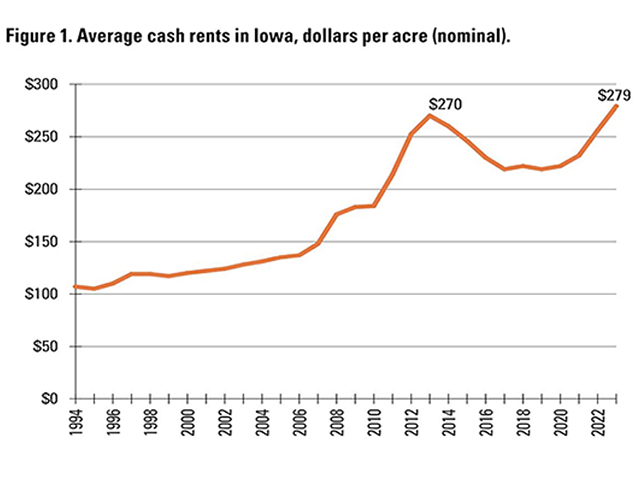

MT. JULIET, Tenn. (DTN) -- The average cash rental rate for Iowa farmland climbed 9% in 2023 to $279 per acre, according to an annual survey conducted by Iowa State University Extension.

It sets a new record, besting 2013's $270 per acre average rent. The survey asked Iowa farmers, landowners, bankers, professional farm managers and others for their best judgment on typical cash rental rates for high, medium and low-quality cropland in their counties, as well as rent estimates for land in hay, oat and pasture. It doesn't ask about rents for individual farms.

"There was considerable variability across counties in year-to-year changes, as is typical of survey data, but 91 out of the 99 Iowa counties experienced increases in average rents for corn and soybeans," ISU extension economist Alejandro Plastina wrote. "Only Des Moines, Jefferson, Lucas, Muscatine, Van Buren, Wapello, Warren, and Woodbury Counties experienced declines in their overall average cash rents."

Since 2021, cash rental rates in Iowa increased by a cumulative 20%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The survey also found that average rents increased proportionally to land quality. Rent for high quality land increased 11.1% to $297 per acre; medium quality, 8.6% to $255 per acre; and low quality, 6% to $217 per acre.

Cash rental rates have jumped significantly alongside land values in the past couple of years, but potential headwinds could slow growth into 2024.

"Lower projected crop prices, along with sustained input inflation in 2024 would result in lower net farm income and put downward pressure on cash rents," Plastina wrote.

He also noted that landowners consider the return on their farmland investment when setting rents. Since the 1990s, landowners have accepted lower returns, which averaged about 3% from 2010 to 2020. In 2021 and 2022, that dropped closer to 2%.

"Although this ratio does not measure net returns to land because ownership costs (such as real estate taxes, maintenance and repairs, etc.) are not considered in its calculation, it suggests that landowners will likely be reticent to accept lower cash rents in the future unless land values decline or stagnate," Plastina said.

According to the REALTORS Land Institute, Iowa farmland values increased by less than 1% from September 2022 to March 2023, which could curtail the growth of cash rent rates in 2024. "However, in a scenario of high interest rates to curtail inflationary risks, the opportunity cost to hold farmland as an investment vehicle remains elevated."

You can view the entire report, which includes average cash rental rates by district, here: https://www.extension.iastate.edu/…

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on Twitter at @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .