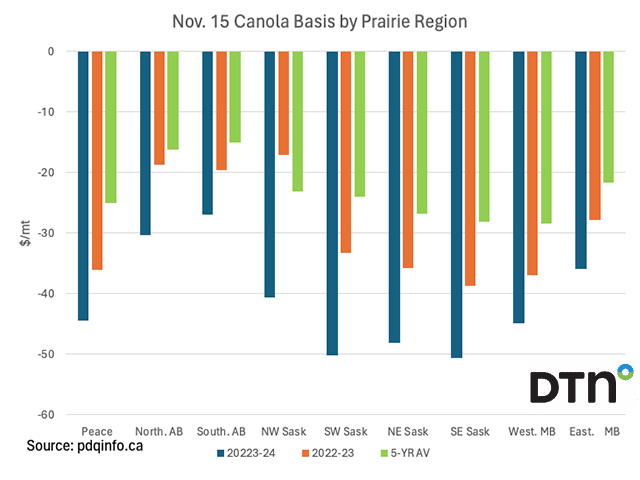

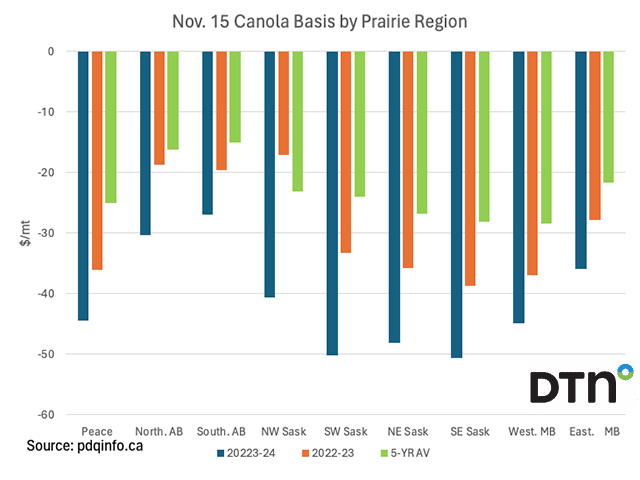

Canola basis has shown modest signs of strength across almost all regions of the Prairies this month, although remain weaker on Nov. 15 than reported one year ago and when compared to the five-year average for each of the nine prairie regions.

Canola basis has shown modest signs of strength across almost all regions of the Prairies this month, although remain weaker on Nov. 15 than reported one year ago and when compared to the five-year average for each of the nine prairie regions.

December European milling wheat closed lower on Wednesday, reaching a fresh low in its short-term downtrend.

Noncommercial short-covering has pushed the January contract to a three-week high, while the noncommercial net-short position remains close to the largest on record.

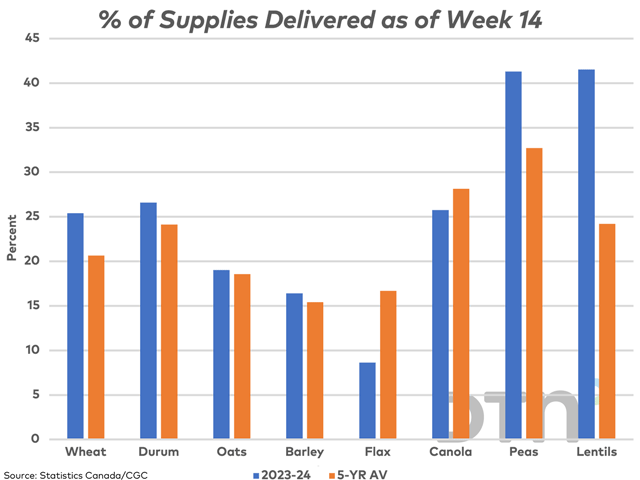

This study looks at producer deliveries of select crops over the first 14 weeks of the 2023-24 crop year.

December hard red spring wheat has closed higher for the fourth time in five sessions. HRS is nearing a test of resistance as noncommercial traders holding a record net-short futures position grow nervous.

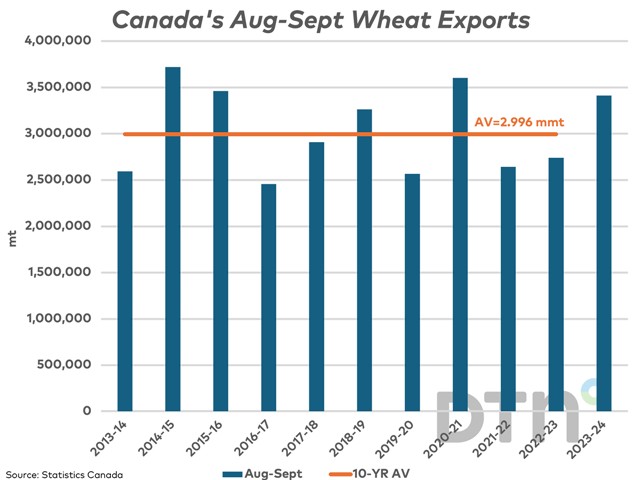

Each month we look at miscellaneous trade data for crops and products as reported by Statistics Canada with a focus on crops where weekly data fails to capture the bulk of activity.

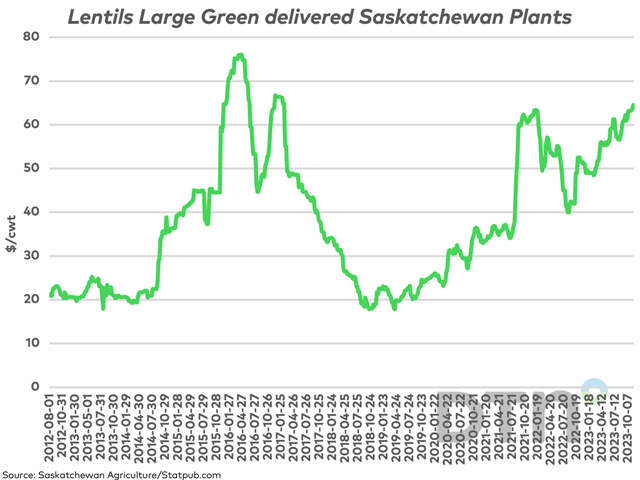

Large green lentil bids continue to push higher, as India reports disappointing summer crop potential and Pulse Canada points to a complicated situation continuing that has not slowed movement overall.

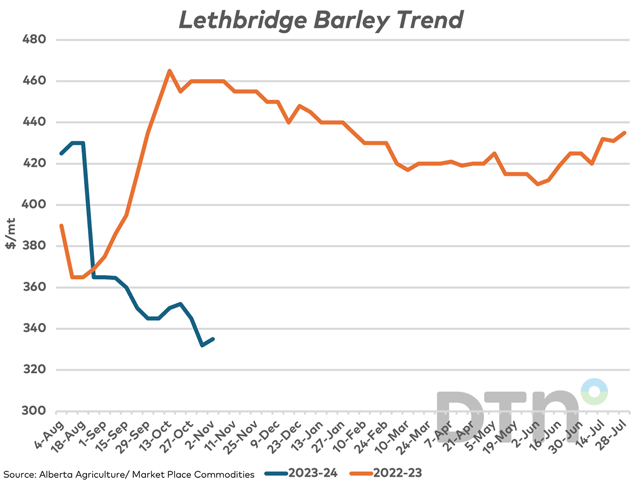

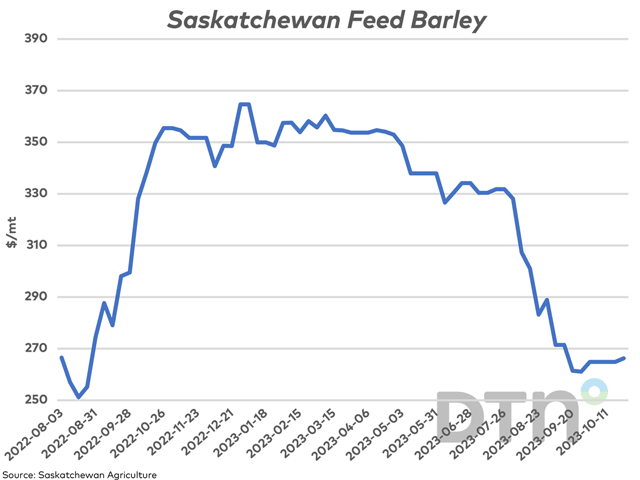

The USDA reports corn exports to Canada have reached a crop year high in the latest week, while this week's barley trade is showing weakness.

The Canadian dollar weakened against the U.S. dollar for a third consecutive month, ending the month of October at its weakest level in over one year while holding barely above support.

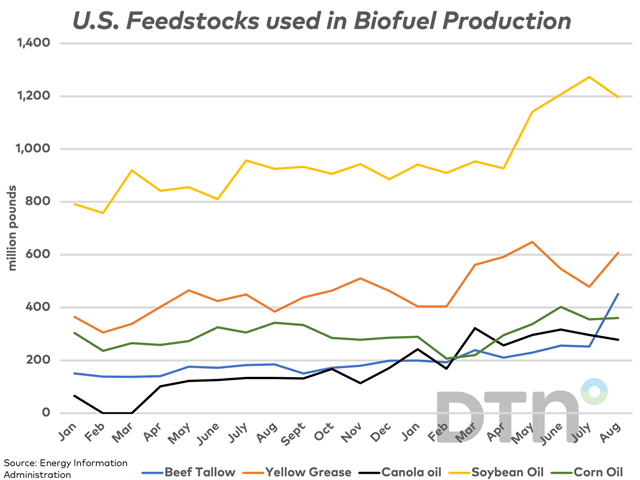

Monthly U.S. feedstock use for biofuel production shows canola oil losing share against competing feedstocks.

Noncommercial traders increased their bearish net-short position in canola for a sixth week as of Oct. 24, now holding a record bearish position.

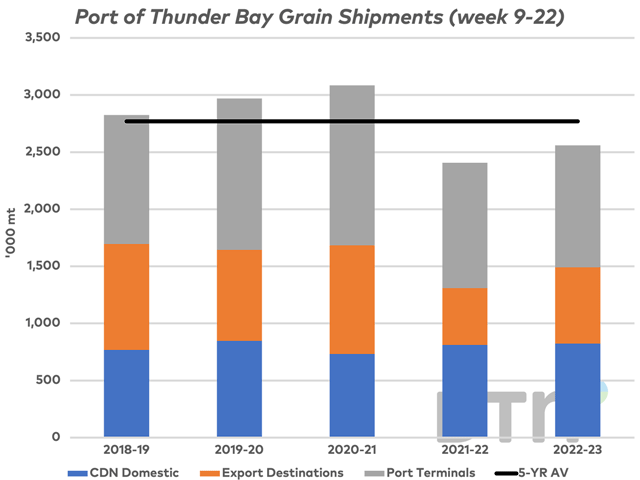

The two sides in the seaway strike are in talks today, with federal government involvement. Movement from Thunder Bay terminals normally totals close to 1 mmt/month over the final months of the year.

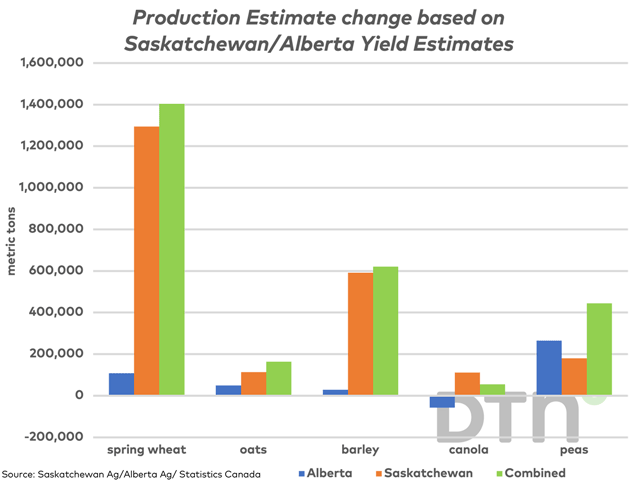

Final crop reports from the three prairie provinces shows estimated barley yields higher than the official Statistics Canada estimates, while there are signs that the reliance on imported corn may be below expectations.

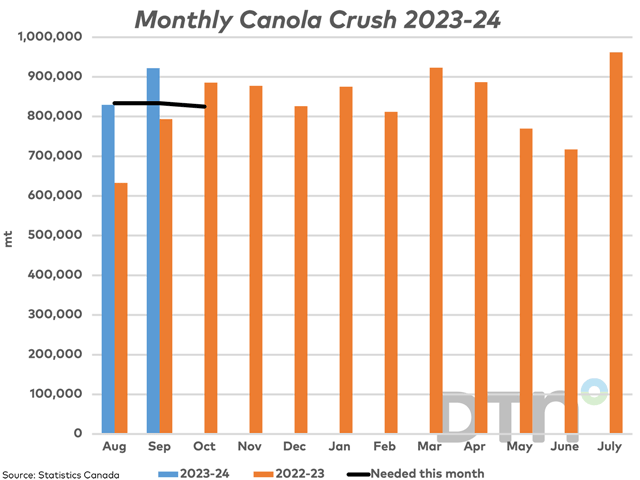

Canada's canola crush after two months is seen at the fastest pace on record, while the September soybean crush was the largest September crush seen in seven years.

The cash market spread between the National Spring Wheat Index and the National HRW Index in the U.S. has more than doubled this month and bears watching.

Yield estimates reported in both the Saskatchewan and the Alberta Crop Reports signal the potential for upward revisions when Statistics Canada reports next in December.

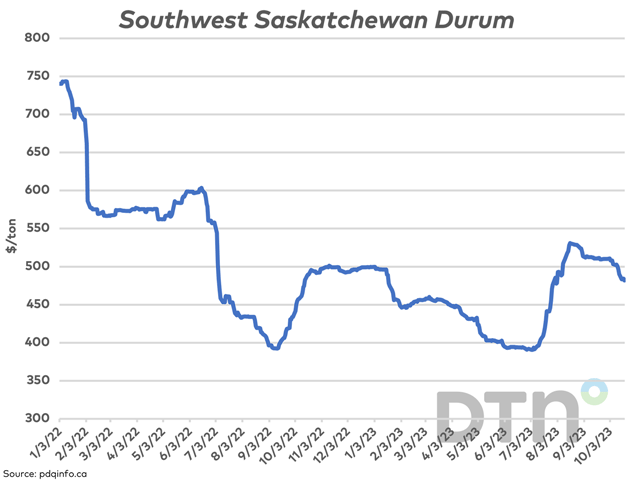

Durum bids for Southwest Saskatchewan have retraced to levels last seen in early August, or the first two days of the crop year. This month's International Grains Council report may put a rally in prices even further out of reach.

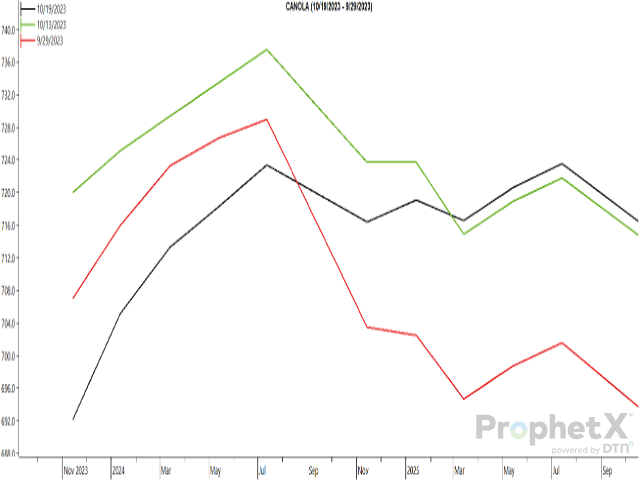

Canola's forward curve has shown weakness over recent weeks following the bearish close of Oct. 19, while supportive signals remain.

European milling wheat for December delivery is nearing the upper-end of the range traded during the past two months, close to a test of its 100-day moving average.

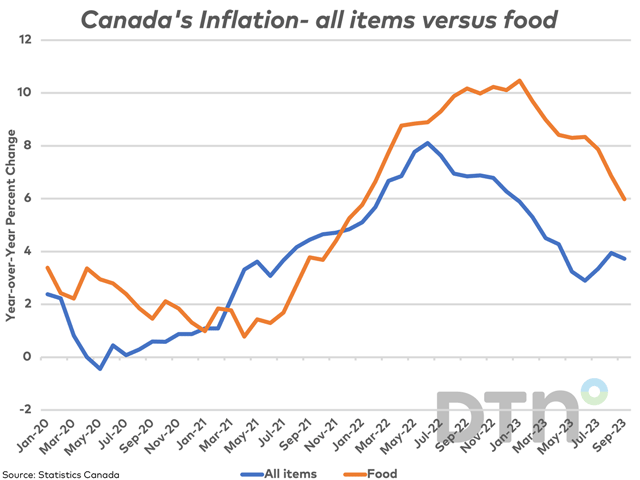

Canada's inflation rate for all items fell in September, while food inflation fell at faster pace, reported at the lowest pace since January 2022.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]