Sort & Cull

CFTC Data Clarifies Sell-Off in Cattle Prices

Editor's note: DTN Livestock Analyst ShayLe Stewart will be out of the office for a few weeks. We will continue to update her Sort and Cull blog with livestock market content. Please send any questions or comments to Editor-in-Chief Greg Horstmeier at greg.horstmeier@dtn.com.

**

February live cattle dropped another $3.40 in the week ended Dec. 8, the ninth weekly decline in 12 weeks, and are now down 16% from the September peak. After falling to a new 2023 low Tuesday, Dec. 5, January feeder cattle finished the week up 87 cents at $215.30, but are down 20% from their September peak. To state the obvious, it's been a rough fourth quarter in the cattle market and the bulk of selling pressure has not come from the usual fundamental suspects. Yes, USDA's on-feed numbers are up 2% from a year ago, but there is no indication herd expansion has taken place or will in 2024.

Grasping for answers, rumors on social media have been making the rounds. Some suggest USDA's Livestock Risk Program (LRP) has added to the selling, another government program with unintended consequences. Many have mentioned selling put options may have become too popular after cattle prices have risen for three years with only limited corrections. Another concern common to the insurance industry is the possibility that at least one of the insurance providers in the LRP program were insufficiently hedged to handle price drops of this size. So far, there has been no evidence of a cash flow problem among LRP providers, and it may help to know the LRP program falls under the jurisdiction of the Federal Crop Insurance Corporation and premiums are subsidized by USDA's Risk Management Agency.

With help from the Commodity Futures Trading Commission (CFTC) and its weekly Commitments of Traders report, we can see which of the rumors look likely and which don't.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

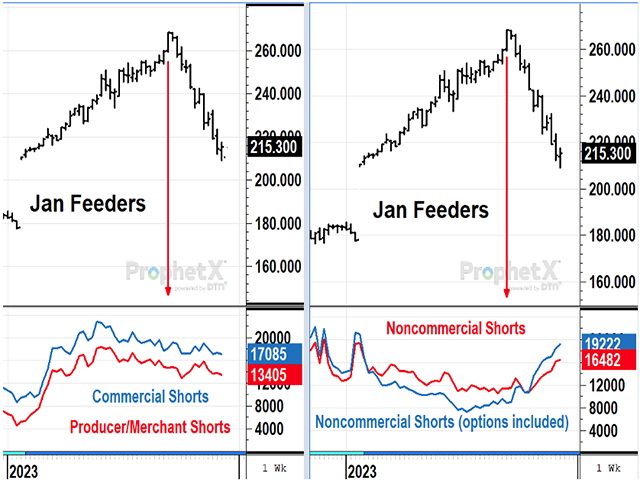

When participating insurers in USDA's LRP program put on hedge positions in the futures or options markets, those positions show up in the Commercial category in CFTC's legacy report, but insurer positions are a small subset of that broad category. More specifically, CFTC also shows insurer positions in the Producer/Merchant/Processor/User (Producer/Merchant, for short) category in its disaggregated report.

Looking at Producer/Merchant holdings of feeder cattle futures and option positions since Sept. 19 shows a decline of short positions, from 14,866 contracts to 13,405 as of Dec. 5. Commercial holdings of short positions also show a similar decline as of Dec. 5. Since mid-September, there is no indication significant selling has come to the feeder cattle market from either the insurers of the LRP program or from the commercial side of the market, in general.

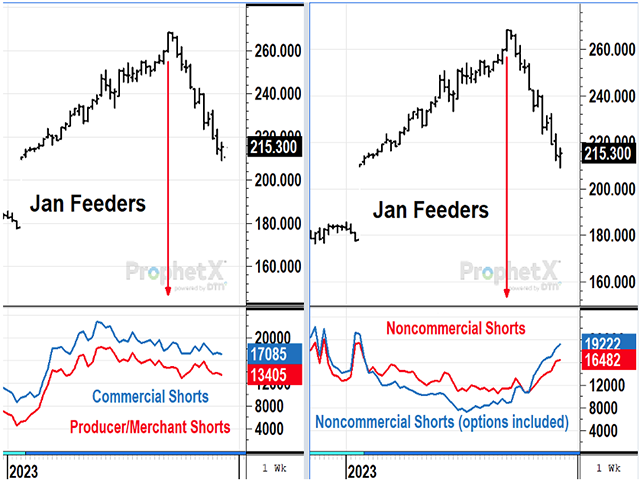

The sector of the feeder cattle market that does show a big increase in short positions since mid-September is on the speculative side of the market, labeled noncommercials in CFTC's report. CFTC data shows short positions of 9,054 futures and options on Sept. 19 increased to 19,222 by Dec. 5, an increase of more than 10,000 contracts. Looking at futures-only short positions for the same group shows an increase of just over 5,000 contracts since mid-September.

It's helpful to understand CFTC's measure of option participation in the market depends on the amount the option is in or out of the money. For example, selling an out-of-the-money put option when feeder cattle prices were high may have been counted as the equivalent of one-fifth of a futures contract. As feeder cattle prices fell and the same put option becomes deep in-the-money, the put option will become close to being counted the same as a futures contract. The 5,000-contract increase in short option positions among specs doesn't necessarily mean more puts were sold. Much of the increase likely came from out-of-the-money puts turning into in-the-money puts.

Specs are typically trend-followers, so it is no surprise their futures positions also added to the recent selling, going from net-long 12,262 futures contracts on Sept. 19 to being net-short 4,841 contracts as of Dec. 5.

As best as I can tell, this is an age-old story of specs, money managers and, possibly, some large cattle traders being over-confident and unprepared for markets' downside possibilities. I should also mention the large presence of put-selling described above is exclusive to feeder cattle and is not seen in the live cattle market. To date, I find no evidence supporting the notion USDA's LRP program is any more flawed than any other product in the insurance industry.

Unfortunately for producers, cash cattle prices have suffered from the strains in the futures market. The weighted average price of live steers in the five-state region dropped from $184 in mid-September to $171 in the week ended Dec. 8. That's not as harsh as the $30 drop in February live cattle prices, but it is significant and the market hasn't found support yet. While the futures market works through its excesses, it is the cash market that needs to shake off the CME's bad news and remind the world more calves will be eventually be needed to restore U.S. cattle inventory in the years ahead.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .