Canada Markets

Canola Crush Slows in May

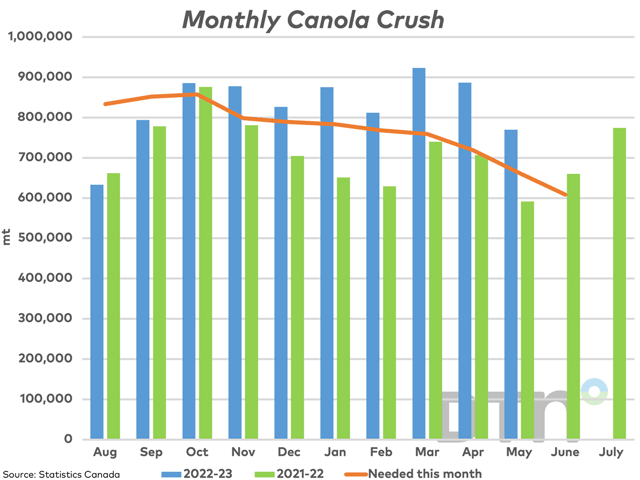

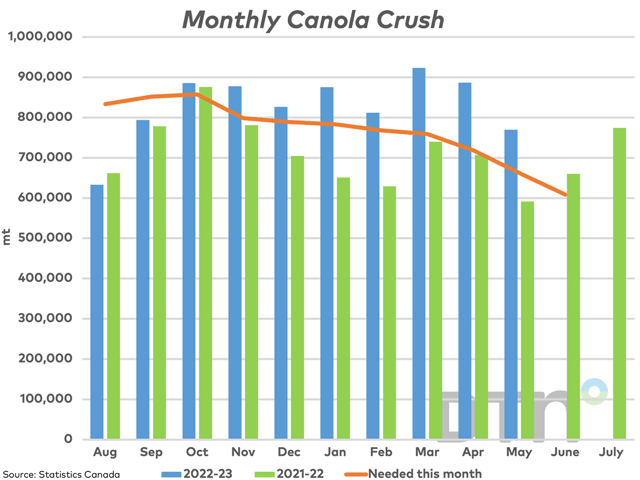

Statistics Canada reported May canola crush at 769,942 metric tons (mt), the smallest volume crushed since August or in nine months. This is no surprise due to the time of year when producers are in the field and crushers take on routine maintenance projects.

This volume is up 30.1% from the same month in 2022, while 1.9% higher than the three-year average for the month of May. It is also more than 100,000 mt above the volume needed this month to stay on the steady pace needed to reach the AAFC crush forecast of 9.5 million metric tons (mmt).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The cumulative crush from August to May, or over the first 10 months of the crop year, is 8.283 mmt. This volume is up 16.3% from the same period in 2021-22, while is 2.1% higher than the three-year average for this period.

Roughly 609,000 mt are needed to be crushed in each of the next two months to reach the current AAFC forecast of 9.5 mmt. Crush remains well ahead of the pace needed to reach the current forecast; note that the 2021-22 crush averaged 717,107 mt over the last two months, while the current crop year's crush remains well ahead of the 2021-22 pace as indicated by the blue bars compared to the green bars on the attached chart.

The oil content for the month rounds to 42%, up from 41.9% in the previous month and the highest percentage reported in 21 months. The cumulative oil content for 2022-23 is 41.6%, which compares to the 2021-22 final average of 41.8% and the five-year average of 43.3%.

Also, during the month of May, the Canadian soybean crush totaled 144,992 mt, the lowest volume crushed in three months. Over the first nine months of the row-crop crop-year, 1.388 mmt of soybeans have been crushed, down 2.2% from the same period in 2021-22 and 2.4% below the five-year average. The current crush is behind the steady pace needed to reach the current 1.9 mmt crush forecast. The oil content for the month is calculated at 19% based on Statistics Canada data, which is up from the 2021-22 final average of 18.7% and compares to the five-year average of 18.6%.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .