Sort & Cull

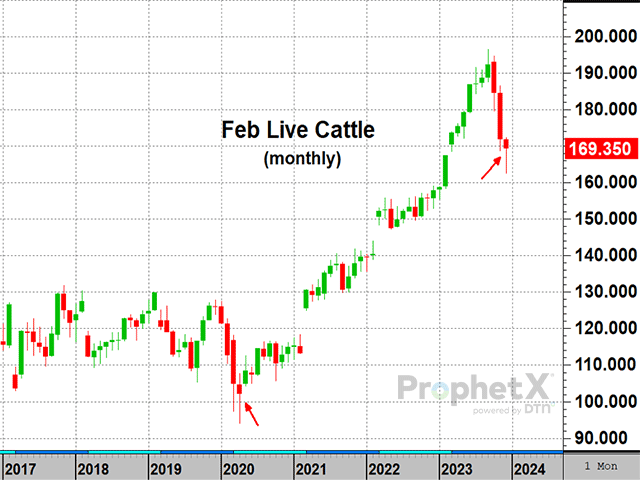

Cattle Futures Prices Show Hints of Support in December

Editor's note: DTN Livestock Analyst ShayLe Stewart will be out of the office for a few weeks. We will continue to update her Sort and Cull blog with livestock market content. Please send any questions or comments to Editor-in-Chief Greg Horstmeier at greg.horstmeier@dtn.com.

**

DTN reported cash cattle prices were lower again in the week ended Dec. 15, but with an interesting twist. Northern dressed trade was reported $2 to $3 lower for the week, near $267 to $268, but firmer trade in the South near the week's end showed live prices down just $1, near $170. Monday's report from USDA will give us the official weighted averages for the week.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

February live cattle futures, on the other hand, finished the week up $3.62 at $169.35, the best weekly gain the contract has seen since before late October when the sharp selloff began. Friday's CFTC data also showed specs held firm in their net-long positions and actually increased holdings slightly to 38,758 as of Dec. 12. After the bearish cattle on Feed report of Oct. 20 triggered a seven-week avalanche of panicked selling, most painfully felt in the futures market, it is starting to look like the fear is being depleted as this week's close in the February contract rebounded $6.95 above the previous week's low.

Even so, USDA's Cattle on Feed report for Dec. 1 offers another bearish threat and is due up this Friday, Dec. 22, the final day of trading before Christmas on Monday. December 1 on-feed inventory may stay up 2% from a year ago, but the market is in a much less vulnerable place this time around and I suspect even if Tuesday's futures prices respond lower, the market will continue to show signs of better support in the latter half of December. Choice boxed beef prices also offered some support last week, ending up $3.63 at $291.64 per hundredweight.

In last Monday's trade (Dec. 11), negotiated steers were quoted $13.17 below the price of formula cattle, the largest discount seen since 2020 and a level that usually doesn't stay that far out of whack for long. There are no guarantees, but the cash market is due for better negotiated bids.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .