January tends to be the weakest month of the year for Canada's currency, while has weakened against the U.S. dollar in 10 of the past 12 sessions.

January tends to be the weakest month of the year for Canada's currency, while has weakened against the U.S. dollar in 10 of the past 12 sessions.

The USDA's January estimates for Canadian production for select crops changed little in January, although the USDA did revise higher its forecast for Canada's all-wheat exports.

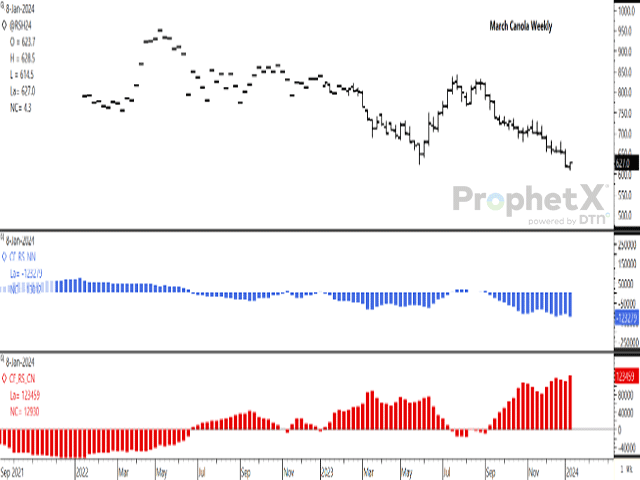

March canola recovered from a contract low this week to achieve a weekly gain for the first time in nine weeks.

The March MGEX wheat contract is close to testing the contract's low, while speculative traders continue to hold a large net-short position.

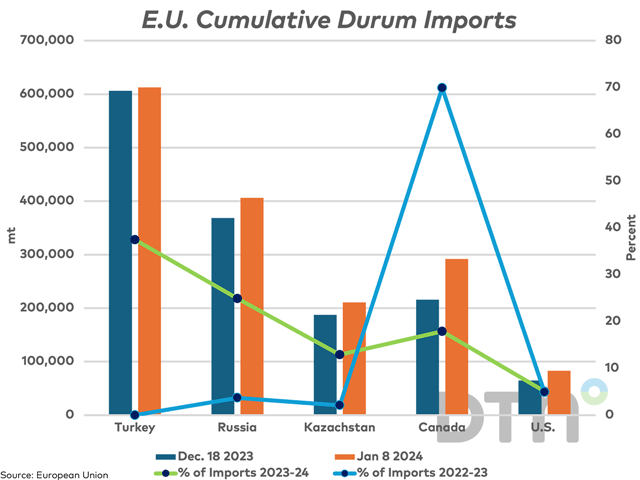

Over recent weeks, E.U. imports of durum from Turkey and Russia have slowed while imports from Canada have picked up.

This is a look at Statistics Canada trade data as it relates to select crop and product trade.

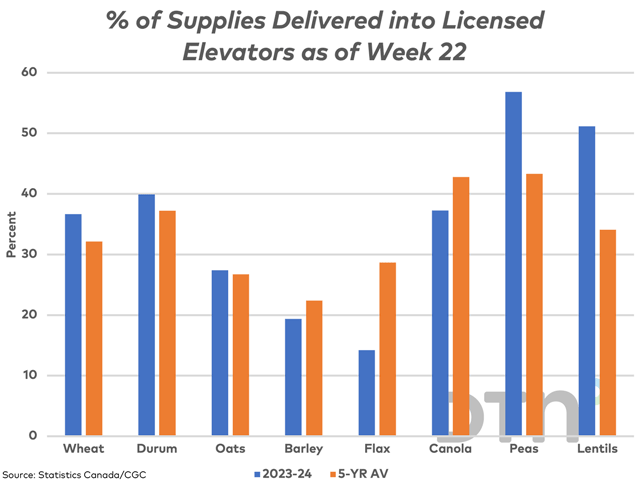

This study looks at producer deliveries of select crops as of week 22, while comparing this volume to the volume available for delivery over the past five years.

Canola contracts for 2023-24 reached contract lows this session and their lowest close seen over the life of the contract.

Negotiations with a federally appointed mediator will be crucial during Wednesday and Thursday of this week, while employees from two Locals of the Grain Services Union representing Viterra staff could strike as early as the afternoon of Jan. 5.

Noncommercial traders moved into a bearish net-short futures position during the holiday season and for the first time since February 2020, while continuing to control the current price direction. The March/May spread is seen narrowing a commercial sentiment slowly...

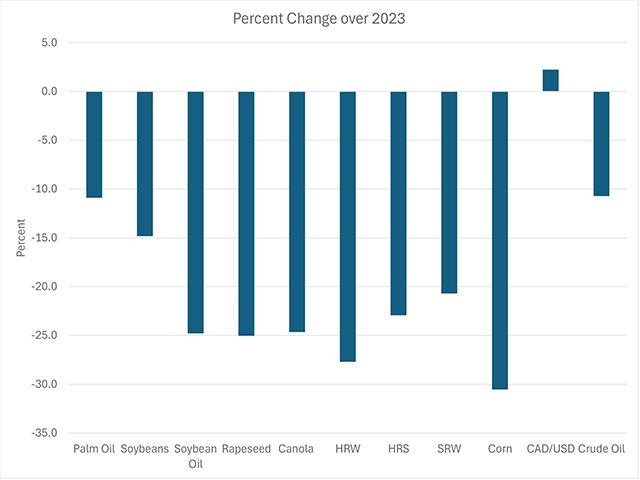

Corn futures led commodities lower in 2023 with widespread losses faced over the year across the grains.

Canada's wheat exports remain ahead of the forecast pace after four months, despite an upward revision in the forecast for 2023-24. This study looks at volumes shipped to Canada's largest markets from the previous crop year.

March canola closed sharply higher this session, the first trade since the Christmas holiday.

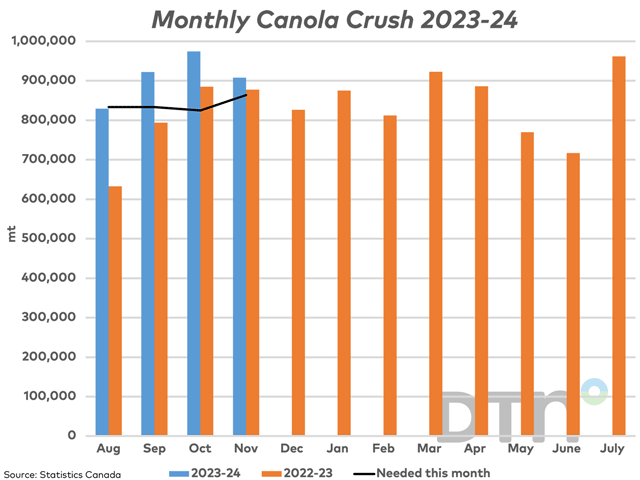

Canada's November canola crush fell from the record volume crushed in the month prior while the overall pace of crush remains ahead of the government's forecast pace.

The November canola contract is showing technical weakness this week and poised to close below retracement support.

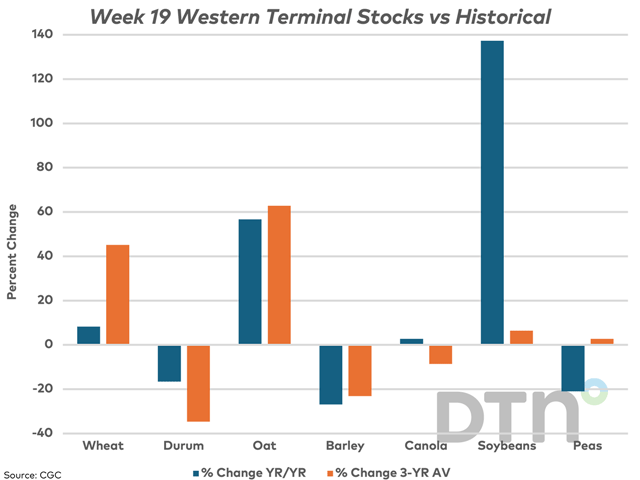

The Grain Marketing Program's Weekly Performance Update shows terminal stocks in week 19 higher than a year ago and higher than the three-year average. This study breaks down this data to show what crops make up this volume.

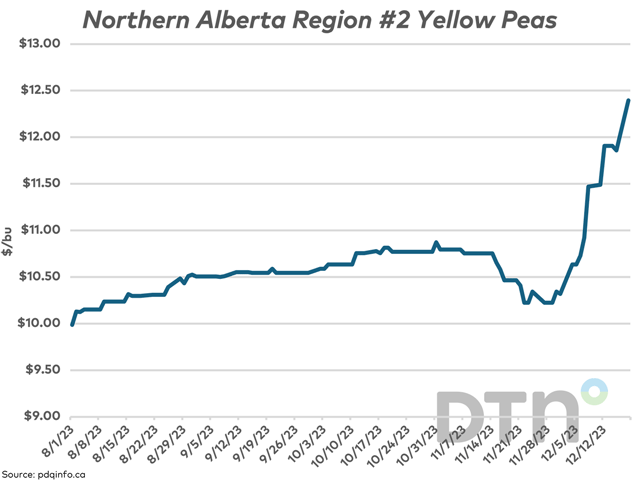

Monday's pdqinfo.ca cash bids show further upside in the yellow pea bid across most of the Prairies, while the market is inverted with a sharp drop shown for delivery in February.

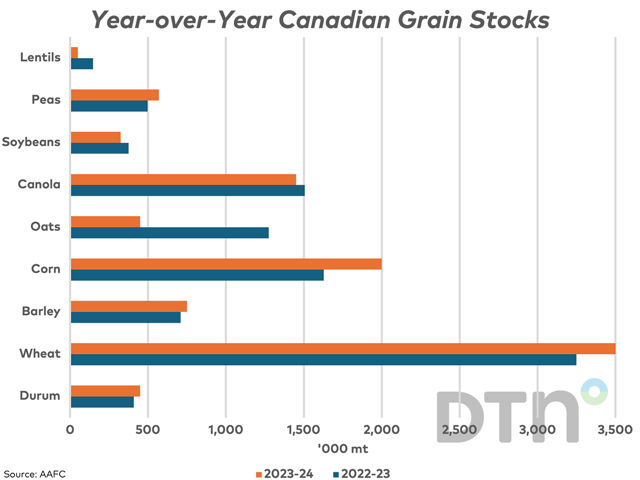

AAFC revised its supply and demand tables in December based on Statistics Canada's recent production estimates.

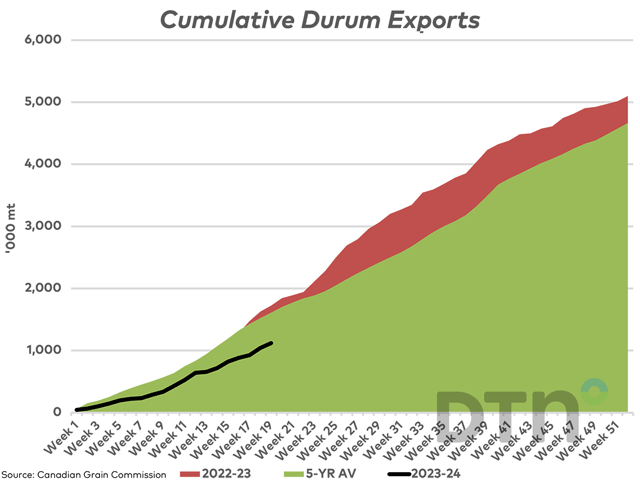

Durum exports are down from last year and the five-year average, while may be on track to reach the current forecast released by AAFC. The European situation bears watching.

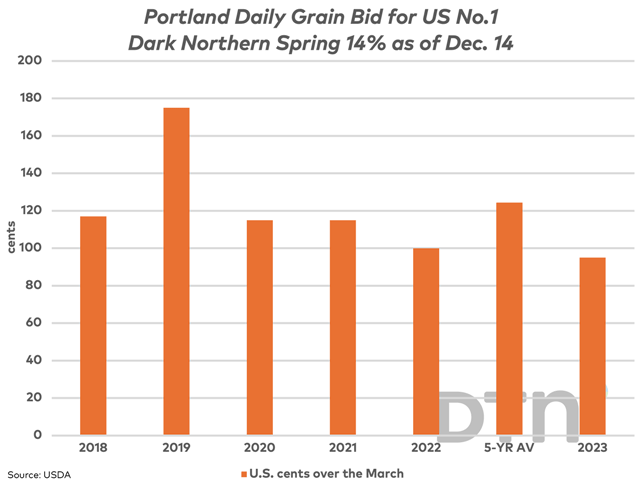

The Dec. 14 basis for Portland spring wheat is weaker than the five-year average, while January trade is showing even further weakness.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]