Sort & Cull

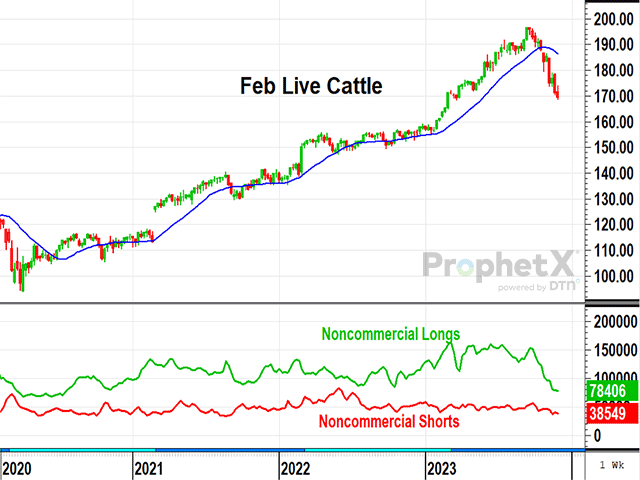

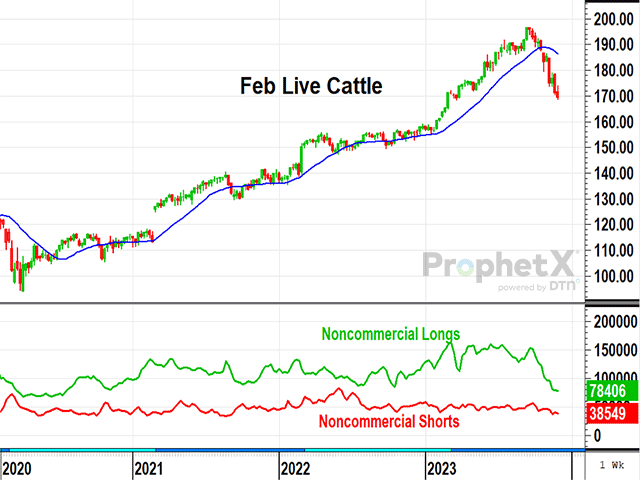

Specs Covering Shorts as Liquidation Continues in February Live Cattle

Editor's note: DTN Livestock Analyst ShayLe Stewart will be out of the office for a few weeks. We will continue to update her Sort and Cull blog with livestock market content. Please send any questions or comments to Editor-in-Chief Greg Horstmeier at greg.horstmeier@dtn.com.

**

February live cattle closed down $1.85 at $169.12 in the week ending Dec. 1, 2023, the eighth weekly decline since mid-September and largest price correction since COVID-19 arrived in 2020. Since the high of $196.60 on Sept. 19, total open interest in cattle futures has fallen 18% and long positions held by bullish noncommercials (speculators) have been cut nearly in half to 78,406, as of Nov. 28. It is common for bearish specs to increase short positions when prices fall, but in the case of cattle, bearish specs have taken advantage of the price drop and reduced their shorts from 53,990 to 38,549, near their smallest short position in more than two years.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In short, half of the bullish specs have been shaken out and almost one-third of bearish specs have decided to call it a day, lacking confidence prices will keep going lower. This is one time where the spec view has fundamental merit as it is difficult to see how the recent eagerness among producers to liquidate cattle, including beef cows, can continue for long.

This week's cash trade for live cattle was estimated by DTN at $2 to $3 lower Friday, putting Monday's five-state weighted average near $176 per hundredweight and down from $187 in late September.

Technically speaking, there is no sign the selling in February live cattle is over yet. Slaughter was active again last week, estimated by USDA at 635,000 head, but negotiated volume has been disappointing since October as packers try to convey the message that they don't need cattle.

It remains difficult to know how long the selling in cattle futures can continue, but given the difficulty in expanding a herd with fewer beef cows and the reluctance of bearish specs to sell into this market, it seems reasonable to expect support near current levels, the lowest February cattle prices since March.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .