Canada Markets

Saskatchewan Milling Oats Retrace to Harvest Lows

Canadian oat stocks as of Dec. 31 were estimated at a record 3.591 million metric tons (mmt), up 91% from one year ago and 43% higher than the five-year average for this date. Prior to the release of this report, Agriculture and Agri-Food Canada (AAFC) had forecast stocks to grow to 1.150 mmt by July 31, which is up 265% from one year ago.

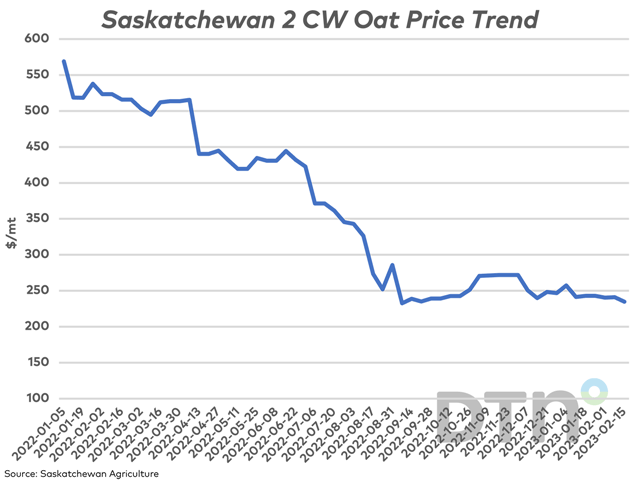

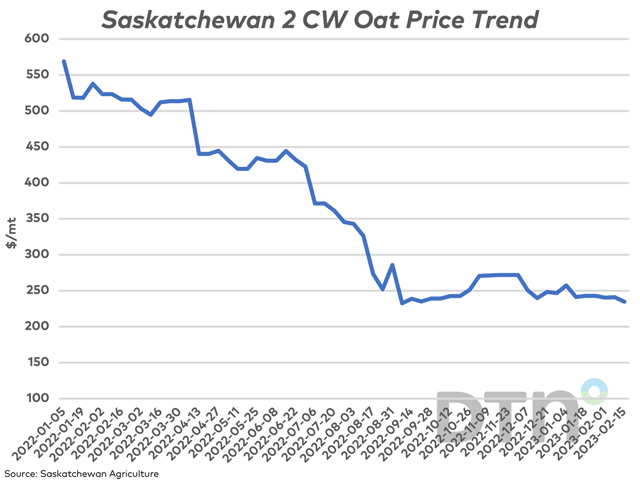

Since mid-August, the weekly cash bid for 2 CW oats has traded sideways, with the Feb. 15 price reported at $234.84/metric ton, falling by 2.7% or $6.46/mt from the previous week, the largest drop reported in five weeks while the lowest seen since the week of Sept. 7. This week's price is only $2.10/mt higher than the Sept. 7 crop-year low of $232.74/mt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

AAFC's January supply and demand tables point to a stocks/use ratio of 26% for 2022-23 is well above the 10.2% calculated for 2021-22, while the highest calculated since the 2015-16 crop year or seven years, when the stocks/use ratio was reported at 30.4%.

Over 29 weeks of price data reported by Saskatchewan Agriculture , the average is calculated at $256.85/mt, which compares to the five-year crop year average of $241.65/mt, which is skewed to the high side due to the extremely high prices reached in 2021-22, when a weekly high of $568.99/mt was reported for the week of Jan. 5 2022.

In the past years, stocks/use ratios above 30% has weighed on prices. In the three crop years during the past 13 years where this ratio exceeded 30%, the average weekly bid for the crop year is calculated at $143.89/mt in 2015-16, $149.06/mt in 2013-14 and $113.78/mt in 2009-10.

It is also interesting to note that the current price has now retraced 87.4% of the move from the May 2021 low of $186.62/mt to the January 2022 high of $568.99/mt. There may be little to prevent a continued move to a test of the $186.61/mt low.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .