Canada Markets

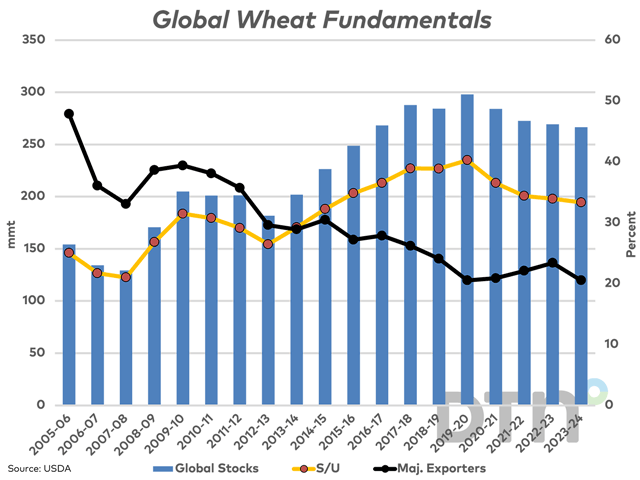

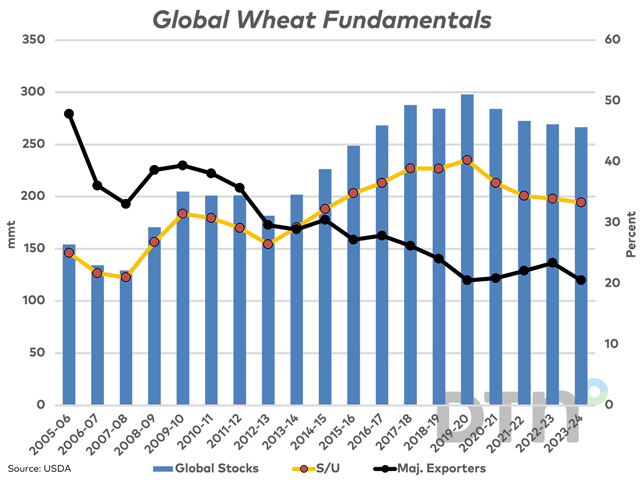

USDA Sees Global Wheat Stocks Falling for a Fourth Year

While the June WASDE forecast included a year-over-year increase in global wheat stocks from 2022-23 to 2023-24, the July report shows the opposite. Today's July WASDE included a 3.52 million metric ton reduction in the global production forecast while domestic use was revised higher by 3.31 mmt, with the end result being a 4.18 mmt lower revision in ending stocks to 266.53 mmt which would be lower for a fourth year. This result was also made possible by a higher revision for 2022-23 ending stocks, or 2023-24 beginning stocks.

This forecast would result in a fourth consecutive year where global consumption has exceeded global production, with the 2023-24 deficit calculated a 2.78 mmt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Ending stocks for 2023-24 would be the lowest seen in eight years, accounting for 33.3% of use, which is the lowest percentage seen in nine years.

From the black line seen on the attached chart, the share of global stocks held by the eight major exporters is forecast to fall for the first time in four years, while at 20.5%, would be the tightest seen in four years.

Another bullish factor to watch is that when China's stocks are excluded from the calculation, stocks are calculated at 129.4 mmt, or the lowest in 11 years. Of this volume, 42.3% is held by the eight major exporters, down from the 48.4% calculated for 2022-23 and close to the lowest percentage calculated in decades.

Focus will quickly turn back to weather with more growing season and weather to deal with for the 2023-24 crop.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow Cliff Jamieson on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .